Calibre Mining (TSX: CXB) (OTCQX: CXBMF) announced its operating results for the three months and year ended December 31, 2022, and also its 2023 production, sales and cost guidance.

The company has consolidated full year gold production numbers of 221,999 ounces. The breakdown has the company’s properties in Nicaragua accounting for 180,490 ounces of gold with Nevada picking up the rest with 41,509. The company’s Q4 gold production numbers are 61,294 ounces with Nicaragua producing 49,854 ounces and Nevada with 11,440 ounces.

“The team delivered record production in 2022, for the third consecutive year, positioning us well for a further 20 per cent production growth in 2023. Strong cash flows continue to drive Calibre’s organic growth strategy as we progressed development at Pavon Central and Eastern Borosi for production in 2023, setting ourselves up for another grade-driven production increase,” said Darren Hall, president and CEO of Calibre.

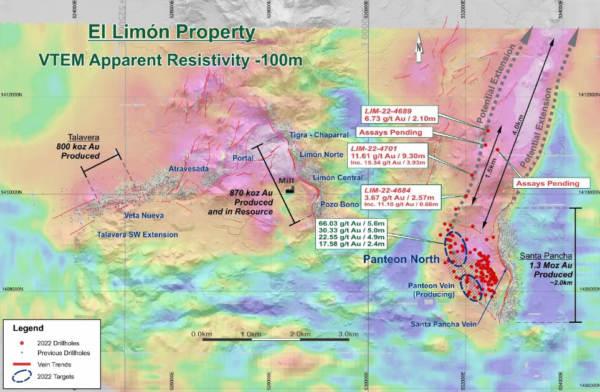

Highlights include a high-grade gold discovery at Panteon North within the Limon Complex:

- 52.59 g/t Au over 3.8 m Estimated True Width (“ETW”); 43.09 g/t Au over 3.3 m ETW

- 22.47 g/t Au over 4.9 m ETW; 17.80 g/t Au over 7.9 m ETW

Also, a new high-grade gold zone discovered 2.5 km north along the Panteon/VTEM geophysical corridor, which remains open for expansion:

- 11.61 g/t Au over 9.3 m ETW including 23.93 g/t Au over 1.7 m ETW and 15.34 g/t Au over 3.9 m ETW

Additionally, the Pan Mine drill results demonstrate strong expansion potential:

- 3.35 g/t Au over 18.3 m; 0.82 g/t Au over 10.7 m; 0.80 g/t Au over 47.2 m

Calibre Guidance Image. Image via Calibre Mining.

Calibre successful permitting process opens new avenues

El Limon property map. Image via Calibre Mining.

The company produced excellent drill results and achieved milestones set across numerous assets over the course of the year. These successes affirm the company’s multiple-year, grade-driven production growth strategy.

For example, Calibre received its open pit mining permit in Q2, 2022, for its Pavon Central location. It’s now on track for production in Q1, 2023. It also made progress at its Eastern Borosi Project. After receiving mining permits in Q4, 2022, and having sufficient road upgrades, site development and the purchase of new mining equipment, production is now slated for Q2, 2023.

Additionally, Calibre published its 2021 Sustainability Report, kicking off its five-year sustainability strategy with a focus on ensuring responsible and sustainable mining practices.

“I believe 2023 will be a transformational year, driven by an organic 20% increase in production, strong free cash flow, and significant exploration to expand recent high-grade gold discoveries not included in our multi-year, grade driven production increase strategy. Calibre has a solid, clear, and sustainable path to profitable growth,” said Hall.

Read more: Calibre gets approval to extend Nevada mining operation for 5 years

Read more: Calibre Mining high-grade gold drill positive results to continue at Panteon North, say analysts

Drilling at Panteon shows strong expansion potential

The company presently has multiple drill rigs operational and its exploration investment is pulling in results as it expands the high-grade gold discovery at Panteon North and the VTEM geophysical corridor running north of Panteon at the Limon Complex. Drilling is also showing strong expansion potential at the Pan mine in Nevada, and the Gold Rock project, where drilling has shown the potential of a high-grade, Carlin type feeder system at depth.

Calibre will drop its Q4 and full year 2022 financials after market close on Wednesday, February 22, 2023. Management will also host a conference call to discuss the results in detail.

Chart via Stockwatch.com

Shares rose $0.11 to close at $1.03.

Follow Joseph Morton on Twitter

joseph@mugglehead.com

Calibre Mining is a sponsor of Mugglehead news coverage