Orla Mining‘s (TSX: OLA) drilling efforts encountered wide zones of high-grade gold mineralization at Camino Rojo in Zacatecas State, Mexico.

The company said on Thursday its 2023 exploration program was a continuation of Orla’s previous drilling initiatives.

Approximately 14,000 meters of the planned 34,000-meter drilling program have been completed. Out of the 57 holes scheduled for 2023, 11 have already been drilled and assay results received. These results have revealed 17 significant mineralized drill intercepts, with a grade-by-thickness factor exceeding 50 g/t gold per meter. Among them, five intercepts have a grade-by-thickness factor surpassing 100 g/t gold per meter.

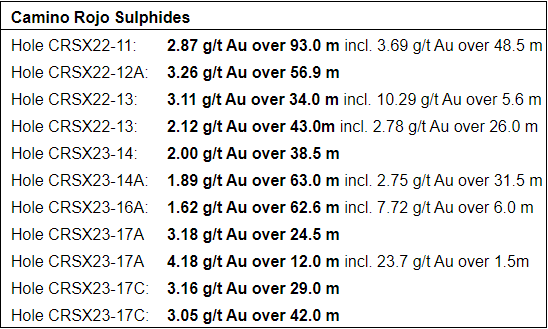

Assay results. Image via Orla Mining.

“The 2023 Camino Rojo sulphides infill and deep extension drill programs continue to generate excellent gold intersections, including massive sulphide replacement-style mineralization below the current resource,” said Sylvain Guerard, Orla’s senior vice-president, exploration.

As of June 2019, the mineral resource estimate for the sulphides in the Camino Rojo open-pit consisted of 74,000 ounces of measured resources (3.3 million tonnes at 0.69 g/t gold) and 7.2 million ounces of indicated resources (255 million tonnes at 0.88 g/t gold).

Recent exploration results near the Camino Rojo sulphides indicate the presence of a new style of mineralization, featuring both high-grade gold and zinc intersections. These findings further support the potential for extending the Camino Rojo sulphides deposit.

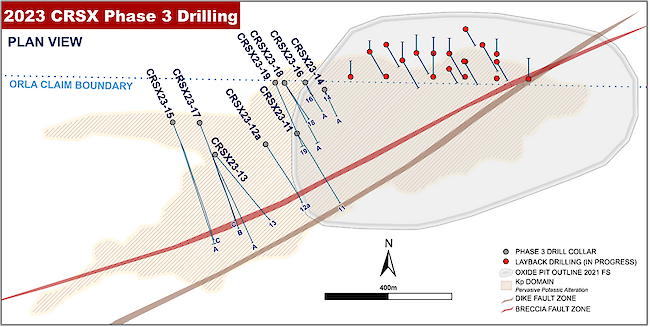

Image via Orla Mining.

Read more: NevGold discovers oxide gold from the surface at Nutmeg Mountain

Read more: NevGold finds high-grade gold underneath the surface at Nutmeg Mountain

Only 40% of 34,000 meters of drilling has been completed

Orla’s 2023 Camino Rojo present exploration program comprises three projects with a combined budget of $22 million. Currently, around 40 per cent of the planned 34,000 meters of drilling on the sulphides has been completed.

The layback oxide extension aims to confirm and define the mineralization in the oxide pit layback area. This will allow Orla to update is estimates of mineral resources and reserves, which are planned for release in late 2023. The layback program, which involved drilling 24 holes covering around 3,000 meters, was completed in late May with assays pending.

Additionally, the regional exploration drill program aims to explore priority regional targets in order to discover new satellite deposits. As of now, about 30 per cent of the planned 20,000 meters of regional drilling has been completed.

The program involves infilling the higher-grade sections of the deposit with drill holes spaced at 50-meter intervals, oriented towards the south. The purpose of this infill drilling is to update the geological model and resource estimate for the Camino Rojo sulphides.

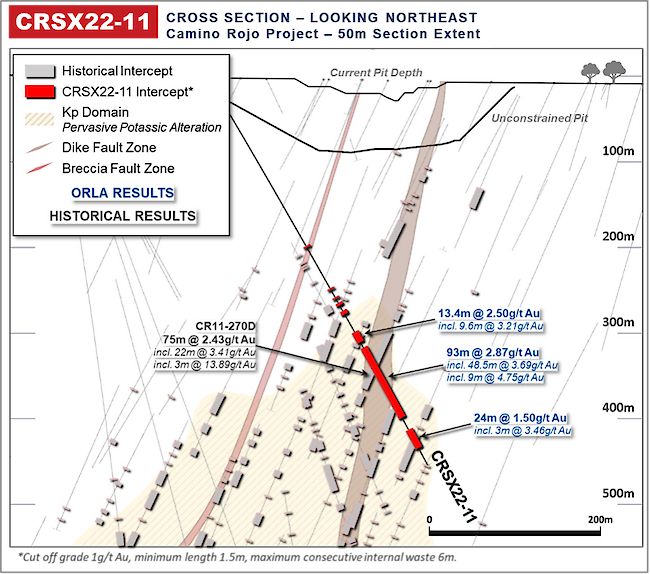

Image via Orla Mining.

Read more: NevGold forms B.C. subsidiary to focus on Ptarmigan

Read more: NevGold intercepts quartz veining on the surface of Nutmeg Mountain

Drilling objective is to assess gold mineralization continuity

Around 20 per cent of the 2023 sulphide drill program has been allocated for extending drilling activities beyond the current boundaries of the open-pit resource estimate.

The objective is to assess the continuity of gold mineralization along the steeply northwest-dipping dike structural zone at deeper levels. The initial extended drill hole, CRSX23-15C, has yielded significant intercepts of high-grade gold and polymetallic mineralization including:

- 15.4 g/t Au and 4.4 per cent Zn over 1.5 m;

- 3.52 g/t Au, 26.2 g/t silver and 3.6 per cent Zn over 8.5 m, including 6.57 g/t Au, 33.7 g/t Ag and 5.7 per cent Zn over 1.7 m as well as 6.86 g/t Au, 38.7 g/t Ag and 1.2 per cent Zn over 1.6 m;

- 4.54 g/t Au over 3.3 m, including 8.0 g/t Au and 12.5 per cent Zn over 1.2 m.

Apart from extending the drill holes in the sulphides drill program, the company has planned to conduct additional drilling in the second half of the year. This phase will involve approximately 2,300 meters of drilling across four directional drill holes.

The objective of this additional drilling is to follow up on a historical intercept in hole CR12-366D, which yielded promising results of 4.04 g/t Au over 46.5 meters. This intercept includes a section of 27 meters with a higher grade of 6.26 g/t Au (including 7.5 meters at 15.8 g/t Au, 36.5 g/t Ag and 5.7 per cent Zn). The historical intercept is situated around 250 meters down plunge from the most recent deep intercept in hole CRSX23-15C.

Read more: Gold is still the best hedge against inflation: NevGold CEO

Read more: NevGold CEO inks open letter reassuring shareholders despite recent upheavals

Mexico offers political stability and high grades

Mexico offers gold mining companies plenty of reasons to do business there. It’s popular as a gold mining hub not only because the gold is there, but because of its to its supportive mining regulations, developed infrastructure and skilled workforce. These contribute to a stable and attractive environment for mining investments.

Despite this, the Government of Mexico implemented a new law in May placing binding constraints on the activities of mining companies, including shorter concessions and tighter rules for permits.

Alamos Gold Inc. (TSX: AGI) found more high-grade gold mineralization beyond what it originally had stated in its existing Mineral Reserves and Resources at Puerto Del Aire (PDA). The PDA is an underground deposit situated next to the Mulatos pit in Sonora state, Mexico. Furthermore, significant gold mineralization was encountered over a wide interval at the Capulin target, located two kilometers east of the former San Carlos open pit.

Agnico Eagle Mines Limited (TSX: AEM) (NYSE: AEM) and Teck Resources Limited (TSX: TECK.A) (TSX: TECK.B) (NYSE: TECK) closed negotiations for the San Nicolás copper-zinc development project in April. Teck and Agnico Eagle have formed a joint venture through a shareholders agreement. As part of this agreement, Agnico Eagle, through its wholly-owned Mexican subsidiary, will acquire a 50 per cent interest in Minas de San Nicolás, S.A.P.I. de C.V. for a total of USD$580 million.

Shares of Orlan Mining dipped by 1.3 per cent to $5.31 on Friday on the Toronto Stock Exchange.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com