Investment firm Canaccord Genuity visited Calibre Mining (TSX: CXB) (OTCQX: CXBMF)’s Nicaraguan operations and saw a vast exploration potential, well-maintained local infrastructure and a strong ability to generate substantial cash flow.

In early March, the gold mining firm welcomed a group of analysts, investors and journalists to its operations at El Limon and Canaccord released an analysts report outlining its positive findings last week.

The firm has given Calibre a resounding BUY rating and a share target price of $2.00. The company’s common shares are currently worth $1.18 on the Toronto Stock Exchange after dropping by 0.84 per cent on Monday.

“We also gained a deeper understanding of the Nicaraguan political situation and the work Calibre is doing to support local communities. We continue to anticipate Calibre will generate substantial Free Cash Flow (FCF) over the next several years as it executes on its plan for grade-driven production growth in Nicaragua,” wrote the authors of the analyst report Michael Fairbairn and Associate MacGregor Ross.

The firm noted that Calibre continues to trade at a material discount to peers, at 0.39x NAV (peers at 0.53x) and just 1.4x 2023E EBITDA (peers at 4.8x). Canaccord expects Calibre to generate a ~32 per cent FCF yield by 2025 and anticipates it will be trading under cash by 2026 if the share price does not re-rate.

Analysts, shareholders and journalists from various countries visited Calibre’s operations in Nicaragua to observe the company’s great results and excellent prospects. #WeAreCalibreMining #miningindustry #Gold #production #exploration #shareholders #analyst #journalists #site pic.twitter.com/FHD70faxyT

— Calibre Mining Corp. (@CalibreMiningCo) March 6, 2023

Read more: Calibre Mining reports high-grade ore from Pavon central mine

Read more: Calibre Mining broke gold production records with 10% increase in 2022

Calibre’s systematic ‘rifle shot’ approach has been successful in recent years

The firm noted five key takeaways following its visit, the first of which was the definitive success of the company’s exploration methods over the past four years.

Canaccord says Calibre has been successfully applying systematic exploration techniques to an under-explored region in Nicaragua since it acquired its asset portfolio there in 2019. The firm says Calibre has been utilizing new technologies and applying a “rifle shot approach” to its targeting, meaning that the company has very specific goals.

Under the leadership of Calibre’s Vice President of Exploration for Nicaragua Pedro Silva, the company has been applying an assortment of geo-science initiatives in order to help identify new targets.

“Although these methods are not new to the industry as a whole, they are new in Nicaragua where historic exploration was largely driven by following artisanal mining and relied upon deposits outcropping at surface,” wrote Fairbairn and Ross.

Silva has been appointed to lead Calibre’s new program in Nicaragua because of his vast experience in the mining industry over almost 30 years working for major companies like Newmont Corporation (NYSE: NEM) (TSX: NGT), Kinross Gold Corporation and Barrick Gold Corporation (NYSE: GOLD) (TSX: ABX).

Through geo-science techniques, Calibre was able to successfully identify the six-kilometre Panteon VTEM corridor; Calvario at Libertad; Blag and La Luna at the Eastern Borosi project; Veta Azul; and Hagie at El Limon.

Canaccord says Calibre has laid the groundwork in Nicaragua to continue its impressive track record.

Evolving infrastructure is beneficial for Calibre’s operations

The second key takeaway Canaccord had was that the Nicaraguan government’s infrastructure and roadways were beneficial for Calibre and that the company had established its value in the country.

Prior to Canaccord’s site visit, the firm was concerned that heavy truck traffic needed to support Calibre’s operations would be disruptive for local communities. However, it no longer believes this to be the case after observing how well-maintained the roads were by the government in Nicaragua during its visit.

Those roads throughout the country have been made with smooth asphalt or interlocking bricks.

Calibre’s busiest trucking route runs between La Libertad and El Limon where the company transports approximately 1,000 tonnes per day with a fleet of 25-tonne trucks. Traffic on the roads could potentially get backed up, but Canaccord believes that won’t disrupt nearby communities too much due to the fact that many people in those communities work for Calibre.

The firm also says Calibre undertakes extensive consultation before starting any new operations, which will also help reduce the likelihood of any issues arising as a result of heightened activity on those roadways.

Common interlocking brick road in Nicaragua. Photo via Canaccord Genuity

Calibre aims to optimize its mine plans through experienced leadership

The third key takeaway was that Calibre has the necessary leadership for success in Nicaragua and that the company is on the right track to meet its 2024 production guidance.

Canaccord has a high level of confidence that Calibre will be able to switch its focus from pure mine life extension to free cash flow generation after the company built an adequate base.

The company is currently prioritizing optimization of its mine plans in an effort being led by David Hendricks, Vice President of Calibre’s Nicaragua operations. Hendricks has also worked for Barrick and Kinross in the past.

Through prioritizing project sequencing, Calibre thinks it will be able to grow or maintain production levels while balancing the growth capital necessary for taking on new projects.

Canaccord believes in the near future this will enable Calibre to fulfil its plans and production guidance of 275-300 kilo-ounces of gold by 2024 after producing 222 kilo-ounces last year.

Calibre’s El Limon mill. Photo via Canaccord Genuity

Read more: Calibre Mining strengthens management team with two new vice presidents

Read more: Calibre Mining increases mineral resources and reserves at its Nicaragua and Nevada operations

Recent U.S. sanctions aimed at the Ortega regime, not local people or miners like Calibre

The fourth key takeaway Canaccord had was that the mining sanctions imposed by the United States would not impede Calibre’s operations.

In October last year, Joe Biden’s government imposed mining sanctions on Nicaragua and its President Daniel Ortega over activity in the country that the U.S. viewed as being an attack on democracy.

“The Ortega-Murillo regime’s continued attacks on democratic actors and members of civil society and unjust detention of political prisoners demonstrate that the regime feels it is not bound by the rule of law,” said Brian Nelson, Under Secretary of the Treasury for Terrorism and Financial Intelligence of the United States in October.

Nelson added that the sanctions were intended to deny Nicaragua the resources needed to continue undermining democratic institutions in the country.

Canaccord says that it met with an assortment of government representatives during the course of the tour, including the Minister of Energy and Mines.

Those representatives made it clear that the recent sanctions from the United States are intended to impact state-controlled mining operations and figureheads in Ortega’s regime, not Nicaraguan citizens of foreign entities like Calibre Mining.

Canaccord added that any sanctions placed on Calibre would negatively impact the local Nicaraguan people due to the company’s integral role in the country’s economy.

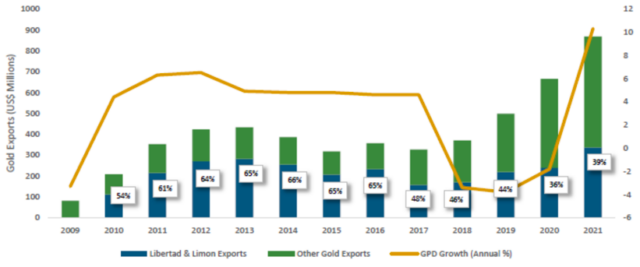

Calibre distributed approximately US$286 million in economic value to Nicaragua’s economy in 2021, which accounted for about two per cent of the country’s gross domestic product.

Nicaraguan exports vs national GDP. Photo via Calibre Mining

Calibre has established a good relationship with the Nicaraguan government

The last key takeaway was that Calibre is doing good work for local people in the vicinity of its operations and that the company has established a good relationship with the country’s government.

Canaccord toured the Cebadilla Resettlement Community built by Calibre to relocate 35 families from the location of its El Limon mine. The Nicaraguan government contributed to the community by constructing an elementary school and hospital and Canaccord feels this demonstrates the government’s willingness to work cooperatively with Calibre going forward.

House built by Calibre in the Cebadilla community. Photo via Canaccord Genuity

Read more: Calibre Mining gold discovery could breathe life into historic mining community

Read more: Calibre Mining budgets $29M for 2023 exploration in Nevada and Nicaragua

Canaccord has offices in Vancouver, Toronto, Calgary, Edmonton, Montreal, Waterloo, Winnipeg, Oakville, Halifax and Kelowna.

The independent investment bank specializes in various sectors including metals and mining; cannabis; blockchain and digital assets; energy; technology, media and telecoms; and real estate.

The firm will be hosting a Global Metals & Mining Conference this May in Palm Desert, California.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com