The U.S. cannabis testing services market will more than triple over the next seven years to a total of US$409.3 million, according to a market intelligence firm.

Coherent Market Insights said Tuesday it expects the market segment will experience a compound annual growth rate of 15.7 per cent over the 2019 – 2027 period.

The information came alongside the firm’s release of a for-purchase report on the topic.

Major growth in cannabis testing services is in part due to the rising number of patients opting for medical weed, Coherent said in a press release.

The firm cited data from the New Jersey Department of Health’s 2018 statistical report, where the patient count for medical cannabis was over 10,000 in 2016, and increased to around 24,000 in 2018.

Growing support from government and healthcare authorities for legalizing cannabis, and implementing cannabis testing laboratory standards is also contributing to growth in the sector, Coherent said.

There is clear evidence that mainstream support of weed-derived drugs is increasing in the States.

The U.S. FDA recently granted orphan drug status to a THC-based treatment for liver cancer, which will allow it to proceed to more formal clinical trials.

Every year millions of prescriptions are written for #pain. Many of these are potent #opioids that are highly #addictive and can cause debilitating side effects. Our lead asset, #CAUMZ, is a non-opioid alternative to treat pain. Learn more here: https://t.co/zTs43dEZBE pic.twitter.com/0iqOG5myJT

— Tetra Bio-Pharma (@TetraBioPharma) December 17, 2019

Caumz, developed by Tetra Bio-Pharma Inc. (TSX-V: TBP and OTCQB: TBPMF), is among a small but growing number of federally recognized applications of cannabis to treat severe diseases.

Read more: US FDA gives rare drug designation to THC cancer drug in clinical trails

Coherent also gave the example of the American Association for Laboratory Accreditation, a non-profit, public service membership society that offers accreditation to laboratories performing analytical testing of cannabis and cannabis-derived products.

According to the firm, leaders in the sector are making moves to grow their IP and market share.

“Major players in the cannabis testing services market are engaged in acquisition of business to create more growth opportunities in the cannabis testing and service market,” Coherent said.

“For instance, in August 2018, Eurofins Scientific [EPA: ERF] acquired Nano-lab Technology, Inc. in Silicon Valley, which provides advanced material and analytical solutions such as and advanced microscopy.”

Coherent listed the following companies as key players in the U.S. cannabis medical services market: SC Laboratories Inc., Eurofins Scientific, EVIO, Inc. (OTCMKTS: EVIO), Praxis Laboratory, Agricor Laboratories, Steep Hill Labs, Inc., Digipath, Inc. (OTCMKTS: DIGP), Sequoia Analytical Labs, Fairbanks Analytical Testing LLC, Aurum Laboratories, LLC, Pure Analytics LLC, Gobi Labs, Cascadia Labs, Encore labs, PharmLabs LLC and Cann-a-Lab.

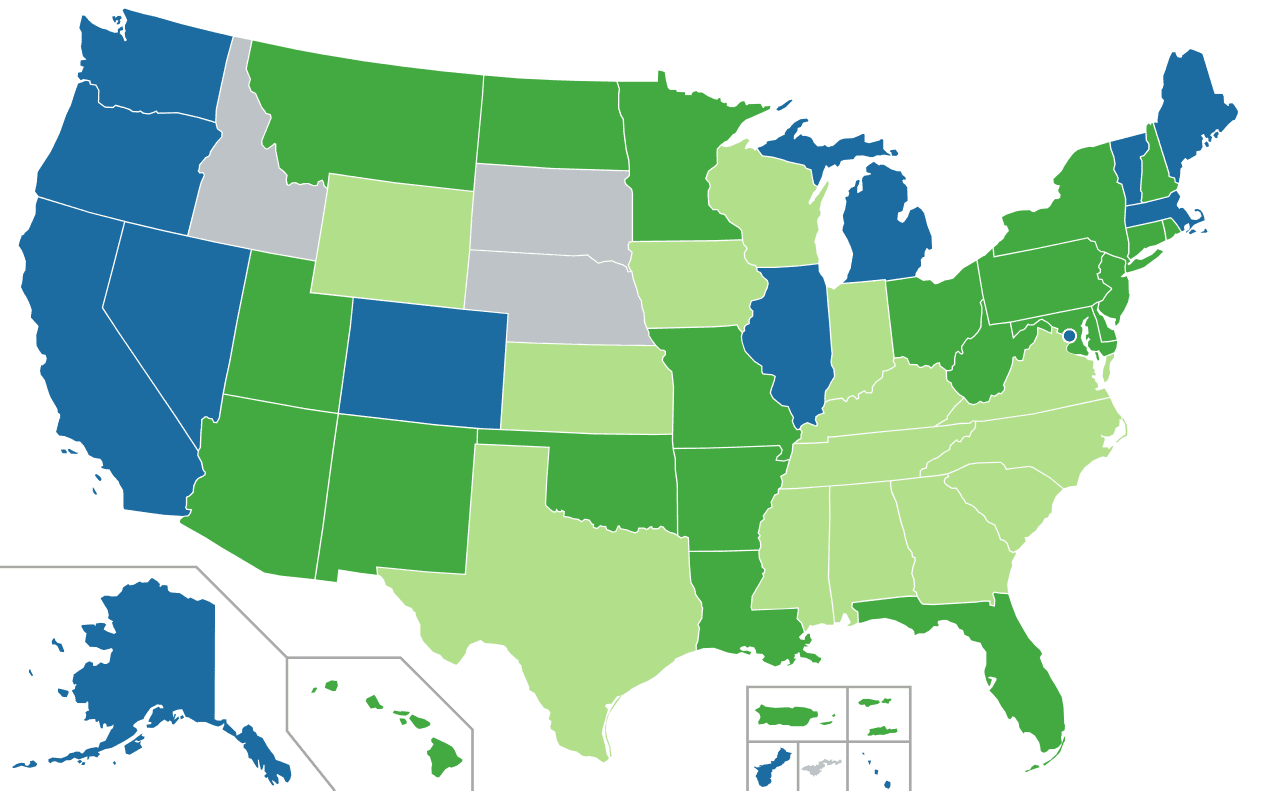

Top image is a map of cannabis’s legal status by U.S. state. Blue is no doctor recommendation required (recreational), dark green is doctor recommendation required (medical), light green is minimal THC content and grey is prohibited. Image by Jamesy0627144 via Wikipedia Commons.

nick@mugglehead.com

@nick_laba