As Canada’s capital-markets cannabis sector got off to a roaring start, and then came to a calamitous halt, the massive firms heading the charge and the executives steering them began to draw intense scrutiny.

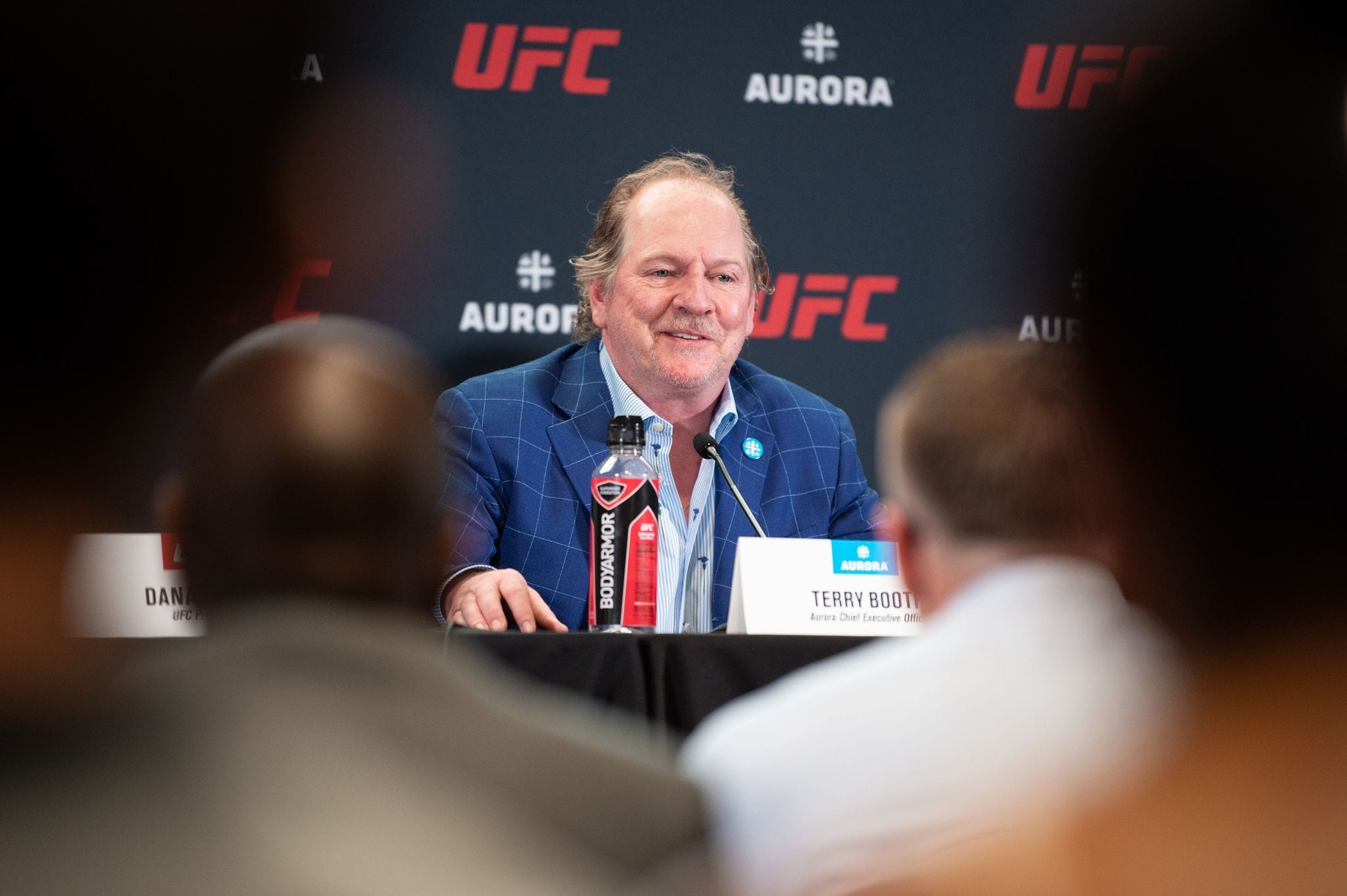

Terry Booth, former top boss at Aurora Cannabis Inc. (TSX: ACB) (NYSE: ACB) and newly minted CEO of Australis Capital Inc. (CSE: AUSA) (OTC: AUSAF), is one of those executives.

So, as Booth looks to continue his career in weed capital, many are wondering if old habits really do die hard. To answer that question, they’ll naturally look to the past, especially as the ventures he now leads are spinoffs of his former company.

When Canada’s speculative bubble burst, a majority of the weed-at-scale assets built or bought by major firms became worthless.

In the rosy months of late 2018, Aurora was valued at over $10 billion, but as of May 2020 things had gotten so bad that the company was forced to execute a 1-for-12 reverse split to keep its stock on the New York Stock Exchange.

By the end of the pandemic year, the firm had laid of 1,200 staff, closed five Canadian facilities and posted a fiscal-year net loss of $3.3 billion mostly in write downs.

Read more: Aurora shares slump on latest round of job cuts

In contrast, the tough times would have been hard to extrapolate from Aurora’s c-suite paystubs. All six of its named executives received a spike in share- or option-based pay, each earning upwards of $1.4 million.

Booth walked away with total compensation of $4.9 million, which he explains is because he was exiting the company. But his former colleagues “should not have gotten a damn raise,” he says, noting the bad message that sent to the public.

Concept art for ALPS’s Project Nordic, planned to be the largest EU GMP compliant cannabis facility, located in Denmark. Aurora is one of ALPS’s biggest clients. Aurora has been scaling back European edeavours since 2019. Image via ALPS

By the looks of it, Booth is trying to turn over a new-yet-familiar leaf this year as he takes his seat at the head of Australis this month, concurrent with its acquisition of Aurora Larssen Projects (ALPS) — another Aurora offshoot — for $12 million in shares and cash.

In the interview that follows, the big-weed pioneer touches on the contentious leadership shift that eventually led to him leading his new company, why Australis isn’t Aurora 2.0, its Trojan horse business model, why he didn’t screw up at Aurora and why he agrees raising executive pay in a year with over $3 billion in write downs was a terrible idea.

The text has been edited for length and clarity.

In your own words, can you explain what’s transpired from stepping down as Aurora’s CEO, to the contentious shift in leadership at Australis, to you being set to lead Australis today?

November of 2019, I was pretty well out of Aurora. When your stock goes from $10 bucks to $2, somebody’s gotta take a bullet.

The entire industry was resetting on valuations. They had to valuate a nascent industry somehow. They used to valuate it by if we had a license, then if we had sales and then our footprint. Companies were chasing those valuations in the public markets.

When you chase a valuation, and you hope it sticks, that was scary sometimes. Certainly, the cannabis space is small today, as it ever will be. Across the planet, there are no backwards steps of cannabis — it just didn’t grow like everybody thought. And certainly the Canadian demand wasn’t what everybody thought either.

And I think that’s really because of Covid, for sure. Ontario was to crack open when when Covid hit. And remember, it’s one-third of our population of users. And then we also had Health Canada impose rules on adult usage — that doesn’t make it very easy to brand or advertise or whatnot, and the taxes associated with that are still keeping the prices sort of high.

So, November 2019. I was pretty well out the door but it became official in February, when I announced my retirement and resigned from the board. A few months later, Australis had spoken to me about coming on board as maybe a chief strategy officer, but they were in a transition, where they were looking at moving to fintech.

Read more: Aurora co-founder Terry Booth retires from board of directors

And that fintech was to do mainly with a company called Folium. And the reason they had to exit the THC space is because Folium wanted to become listed on the Nasdaq.

Okay, so, the pivot to those assets of Australis. They were going to go with a fintech company called Cocoon for password technologies that were going to run all that. I don’t know the full story, but who’s gonna end up with Folium?

From what I understand from the review of the Folium deal, it ended up that they didn’t do it. I don’t know all the reasons why, but I don’t think Folium were quite the company they said they were. We had looked at Folium — we were in competition with Tilray and Archer Daniels Midland.

Link: Australis Capital Announces Termination of Merger Agreement with Folium Biosciences

When it came to getting their books, getting their audited financial statements, it was very difficult for them because it wasn’t all right. So I think Australis went through the ropes to figure the same thing out, and they pulled out of the Folium deal.

Australis’s former CEO Scott Dowty is now the top boss of Passport Technology, which provides payment software for the gaming industry. Press photo

The problem was there was no plan B or plan C, there was only “What do we do now?” That’s when there was a decision by the board to acquire a company called Passport Technology, which happened to be owned by the CEO. And a guy I happened to appoint, because I used to be the founder.

The reason we spun Australis out was because of difficulties with the Toronto Stock Exchange and the New York Stock Exchange. We spun it out, issued a dividend to 250,000 happy shareholders at the time, which Aurora grew to 800,000. One of the things I’m pretty good at doing is attracting shareholders.

Then a dissident battle started.

These dissident battles seem very, very bitter in the press. But at the same time we’re negotiating. Your proxy firms — maybe it’s a reflection of society — recommend that you shit all over your competition in a proxy battle, and their proxies grifted the same.

Link: Australis Shareholders are not Fooled by the Recent Cosmetic Board and Management Changes

Because they didn’t have a solid path forward and because of the accusations that there was a lot of self dealing, a group started. I know them, of course I do. I didn’t join that group until it was well into the the throes of the dissident battle.

I was a significant shareholder in Australis at the time, and I had my own concerns about decisions the board was making, okay. I felt it necessary, as the dissidents did, to remove the board.

These dissident battles seem very, very bitter in the press. But at the same time we’re negotiating. Your proxy firms — maybe it’s a reflection of society — recommend that you shit all over your competition in a proxy battle, and their proxies grifted the same.

So you get the bitter stuff in the press about all the terrible things that were going on. But we’re not the ones writing those press releases, it’s the proxy firms. We actually pulled back on some of the rhetoric. You might say there were too many personal attacks. Who cares? It’s over. We won.

We won handily. It was north of 60 million shares to approximately 20 million, and of the 20 million the CEO owned 11 million. We were actually going to contest those but we didn’t have to.

They delayed their year end, which pissed us off a bit, but once they hit the AGM it was official that a new board would come in. Originally, I was slated to be on that board. I pulled my head out of that ring because of other deals I was working on in the U.S. cannabis space.

Page that forward not and now you have Australis acquiring ALPS, as well as acquiring GT Therapeutics, and also settling a lawsuit with them. So we’ve tidied up the house in a very expeditious manner.

Link: Australis Completes Acquisition of 51% Interest in ALPS

On our recently reported earnings, you’ll see some write downs and whatnot. We’re just selling house. The management team has been replaced. We didn’t need all those c-suites. We needed a CEO, which was Duke Fu of GT Therapeutics in the interim, and we hired a great guy named John Paul from the industry to be CFO.

You’ve told media on a few occasions that Australis is not Aurora 2.0, but as Australis and ALPS are both Aurora spinoffs in some form and Aurora holds warrants that would allow it to acquire ownership interest of Australis’s U.S. operations come federal legalization, how is it not set to be exactly that: the next major iteration of the original business?

About Aurora’s back-in right to Australis: It was at 20 cents, but it was based on a certain value and a certain number of shares outstanding. At that time, it was worth about 20 per cent of the company. After these ALPS and GT transactions, that amount of Aurora’s first back-in right will be down well below 5 per cent.

That’s diddly.

Their second back-in right, this is if America goes legal, is to buy another 20 per cent at market. I’ll welcome that money with open arms of love.

Hard to get that type of money and we’re within 23–24 per cent of Australis. Is that planned? I don’t think so at the Aurora level, but I can’t comment on them. They’ve gone the other direction with M&A expansion. And we also needed to be not just decriminalized but federally legal is the other clause in there, which I think they would struggle with.

I had it analyzed before I took on this role because I didn’t want an Aurora hangover — not that I don’t think they would be a great partner.

But as far as them, I think their chances of being a significant shareholder and in any control whatsoever of Australis going forward — which will have a different name — is minimal. But who knows, they could do a hostile takeover.

But as it stands now, with the back-in rights, the way you describe it is they stand to gain a maximum of 25 per cent equity based on their rights to exercise share options?

Yes, at this moment in time.

If Australis were to do more acquisitions, and we issue more shares, 5 per cent could go as low as 1, right? So call it 20–25.

Regarding your vision for Australis, I’ve seen you use the language of “big facilities” and “building for others” – this terminology brings to mind the failure of the massively overbuilt Canadian industry and its continuous, still-mounting oversupply issues, as well as third-party models which have also shown muted success. Can you explain Australis’s path to profitability in detail?

I would, and others have described it as a Trojan horse theory of business. The facilities we build will not be for us — they’ll be for others.

That’s what ALPS does. It’s an engineering and design firm that not only builds cannabis facilities, but it has been building high-level, high-tech greenhouses for over 30 years.

So if ALPS is able to secure good sized contracts, they don’t have to be mega, in the range of 1 million square feet. The conversations we had recently was one was for 300,000 square feet, and the other was for 150. We’ll build any facility.

ALPS is owned 51 per cent by Australis. So during the negotiations to build those facilities, we want to have a 5 per cent bio mass assignment, maybe 10. It’s not gonna be free. We’ll pay cost for it. Maybe cost plus 5 per cent.

What that gives you is a stable price for biomass and obviously high quality flower that we can then sell.

If we get retail licences, we can make it into derivatives. If we get production licences, we can distribute them. But only if we get those licences.

Many of these companies that are building these facilities already have their licences. So you’re piggybacking onto the licences in the various states.

One would say, “Well, why the hell would a company want to do that? Why would they assign 5 per cent of this facility to our cultivars, to our brands?”

In the Aurora days, we were always giving them pro formas: “This is what we’re gonna make. Here’s your hockey tickets.”

Well, number one: when we build these facilities, we’re going to increase your yield by 20 per cent because the quality of the facility. We’re going to give you standard operating procedures, so you don’t get recalled from the government.

It’s really a knowledge and quality pitch along with a partner that’s going to grow its brands in your facility. We’re going to trade off. We’ll do white labelling back and forth.

We want to be top shelf, front shelf and side shelf — if they have retail licences. But we certainly aren’t going to be a company that doesn’t spend anything.

In June, 2020, Aurora said it was closing five facilities including Aurora Eau in Lachute, Quebec. Press photo

I’ve learnt another lesson. I’m not going to buy any more Tonka trucks. No more distressed assets, man. We bought distressed assets [at Aurora] and it’s always on the CEO. But there are other people that weigh into this off a big board, and say, “Yeah, let’s buy that. It’s on the cheap.”

What I’ve learned is: it’s distressed for a reason, and the fix is sometimes more than the cost of the business. And you end up with someone that not only doesn’t contribute to EBITDA. They’re a drag on your EBITDA.

So the sort of companies we all do M&A with, the golden rule will be: EBITDA positive and hopefully cashflow positive. The two companies we’ve done a deals with are both EBITDA positive, GT and ALPS.

They’re adding to our book value, which is very important in the capital markets. I go out with the CFO to raise these guys money because they’re not making enough for us to expand and grow. We’re able to tell a very good story.

In the Aurora days, we were always giving them pro formas: “This is what we’re gonna make. Here’s your hockey tickets.”

Everybody else did it too: “Here’s where it’s going.” It never got there, man. It’s still not there. You can’t pitch that anymore.

Your pitch now is: “We’re making this. We need this to take it to there. We’re going to have a return on investment and that money contributes to organic growth.” That’s the difference.

While some see you as an industry trailblazer, probably more view you as at the core of what’s wrong with the world of corporate finance: a white male c-suite executive that’s received millions in compensation — more than many will see in their lifetimes — while shareholders have lost billions and the company you ran laid off hundreds of workers. So, what are your personal views on meritocracy? In other words, do you see your value as an employee of a company being worth thousands of times the hourly wage of someone working in a cultivation facility? And, relatedly, do you think an executive should be compensated millions before a company is profitable?

My $4.8 million had nothing to do with the raise. That has to do with my termination. You have an employment agreement, and a termination agreement. I wouldn’t have gotten $4.8 million had I still been there.

I also signed a non-compete. Imagine if I didn’t. That’s not my salary.

Those salaries are high, but you know what? There are some that are far higher. What these public companies do — a New York Stock Exchange listed company, all of them, not just the cannabis ones — they go to advisors like Merck, and Merck will tell you what the salary should be of the executives that bring in x-amount of top-line revenue and bottom-line revenue.

There’s even a model for MSO one, two, and three in the U.S. I’m taking a hell of a haircut being an MSO three, if we’re even there yet at Australis.

But I would expect more money at MSO two and MSO one, if we’re EBITDA positive and our stock price has appreciated.

If you and I are talking in three years, and we’re trading at 50 cents, I screwed up. If our market cap is $80 million bucks, I screwed up and I don’t deserve the money I was paid at Aurora.

I didn’t screw up at Aurora. We built a monster there, man. And it’s still in the billions of dollars and it started at $10 million. Do the math. There’s only so many executives in the cannabis space that can do what the larger companies have done to ascertain these values.

Am I guilty for the money I made Aurora? Hello, I should have made more. If I had the ability to sell my stock, I wouldn’t be talking to you. I’d be retired.

The last round of raises at Aurora I had nothing to do with. And I do agree with you 100 per cent that they should not have gotten a damn raise last year.

It’s a difficult proposition when someone says, “Oh, you really screwed up with Aurora.” No, I did not. We built a great company. We’ve got great facilities. They’re still there.

The demand wasn’t what we at all thought. That’s the whole industry. And I expect to build a very successful company in America as well.

Read more: Canadian pot industry could take lessons from Colorado’s success: expert

Last December, Aurora said it was cutting production and laying off an additional 214 workers at its flagship Aurora Sky facility in Edmonton, Alberta. Press photo

If I’d stepped into Australis and it was at $1.2 billion, I’d be a little bit scared. Now that everybody knows the top valuations in the world of cannabis companies are probably $6 billion to $1 billion. And in that $6 billion to $1 billion, there’s less than 50 companies. Compare that to tech.

This is a nascent industry. And what do I bring to the table? Regulatory knowledge and I know cannabis as well as anybody because I’ve studied and studied and studied it for the last seven years and what we can and cannot do with this amazing plant.

And I believe in it. I believe that it will soon be a medicine that will be prescribed and covered by all of our insurance companies. And it’ll stop people from killing themselves with opiates and a quart of whiskey.

That’s my thinking. I’m not only in it for the dough. I’m also in it for the cause. And if someone’s gonna pay me x-amount of dollars to do it, thank you very much.

Will I ask for a raise next year if I’m successful? Damn right I will. And I’ll ask for an increase for my executives, and all my people and all my cultivators. It wasn’t just the execs that got raises.

And guess what? The last round of raises at Aurora, I had nothing to do with. And I do agree with you 100 per cent that they should not have gotten a damn raise last year.

How does that make sense, especially when 1,200 people lose their jobs? And all these facilities get shut down?

Aurora executive chairman Michael Singer received $2.9 million in total compensation for fiscal 2020, when his company laid off 1,200 employees and lost $3.3 billion. Photo via Aurora

I wasn’t the CEO. I didn’t have any say in that whatsoever.

You can talk to those guys and talk to that executive, and ask, “What would Booth have said about giving all of us a raise? After we had that massive write down?”

It was a very bad message to all the people.

Terrible.

Terrible. And that wasn’t under my helm. I’m not owning that.

I’ll own that we went down in market cap because we overshot what we said we’re going to do. I will not own that those guys give themselves raises in a year that was catastrophic from a market-cap perspective. I think it was at least 50 per cent of the value in one year.

And 30 per cent of our staff. I agree with you 100 per cent. Print it. They didn’t like me when I left there, Nick.

Lastly, what are your predictions for the cannabis industry at large for the next year and in five years from now, and where do you see yourself and Australis in those timeframes?

You’re seeing even Southeast Asian countries get into this, where you used to take a bullet if you sold weed. The globe is changing. It’s growing.

The opportunity is immense. Globally, it’s going to be tough for Australis unless it’s a spin out.

But let me tell you this: ALPS — the company that Australis is acquiring — can do anything on the planet. It’s doing massive vegetable facilities that haven’t been announced yet, and I can’t really say where but you’d be surprised.

Read more: Are these countries next in line to legalize medical cannabis?

Read more: Mexico’s lower house approves recreational marijuana bill

Read more: Morocco moves to legalize cannabis for medical and industrial use

It’s talking to Middle East countries about cannabis, and just signed an Australian deal on medical cannabis. That is truly a global company.

But let me tell you this: ALPS — the company that Australis is acquiring — can do anything on the planet. It’s doing massive vegetable facilities that haven’t been announced yet, and I can’t really say where but you’d be surprised.

Touching the plant if we’re not federally legal, we would have to have a spin co. But CBD derived from hemp, we’re all over that.

We’re waiting. It’s sold everywhere in the States. Ingestibles are illegal really, when you look at the FDA, but the companies that we were talking to when I was in Aurora were big CPG companies and the rumors were all there. And the rumors are true.

We were talking to big, big companies and they all waited, waited with bated breath for this one molecule that is safe and it works. Right now they can use all the minor cannabinoids.

Like the guy from Oreo said, and you can look it up on YouTube. He said, “Imagine a snack that makes you want to eat more snacks.”

I love it. But we’re not there yet.

Top image via Aurora

nick@mugglehead.com