The recent bank runs and subsequent collapse of the Silicon Valley Bank and Signature Bank have brought a number of concerns forward regarding the lack of transparency in the way the Federal Reserve has been handling the inflation crisis.

While there has been an increase of countries beginning to store gold as a hedge against inflation, some states such as Idaho have begun to follow suit as well. The House of Representatives of the State of Idaho introduced Bill 180 earlier this month which would allow it to use idle treasury funds to buy gold and silver. The bill is now being reviewed in the Senate and should not be long until it reaches Governor’s Brad Little’s desk for a signature.

NevGold Corp.’s (TSXV:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) CEO Brandon Bonifacio sat with Mugglehead in an interview to discuss the new bill, inflationary pressures, deglobalization, the recent upheavals in the finance world, and why he’s still bullish on gold despite all of this calamity.

The following interview has been edited for length and clarity.

Brandon Bonifacio, CEO of NevGold Corp. Photo via NevGold.

What does House Bill 180 change?

Well, it’s in realizing the importance of commodities like gold and silver in today’s world. In terms of those commodities being a store of wealth. So from a state treasurer standpoint, the ability for them to be able to invest in gold and silver is a great signal not just to the state of Idaho or the United States, but the world as a whole.

[The state is] realizing that regular fiat currencies are not necessarily the best store of wealth because of all the money printing that’s occurred over the last one or two decades, which has led to rampant inflation. Overall, the fact that they’re turning to asset classes like gold and silver, I think is extremely positive for the business that we work in specifically.

Does that necessarily imply or suggest a growing distrust from the individual states in the federal system, or is this widespread across the political spectrum?

Yeah, in the state of Idaho it definitely is. I don’t think there there’s a right or left per se with respect to this specific bill. I think it does have bipartisan support to the best of my knowledge. Whether other states will follow suit, I’m not sure if that will occur, but especially with having a gold specific project in the state of Idaho.

I think it’s very interesting to see them take this, what I would call pretty forward approach at how they manage the state finances. It is a signal that they most likely have less trust in the Federal Reserve and federal banking system versus owning a physical commodity like gold and silver to hedge against the devaluation of the US dollar effectively.

Read more: Idaho’s House Bill 180 challenges exclusive currency control of Federal Reserve

Read more: NevGold to hit the ground running at Limousine Butte in 2023: Caesars Report

Gold and silver in deglobalization

Do you think a return to the constitutional role of gold and silver is going to increase demand?

I do. And I think it actually helps make projects that are in the United States get more support. So we all know about producing gold and silver and then it being sold to commodity trading houses and then doing a full U-turn back to whoever the end buyer of the physical commodity is.

Where I think we’re going is through de-globalization. So we had a rapid globalization period, starting in the 1990s-2000s, and everything was offshored. And the world was open for business and I think what’s happened with COVID. Not to be political, but that’s the east versus the West, the North America versus Russia and China. I think there’s trust issues that have been evolving and I think supply chains being disrupted.

I think countries like the United States and global powers are realizing that they need to be self reliant and self sufficient.

So the fact that there are an abundance of natural resource projects in the United States, I think that will bode well for the companies that are operating there in terms of support, getting projects permitted, support from the communities, and support for gold ‘Made in America.’ If that makes sense.

Read more: NevGold CEO inks open letter reassuring shareholders despite recent upheavals

Read more: 2023 will be a ‘very strong’ year for gold mining: NevGold

Where do you see the gold market going in the next year, especially given the context of the failure of the two banks lately?

Up, up and more up!

No, I think it’s very interesting to see. Gold as a commodity is performing exactly how it would be expected in times like these. I think the gold equities have not got as much attention or as large of a bullish move because other asset classes are being sold down. So gold is acting as a bit of a cover in terms of when people are looking at their entire portfolios, but I do think that is going to change. When you look at gold, the commodity, today it touched USD$1,940.

I think with what has occurred in the banking system, the one thing about gold is there is no counterparty risk. So I think that’s a very important characteristic of gold, and as mentioned as an asset class that cannot be manufactured or made or printed, that has a lot of positive qualities with what’s happening now globally.

So I think from that standpoint, and it’s more of a when not if, I expect gold to reach all time highs over the over the near to medium term. I don’t know if that’s three months, six months, but I do think there will be a very large bullish move in gold to new all time highs breaking through USD$2,100 and then who knows where it could end up.

Another monstrous volume trading day in Gold — total volume over 421,000 contracts or 4.21M Troy ounces, which exceeds Friday’s highest volume day of the year: https://t.co/i9tix1M6Vg pic.twitter.com/TWWm3bx1Y4

— Peter Spina ⚒ GoldSeek | SilverSeek (@goldseek) March 13, 2023

Gold equities have a lot of leverage: Nevgold CEO

So it’d be safe to say you’d suggest people to buy gold?

Definitely. Gold physical and gold equities. Because I think the gold equities are a product that it has a lot of leverage. So I think gold will trade where it does but that will translate into what could be three to four times leverage in some of the equities. Specifically development companies like NevGold have even more torque or leverage compared to the senior producing companies.

What do you think the odds are on the Federal Reserve backing off on interest rates given the pressure put on the two banks?

Yeah, I mean, we’ve had a lot of key data points over the last couple of days. I’m just digesting those myself. And I think speaking with a lot of people who follow the markets, I think with what happened with Silicon Valley Bank, Signature Bank and the banking system and then this past Tuesday, you had the CPI (Consumer Price Index) data come out, or inflation numbers. It looks like things are starting to plateau month over month and year over year.

I think with what happened with the banking system actually creates an elegant out for the Fed to actually go with 25 basis points or even no rate hike all together. So I think next Tuesday or Wednesday is the next Federal Reserve meeting. I think the probability of that 50 basis points rate hike has significantly decreased and I think the market is pricing in something sort of ranging from 25 basis points to even zero.

I think if it is zero in this next meeting, I think all markets will potentially go parabolic. I think it means that the Fed will be backing off, and I personally think they will. They need to back off at this next meeting to really keep an orderly functioning global financial system, not just in the United States.

Read more: NevGold’s oxide gold drill program in Nevada finds positive results

Read more: NevGold submits exploration and expansion plans for gold project in Nevada

Federal Reserve chairman Jerome Powell. Image via Federal Reserve.

So what do you think about Federal Reserve chairman Jerome Powell’s stance on inflation reduction right now?

[Powell has committed to an aggressive campaign of interest rate hikes in order to reduce inflation He’s raised interest eight times in the last year to weaken demand.]

I mean, when you put that much free money or liquidity into the system over the last one or two decades, and then it’s exacerbated with the COVID situation in 2020, and the US debt balance is now 50 trillion. It’s doubled in the last couple of years. There was so much low interest rate money in the financial system, and effectively money was flowing. I think him hiking out of that over the past 12 months, or however long it’s been, it was done in too rapid of a manner to try and tame inflation.

So I think he now needs to think long and hard about this next upcoming meeting and thereafter about keeping an orderly function. I think there’s always pendulums in whatever market and cycles that occur, but I don’t think there is a “soft landing” here.

If [the Federal Reserve] hikes too fast, which is what they’ve done to date, and they continue hiking at that pace, there could be the potential for significant negative implications in the global financial system, not just in the US specifically.

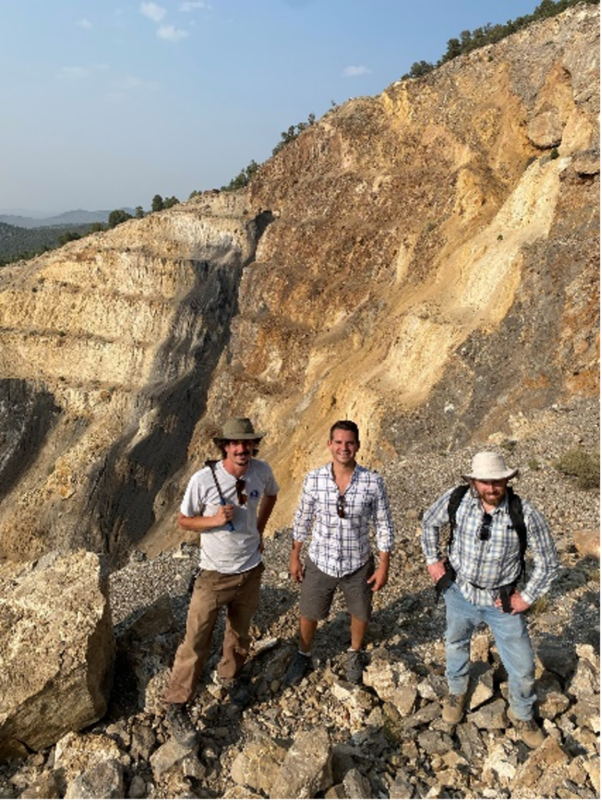

From left to right: Senior Geologist-Robert Springs, President & CEO-Brandon Bonifacio, Chief Geologist-Derick Unger. Image via NevGold.

Is there anything else you’d like to add?

I think when people are looking at gold equity investment, there’s some key ingredients or criteria that one should look at. First and foremost, it’s companies that are advancing de-risking projects with drilling or potential resource updates. That’s order of business one. Order of business two involves companies that have the financial knowledge or the treasury position to do so, as in that they don’t have a financing overhang.

We at Nevgold, thankfully, did a $4 million plus Canadian raise last December. So we are well financed to complete all of our active field programs over 2023 with no financing requirements.

So that’s the second piece of criteria. And then the third is the capital structure of the company. The companies that will be rewarded the most are the ones that are held tightly by a stronger shareholders. And when you look at the NevGold shareholder registry, we’ve got two strategic shareholders that own approximately 25 per cent, then there’s us as the insider and key core ownership group own another 30 plus per cent on top of that.

I think there has been a bifurcation, and I hate to use this colloquial term, but between the haves or have nots. The ones [companies] that have maintained their capital structure, that have access to capital, that have projects that have value that they’re advancing, those are the ones where all of those ingredients and ecosystem are working together. They’re going to be rewarded the most.

Some companies might have great assets but don’t have access to capital and they’ve issued shares at very low prices and the capital structure is very large in terms of shares outstanding. Those ones have less ability to really get that exponential rerate so I think we’ve done a great job of that. I think that’s going to allow us, in this next cycle or this next window, where gold does have its moment in the sun to really have the most upside potential from that.

So you’ve managed to raise funds and improve your cash position without falling into debt?

Yes, and and we raised before the herd or before the rush occurred. I think that it’s very tough in this business to do things when nobody else is doing it. But that then allows you to be able to get into the field and start drilling prior to anybody which then means results.

So for example, because we did the raise ended November last year, we started drilling in January. Our first drill holes are going to start to be released over the next one to two weeks. If groups are still trying to scramble to raise money now, that means their first drill holes are not going to come until August, September, October, potentially. So being able to raise in the right windows allows you to potentially have catalysts or news flow when the markets might have a bullish run. Which is the goal.

Nevgold is a sponsor of Mugglehead news coverage

Follow Joseph Morton on Twitter

joseph@mugglehead.com