NevGold Corp. (TSXV:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) discovered oxide gold intercepts from the surface of its Nutmeg Mountain gold project in Idaho.

The company also announced on Thursday it has made significant progress in completing the current Mineral Resource Estimate (MRE) at Nutmeg Mountain. The MRE is expected to be finalized by early July.

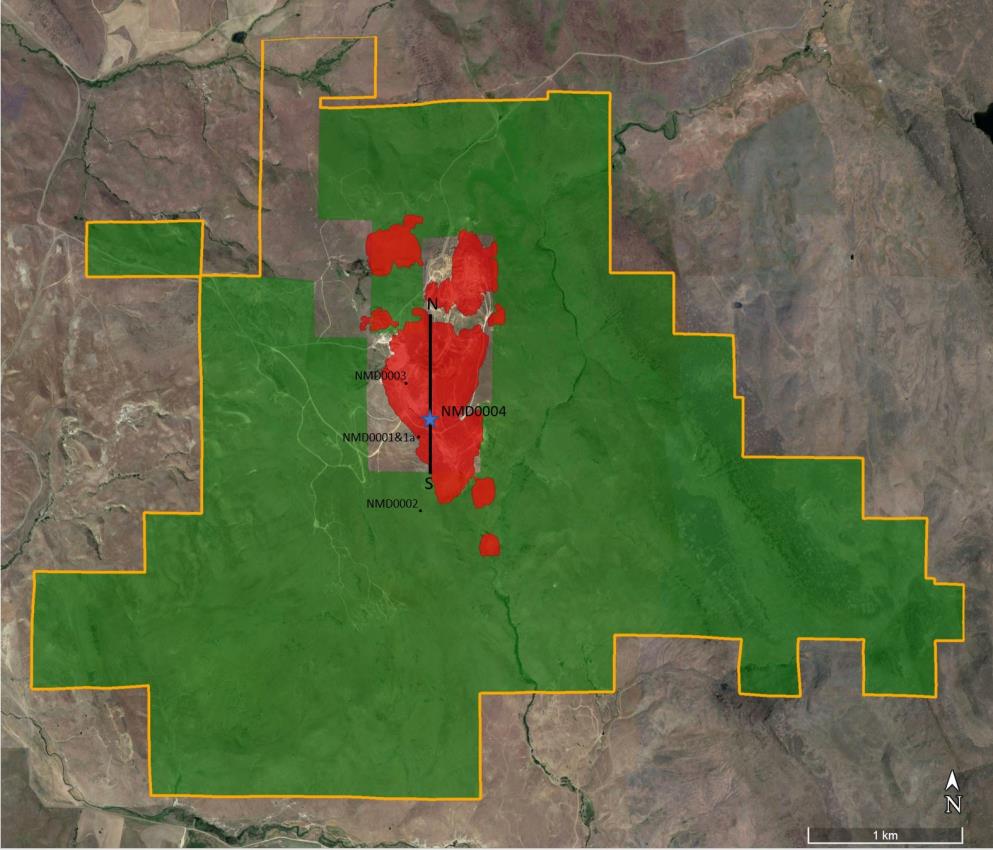

Recent drilling results indicate the potential for heap leach processing, with an intercept of 0.80 g/t Au over 51.5 meters from surface (oxide), including 1.40 g/t Au over 11.3 meters from a depth of 9.8 meters (oxide) in Hole NMD0004.

Assays for the remaining approximately 130 meters of this hole are pending. In addition, metallurgical testwork has commenced with Hole NMD0004, and the company has engaged McClelland Laboratories in Sparks, Nevada, to evaluate optimization opportunities related to grinding, comminution and recovery methods.

The company’s 2023 drill program has also revealed other promising results, including Hole NMD0003, which intercepted 0.72 g/t Au over 79.3 meters from a depth of 10.4 meters (oxide), including 2.32 g/t Au over 13.4 meters from 25.6 meters depth (oxide).

Hole NMD0001 encountered 0.56 g/t Au over 23.9 meters from 24.1 meters depth, including 0.89 g/t Au over 11.4 meters from 25.6 meters depth, with a significant intercept of 4.33 g/t Au near the bottom of the hole. Unfortunately, Hole NMD0001 was lost in mineralization.

The orientated core drilling portion of the current drill program has been completed, and the program will now shift to reverse circulation drilling.

“The further results from our inaugural drill program at Nutmeg Mountain continue to highlight the at-surface, oxide gold mineralization at the project that we anticipate will be amenable to heap leach processing,” said Brandon Bonifacio, CEO of NevGold.

Plan view map of Nutmeg Mountain with drill collar locations. Yellow lines are the property boundary. Image via NevGold.

Read more: NevGold finds high-grade gold underneath the surface at Nutmeg Mountain

Read more: NevGold assays high-grade silver at Ptarmigan, expands copper trend

NevGold six months ahead of schedule with mineral resource estimate

The company acquired Nutmeg Mountain in June 2022 from GoldMining Inc. (TSX: GOLD) and it came with a historical resource dating to 2020, but as the company started drilling it viewed its recent successes as an opportunity to update the resource now.

“We originally had plans to update the resource at the end of the year after completing a full drill project for 2023, but as we were doing some of the internal work, we actually covered a lot of optimizations and saw a potential upside in that 2020 resource,” said Bonifacio in an interview with Global One Media Group.

“We think it’s an important milestone to underpin the valuation of the company and we’re pretty excited about getting that resource out over the next couple of weeks.”

NevGold recently discovered high-grade heap-leachable gold results at surface at Nutmeg Mountain. These findings, obtained from drilling conducted earlier this year, suggest the presence of elevated-grade gold deposits with the potential for resource expansion.

Notably, these mineralized zones begin at the surface, requiring minimal stripping for extraction. The ongoing drill program at Nutmeg Mountain is progressing according to schedule and within the allocated budget.

The project has a 2020 mineral resource estimate of indicated 910,000 ounces of gold, with a tonnage of 43.5 million tonnes at a grade of 0.65 g/t Au. Additionally, there are 160,000 inferred ounces of gold, with a tonnage of 9.1 million tonnes at a grade of 0.56 g/t Au.

NevGold shares were flat on Thursday at $0.38 on the TSX Venture Exchange.

https://www.youtube.com/watch?v=Q6IvkgV2LLc

Read more: NevGold forms B.C. subsidiary to focus on Ptarmigan

Read more: NevGold intercepts quartz veining on the surface of Nutmeg Mountain

Idaho gold history stretches back to the Gold Rush

Idaho has always been a historically significant mining stage with a rich gold mining heritage that stretches back to the Gold Rush era. Additionally, the state’s favorable geological conditions and the potential for significant gold deposits have attracted increased exploration and mining activity in recent years.

Galleon Gold Corp. (TSXV: GGO) reached an agreement to acquire a mineralized material known as the stockpile from 2176423 Ontario Ltd., which is owned and controlled by Canadian billionaire, Eric Sprott.

Additionally, the agreement includes the vendor’s 20 per cent interest in the project. In exchange for these assets, the company will issue 2 million common shares of to the vendor.

The stockpile is a 13,900-ton bulk sample with gold-grades of approximately 4.54 gpt Au, equivalent to approximately 1,835 ounces of gold in-situ, pulled from an open cut area in 2016-2017. The stockpile is located on the Neal Idaho Project, located 27 kilometers southeast of Boise, Idaho.

Revival Gold Inc. (TSXV: RVG, OTCQX: RVLGF) has spent the past six months focusing on its updated Mineral Resources and Preliminary Feasibility Study for its Beartrack-Arnett property in Idaho. The company announced last week that it anticipates being finished within the next 4-6 weeks.

Nevgold is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com