Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF) announced on Wednesday it has started mining operations at its Pavon Central open pit mine, which exceeded its target by averaging 1,000 tonnes per day to the Libertad Mill in February.

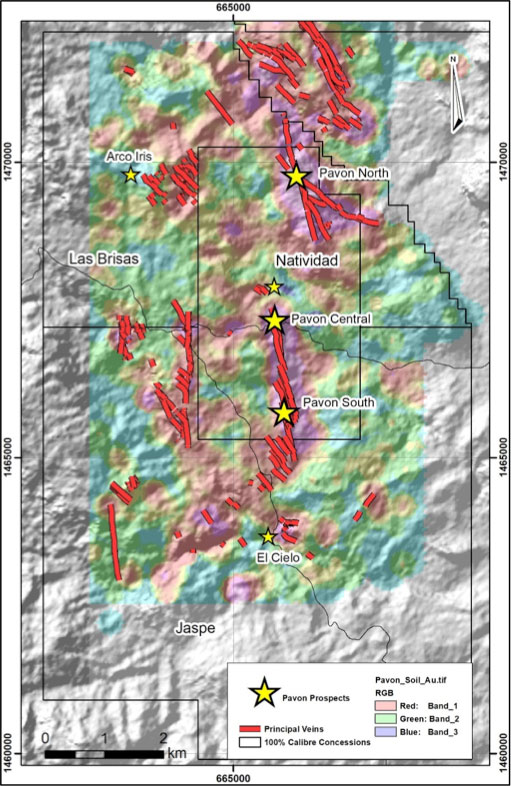

The Pavon project is a newly emerging gold district in Nicaragua, and the region has remained largely underexplored by modern methods. Historical exploration focused on delineating resources within the near-surface portions of the Pavon Norte, Central, and South deposits, where indicated resources totalling 231,000 ounces of gold averaging 5.16 g/t have been delineated within the upper 100 meters.

There is significant exploration potential at Pavon, with multiple untested vein systems identified, and more suspected undercover. An initial 8 km resource confidence and extension drill program is underway on high-grade vein systems covering more than 30 kilometres squared, and the final approval process is underway with additional surrounding mineral concessions of around 45 kilometres squared.

Read more: Calibre Mining broke gold production records with 10% increase in 2022

Read more: Calibre Mining increases mineral resources and reserves at its Nicaragua and Nevada operations

Pavon Central marks another significant milestone

“I am very pleased with the team’s efforts to safely deliver the Pavon Central mine ahead of schedule and on budget,” Calibre CEO Darren Hall said.

“Pavon Central marks another significant milestone as we leverage the surplus processing capacity at the Libertad mill. With 1,000 tonnes per day averaging in excess of 7 g/t delivered to Libertad in February, Pavon Central will be a significant contributor to our grade-driven production growth during 2023 and beyond.”

Pavon property is situated within the Natividad and Las Brisas exploration concessions, covering 31.5 kilometres squared and is located about 300 kilometres away from the Libertad processing facility.

Map via Calibre Mining.

Since acquiring the property in 2019, Calibre has completed an initial open pit resource estimate, environmental impact assessment, mine design, and construction, and started open pit mining and transportation to the Libertad processing plant. Calibre’s operating model, the “Hub-and-Spoke” model, has extended the processing life of the Libertad Complex and is expected to generate significant cash flows over several years.

The Pavon satellite deposit represents a portion of the mill feed from 2021 through 2024 and is expected to provide an average of 0.32 million tonnes per annum of mill feed over the next four years.

Calibre’s exploration efforts in Pavon have demonstrated the value of the company’s operating approach. The Pavon PFS has shown that by utilizing the surplus capacity at the Libertad mill, investing in exploration to expand the current mineral resource base at Pavon, and discovering new satellite deposits, Calibre can achieve low-cost growth.

Over 50 per cent excess mill capacity exists at the Libertad mill, which underpins Calibre’s focus on exploration to expand resources and discover new satellite deposits that could provide future mill feed.

Read more: Calibre Mining Pan Mine assays show strong potential for Coyote mine target

Read more: Calibre releases short doc on environmental initiatives in Nicaragua

Calibre Mining is a mid-tier gold producer listed in Canada and primarily operates in the Americas. The company is focused on delivering sustainable value to its shareholders, local communities, and stakeholders through responsible operations and disciplined growth.

Calibre has a robust pipeline of development and exploration opportunities across Nicaragua, Washington, and Nevada in the USA. The company boasts a strong balance sheet, an experienced management team and a strong operating cash flow.

With its accretive development projects and district-scale exploration opportunities, Calibre aims to unlock significant value.

Company stock went up by 2 per cent on Wednesday at $1.16 on the Toronto Stock Exchange.

Calibre Mining is a sponsor of Mugglehead Magazine news coverage

Natalia@mugglehead.com