Calibre Mining (TSX: CXB) (OTCQX: CXBMF)’s resource expansion and exploration drilling around Pan shows growth and discovery potential which financial analysts consider could lead to higher positive values for the company.

This Wednesday, the investment banking firm Haywood Securities Inc. released a research report on the gold mining company and concluded that the firm’s take on Calibre is positive and continues to climb as drilling pushes at the margin of Pan resource and uncovers new value on its Coyote target.

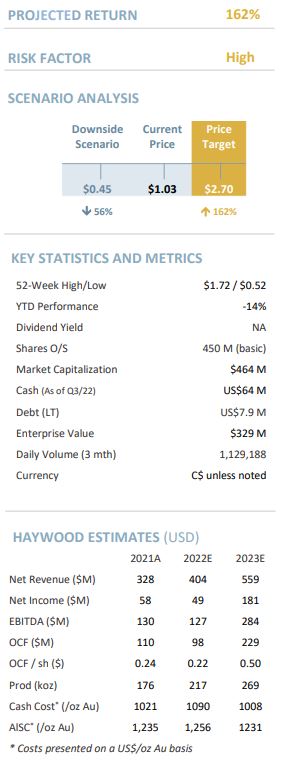

Tables via Haywood Securities

Haywood analysts identified three key points for Calibre including:

- Drilling around Pan pits shows additional shallow gold mineralization with grade (Black Stallion) and early drilling on the Coyote target uncovers the potential for a new discovery.

- The results from Pan are expected to expand future production incrementally. Pan with Coyote and other targets showing potential for even greater leverage to future resource growth.

- 2023 exploration on Pan is expected to deliver 28,000 metres in drilling that is focused on new targets and the expansion of available resources as stated by Calibre.

Haywood estimates 2023 production of 269,000 ounces of gold at a total cash cost of US$1,008 per ounce and an all-in sustaining cost of $1,231 per ounce gold.

This forecast represents approximately 20 per cent year-over-year growth in production.

The firm recommends accumulating shares at existing levels. It placed a target price of $2.70 based on a 3.3x EV/CF multiple to its 2023 OCF (pre-WC) estimates of US$0.50/sh.

Calibre trades at an EV/CF23 of 0.9x and P/NAV of 0.31x.

It anticipates Calibre shares will garner further investor interest as the company is expected to deliver on its near-term plans to yield drill catalysts across its assets and convert those successes into near and mid-term production.

New Coyote Pan South Discovery Initial Results:

• Hole PR22-237 18.29 metres grading 0.61 per cent g/t Au from 44.20 metres

• Hole PR22-238 13.72 metres grading 1.36 per cent g/t Au from 24.38 metres. Including 4.57 metres grading 2.77 per cent g/t Au from 25.91 metres

Read more: Calibre Mining Pan Mine assays show strong potential for Coyote mine target

Read more: Calibre Mining 2022 operating results show year-round gold production of 222K ounces

Haywood’s investment thesis for Calibre includes characteristics such as having a strong management and exploration team.

It highlights in an analysis that in the past, Calibre’s team members have delivered significant shareholder returns through the successful sale of seven mining companies (exceeding US$5 billion), including two significant take-outs over the past five years.

“The diverse asset portfolio offered by Calibre provides a value kernel in the presence of three operating mines that are expected to furnish free-cash-flow generation to an already healthy balance sheet, providing the funds to explore the asset portfolio (as shown by updated plans on Pan and Gold Rock for 2022) aid in the development of Gold Rock over the mid-term,” reads the report authored by analysts Geordie Mark and Nicholas Lobo.

Other characteristics highlighted by Haywood are Calibre’s latent capacity and geological potential due to its broad-ranging portfolio.

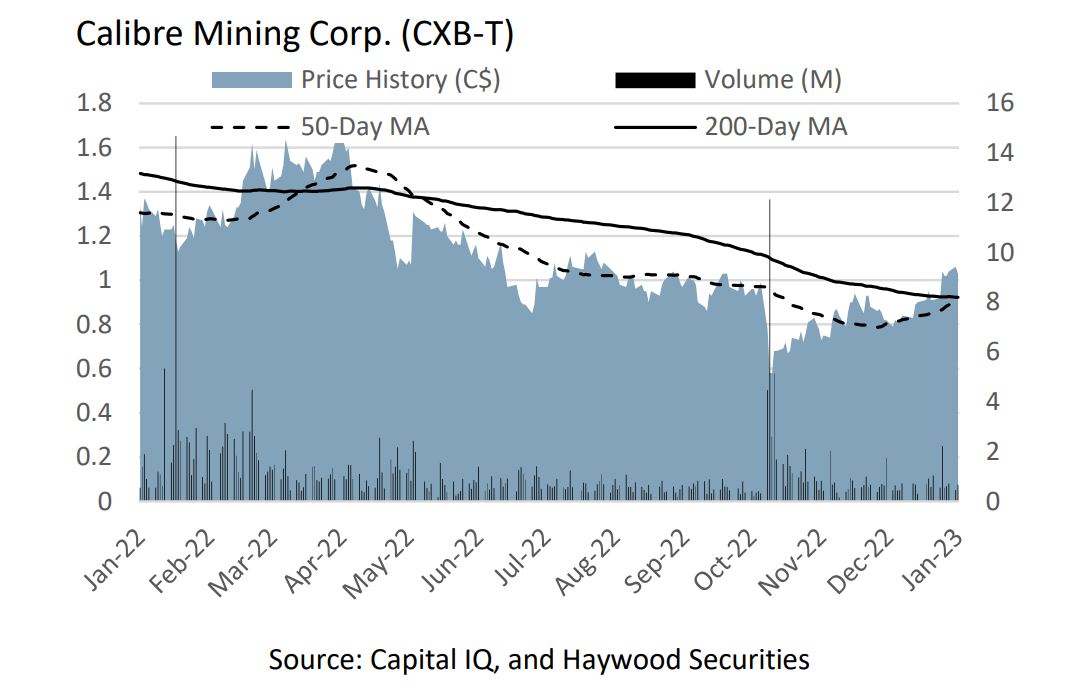

Calibre stock went up by 3.92 per cent on Thursday to $1.06 on the Toronto Securities Exchange.

Graph via Haywood.

Read more: Calibre Mining high-grade gold drill positive results to continue at Panteon North, say analysts

Read more: Calibre Mining step-out drilling results show bonanza grade gold intercepts in Nicaragua

Among the risks identified, Haywood identified valuation as a potential risk as according to them Calibre warrants a premium relative to peers based on its forecast cash flow generation profile, latent growth capacity and resource discovery potential.

“However, we acknowledge that valuation risk is high given fluctuations in market sentiment, the need to backfill production profile at La Libertad, and the inherent asset concentration risk being in one jurisdiction.”

Haywood also identified financial risks as Calibre’s near-term cash requirements are projected to be funded through cash flow from operations using Haywood’s commodity price assumptions.

Calibre’s balance sheet is forecast to be underpinned by our projections for near-term cash flow from operations that will likely require modest capital for individual mine development requirements and exploration expenditure, the firm explained.

Finally, another key risk identified by Haywood involved political risks related to social unrest in Nicaragua.

Calibre Mining is a sponsor of Mugglehead news coverage