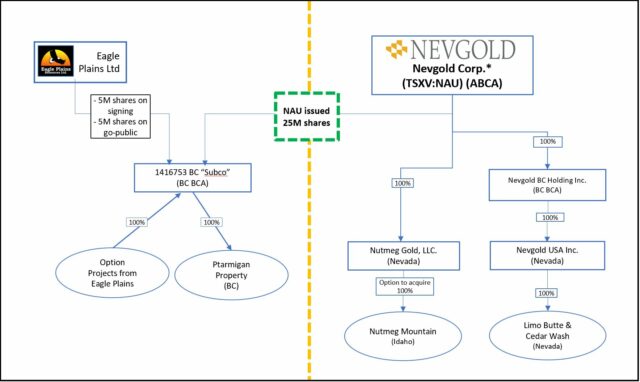

NevGold Corp. (TSX-V: NAU) (OTC: NAUFF) has created a new British Columbia-focused subsidiary to advance its Ptarmigan project in the southeast corner of the province.

On Wednesday, the company announced the formation of 1416753 B.C. Ltd. (SubCo), a soon-to-be publicly listed entity. Once made public, NevGold will be transferring the Ptarmigan project to SubCo in exchange for 25 million common shares of the new subsidiary.

NevGold also signed an option agreement on Friday to acquire a series of exploration assets from Eagle Plains Resources Ltd. (TSX-V: EPL). This will include three lithium projects and two copper-gold-silver projects in B.C.

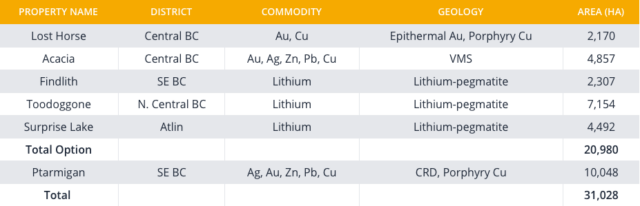

The option projects from Eagle Plains span over 20,000 hectares and are summarized in the following table:

Table via NevGold

Read more: NevGold intercepts quartz veining on the surface of Nutmeg Mountain

Read more: NevGold finds high-grade gold underneath the surface at Nutmeg Mountain

SubCo and option projects benefit NevGold and shareholders

The formation of the new subsidiary will unlock immediate value from the Ptarmigan project through the 25 million shares being issued to NevGold for the benefit of its shareholders.

It will provide further exposure for NevGold’s shareholders to the promising series of option projects being acquired from Eagle Plains and allow NevGold to focus on its flagship assets in Nevada and Washington.

The acquisition of the option projects will also give NevGold a large land position totalling over 31,000 hectares in the highly prospective districts of Atlin, Columbia and Toodoggone. The Ptarmigan, Acacia and Lost Horse option projects have several targets deemed as being drill-ready.

“The SubCo provides exposure to a highly prospective portfolio of advanced exploration assets including high-grade silver-lead-zinc, copper, gold and lithium in B.C. which can be financed separately without impacting the NevGold capital structure and technical resources,” said NevGold’s CEO Brandon Bonifacio, adding that Ptarmigan has not been receiving adequate attention due to NevGold’s focus on its gold assets in the western U.S.

Bonifacio also says the transaction will deliver tremendous value to NevGold shareholders as the B.C. subsidiary is brought into the public market.

Eagle Plains’ Vice President of Exploration Chuck Downie says the synergies created with NevGold through the option agreement will fast-track discovery potential and create value for the shareholders of both miners. SubCo has agreed to grant Eagle Plains a 2 per cent net smelter royalty (NSR) on certain option projects provided to SubCo.

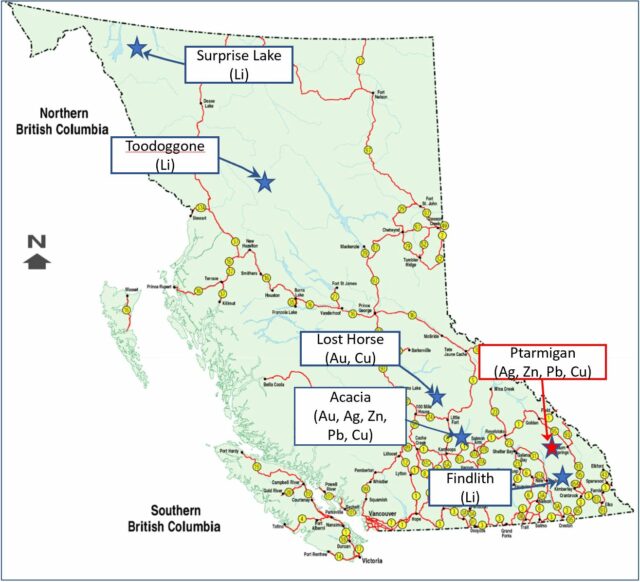

Option project locations . Map via NevGold

Read more: NevGold assays high-grade silver at Ptarmigan, expands copper trend

Read more: Gold is still the best hedge against inflation: NevGold CEO

The Findlith project is located about 35 kilometres northwest of Cranbrook and contains pegmatites that are very prospective for lithium.

The Acacia project is situated about 60 kilometres northeast of Kamloops and has strong potential for volcanogenic massive sulphide deposits. It is fully permitted by the province’s Ministry of Energy Mines and Low Carbon Innovation through a Multi Year Area Based (MYAB) Permit.

Lost Horse is a strategically positioned project surrounded by New Gold Inc.’s (TSX: NGD) mining operations. It has several prospective copper and gold occurrences and also holds a MYAB Permit.

Arrangement structure. Image via NevGold

Ptarmigan is a district-scale high-grade polymetallic project situated in the southeast corner of B.C. It has had about $7 million invested historically in surface mapping, geochemical and geophysical analysis and more than 14,000 metres of diamond drilling.

Historical high-grade intercepts at the project include the following:

- 2,455 g/t silver and 1.00 g/t gold with 0.91 per cent copper over 3.65 metres

- 2,315 g/t Ag and 1.64 g/t Au with 1.10 per cent Cu over 1.16 metres

- 452 g/t Ag and 0.52 g/t Au with 0.26 per cent Cu over 6.8 metres

Geochemical sampling results include the following:

-

- 1,171 g/t Ag, 0.96 g/t of Au, 0.30 per cent Cu, 29.7 per cent lead

- 2,210 g/t Ag, 1.8 g/t Au, 1.4 per cent Cu

- 3,188 g/t Ag, 0.22 per cent Cu, 29.4 per cent Pb

NevGold’s shares dropped by 4.23 per cent Wednesday to $0.34 on the TSX Venture Exchange.

NevGold is a sponsor of Mugglehead news coverage

rowan@mugglehead.com