Calibre Mining (TSX: CXB) (OTCQX: CXBMF)’s history of resource expansion success and strong community relationships lead financial analysts to a positive rating following a recent site visit.

Recently, independent investment firm Cormark Securities released a report detailing its site visit to the gold mining company’s operations in Nicaragua, and concluded that the company’s development and production numbers are on pace to make it an attractive investment when placed against other larger companies in the industry.

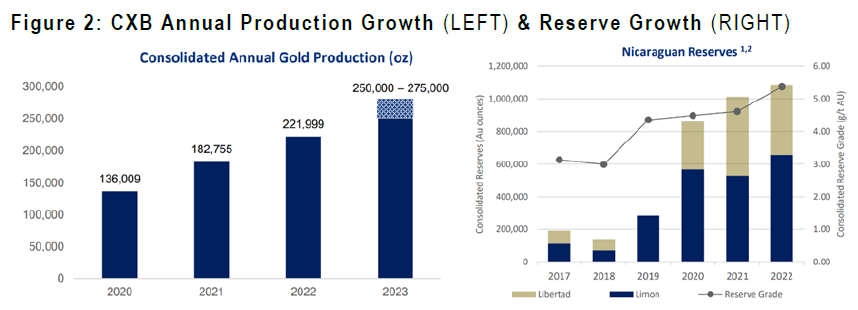

Calibre has demonstrated over the past few years it can discover, prove-out and produce from high grade deposits across Nicaragua. During a previous tour, years ago, Calibre’s proposed hub-and-spoke production strategy was in its infancy and appeared to be a somewhat far-fetched goal, according to Cormark. Today, however, the company has succeeded on this strategy, and now produces over 200,000 ounces per year from two mills and three mining hubs across Nicaragua.

Calibre anticipates 2023 as being a big year for production growth with Pavon Central and Eastern Borosi. Production from the Pavon Central mine (6.49 g/t) started this quarter, and EB (also over 6 g/t) is anticipated to come along in Q2, 2023. The 2023 guidance is for production growth of 20 per cent to 250,000 to 275,000 ounces, spurred on both high grades coming from Pavon Central and EB.

The company expects grades to continue to improve in 2024. At present, it has over 1 million tonnes of surplus mill capacity at Libertad. The site visit indicated that Calibre is well positioned to continue its organic growth through increases in grade and throughput courtesy of the new exploration discoveries.

Production growth charts. Image via Calibre Mining.

This information combined caused Cormark Securities to raise its target price to $1.70 (from $1.60) based on 0.8x its net asset value (NAV) and 4x 2023 cashflow per share (CFPS) at $1,800 per gold ounce.

Calibre Mining’s recent successes with its hub-and-spoke strategy have effectively expanded their exploration reach throughout much of Nicaragua. This success has enabled them to discover more deposits to feed into their two mills. The company’s growing significance to the Nicaraguan mining sector is further bolstered by the strong social license they have built over the years. The site visit noted that the trust and support from local communities have given them an edge in acquiring new exploration targets, adding to their overall growth potential.

Currently, Calibre Mining has over 40 individual veins being mined or drilled and this robust exploration effort implies the company has a reasonable line of sight to production extending beyond the ounces reflected in its current reserves.

Read more: Calibre Mining offers a ‘very attractive’ value-risk proposition: Haywood Securities

Read more: Calibre Mining reports high-grade ore from Pavon central mine

Calibre Mining to drilling over 100,00 meters in 2023

Calibre’s plans for 2023 are to drill approximately 100,000 meters with a 60/40 split between Nicaragua and Nevada. The focus here will be on area outside the present resources. During the site tour, Calibre gave an update on its priority targets.

The first priority target is the Pantone VTEM Corridor.

The present plans include 18,000 meters of drilling directly following strong results from the end of 2022. These included 11.61 g/t over 9.3 meters. The VTEM corridor represents a resistivity target extending approximately six kilometers of Panteon North, which has been partially tested by first-pass drilling.

What’s especially noteworthy is that the Limon open-pit deposits occur along a similar resistivity low/high contact. In time, the VTEM corridor could develop into a series of open-pits if Calibre can prove out a series of smaller deposits located in close proximity to each other.

VTEM Resistivity at El Limon Property. Image via Calibre Mining.

The second priority target is the Talavera Extension. The company is presently drilling Talavera at Limon, which has enjoyed earlier production of 800,000 ounces and is not presently included in Calibre’s resources.

The third target is Veta Azul (at Libertad). This is a newly acquired target identified in 2022. It’s 10 kilometers from La Libertad. Historically, it’s been a place of artisanal mining at surface, and high-grade surface samples indicate a 1.5 kilometre strike extension. Calibre will drill this in early 2023 to test depth extensions and delineate potential ore shoots along the bend.

The fourth target is the Eastern Borosi. Several deposits on the property have inferred mineral resources that haven’t been drilled for years. There’s strong potential to upgrade several of these resources to the indicated category, while focusing on several higher grade zones. Mining starts next quarter.

Last, Calibre will also start first-pass drilling at its recently permitted Buena Vista and La Fortuna concessions, which are located near the Limon and Libertad mine complexes, respectively.

Read more: Calibre Mining strengthens management team with two new vice presidents

Read more: Calibre Mining budgets $29M for 2023 exploration in Nevada and Nicaragua

Calibre’s operation remains unaffected by wider geopolitical issues

Both the visit to the mining site and the country at large helped Cormark get a better understanding of the political climate and state of the mining sector in Nicaragua. The country’s economic has enjoyed strong economic growth compared to other Central American countries, and the government has made significant investments in the country’s infrastructure.

The roads Cormark used to attend the mine were generally in good shape, as evidenced by Calibre’s ability to haul ore hundreds of kilometres between operations as part of its hub and spoke program. The site visit also included a meeting with representatives from the country’s Ministry of Energy and Mines.

The meeting put the country’s economic growth on display (3.2 per cent per year, with gross domestic product growth since 2012) and improvements in the quality of life of its population. The government has also increased infrastructure investments in recent yeras and now claims to have the highest quality road network in Central America.

Additionally, the country is planning to build new ports and a new airport to improve the country’s import/expert abilities.

Read more: Calibre Mining broke gold production records with 10% increase in 2022

Read more: Calibre Mining gold discovery could breathe life into historic mining community

Calibre Mining provides stepping stone to Nicaraguan prosperity

Other significant improvements include energy infrastructure to provide electricity to over 99 per cent of the population, with 75 per cent of this coming from renewable sources such as biomass, geothermal and wind. These improvements have helped to lift the country out of poverty. What’s especially noteworthy about this is that Calibre’s presence has been a significant boon to the Nicaraguan economy.

Gold is among the country’s top three exports, and Calibre is the largest single producer in the country. In 2021, Calibre invested over $286 million into the economy, which is approximately two per cent of the nation’s GDP for the year. The present population of Nicaragua is six million people, and Calibre employees over 3,500 workers and contractors, with over 96 per cent of its workforce sourced locally.

The mining industry has had a positive effect in reducing poverty.

“Given Calibre’s significance to the Nicaraguan economy, we believe it is strongly in the interest of both parties (CXB and Nicaraguan govt.) to maintain a healthy relationship,” said Cormark in the report.

It’s also important to note that there has been no impact from the latest round of United States sanctions. Late last year, the US government introduced sanctions against certain individuals involved in Nicaragua’s mining sector. During the site visit, Calibre noted its operations remained unaffected by the sanctions.

Read more: Calibre Mining expands high-grade gold discoveries at Panteon North

Read more: Calibre Mining builds strong foundation for continued success in Nicaragua: Canaccord Genuity

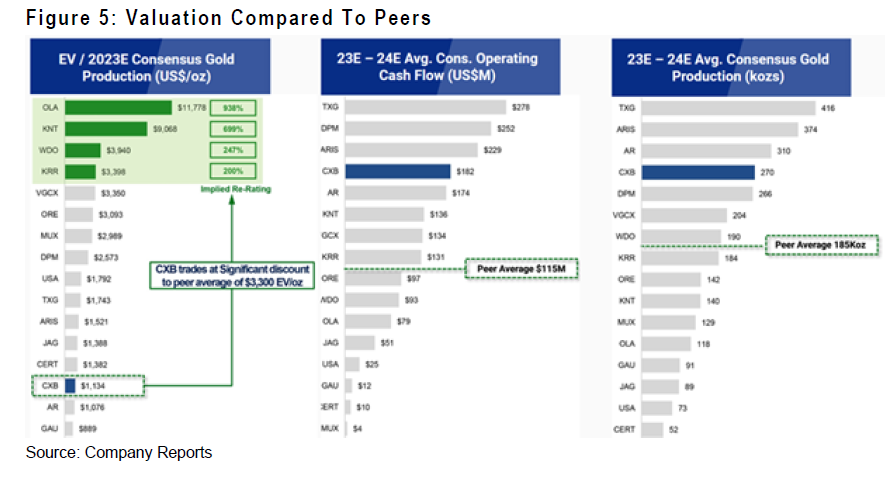

Comparable valuations strong draw for investment: Cormark

Cormark’s reasons why Calibre is a buy include its attractive valuation. Calibre trades at approximately 0.55 times Cormark’s NAV (at $1,800). It’s also on the lower end of its peers and well below where it has traded in the past. The firm believes this price drop is due to the perceived risk of operating in Nicaragua.

Cormark models $25.6 million in free cash flow in 2023, driven by higher grades. This represents a free cash flow yield of approximately 7 per cent, which is well above Calibre’s mid-tier peers. Cormark also stated they believe the shares will rerate higher if the political situation in Nicaragua remains relatively stable.

Calibre’s valuation compared to peers. Image via Calibre Mining.

Cormark represented Calibre’s Nevada assets as 12 per cent of its NAV. It noted that 2023 will see advancement of its properties as well. Calibre intends to spend $9 million on exploration. This will include 40 kilometres of drilling, focused on new discovers at both Pan and Gold Rock.

Additionally, the heap leach operation at Pan produced 41,509 ounces in 2022 at all-in-sustaining-costs (AISC) of $1,421. The company anticipates similar performance in 2023. Expected production at Gold Rock along with Pan could potentially bring production in Nevada over 100,000 ounces per year.

Read more: Calibre Mining Pan Mine assays show strong potential for Coyote mine target

Read more: Calibre releases short doc on environmental initiatives in Nicaragua

ESG strategy is behind the relations in Nicaragua

Cormark finds Calibre’s commitment to environmental, social and corporate governance (ESG) initiatives impressive, according to the report.

“Examples include over 1 million trees planted since 2010, creation and maintenance of wildlife sanctuaries, resettlement of impoverished families near the mine site, and may other investment projects in local communities,” the report said.

“Calibre has reported zero high-risk environmental incidents and zero scope 2 emissions in 2022 due to 100% clean energy sourced from the grid.”

The firm noted the Nicaraguan government agreed to build a new school and hospital to support the resettled families. This demonstrates the strength of the relationship and further commitment to infrastructure spending.

Calibre’s ESG commitments. Chart via Calibre Mining.

Calibre Mining shares rose 6 per cent on Wednesday and are trading at $1.23 on the Toronto Stock Exchange.

.

Calibre Mining is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com