Franco Nevada Corporation (TSX: FNV) (NYSE: FNV) has declared an increase on its dividend payments for the duration of 2023, beginning at the end of March.

The Toronto-based gold company announced the news on Tuesday and the 6.25 per cent increase in quarterly payments to shareholders will yield an increase of US$0.02 per share.

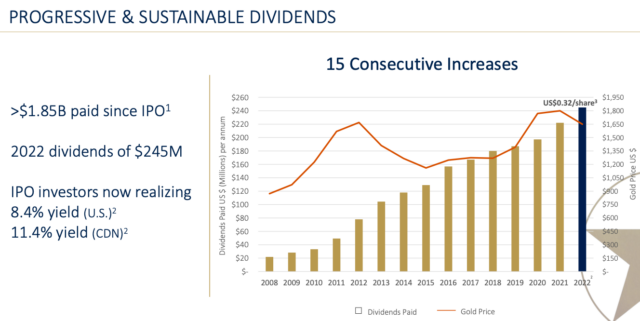

The rise in payments marks the 16th annual increase for the company’s shareholders and Franco Nevada also says investors in its Initial Public Offering (IPO) from the end of 2007 will now receive a 12.2 per cent yield on their cost base.

Dividend graph/timeline from January presentation. Photo via Franco Nevada

Read more: Calibre Mining Pan Mine assays show strong potential for Coyote target mine

Read more: Calibre Mining 2022 operating results show year round gold production of 222K ounces

However, Franco Nevada will also be decreasing the discount on shares purchased at average market price through the company’s Dividend Reinvestment Plan (DRIP) from 3 per cent to 1 per cent, also effective at the end of March.

Franco Nevada will be providing its 2022 results on March 15. The company is a World Gold Council member with a lengthy history dating back to 1986.

Franco Nevada stock increased by 1.61 per cent today to $193.33 on the Toronto Stock Exchange.

Franco-Nevada Declares Dividend Increase and Provides Details for Upcoming Release of 2022 Results. Please see the full press release here: https://t.co/jbLR8TjGb9 pic.twitter.com/3buRHyXuyK

— Franco-Nevada Corporation (@FrancoNevadaFNV) January 17, 2023

Read more: Calibre releases short doc on environmental initiatives in Nicaragua

Read more: Calibre gets approval to extend Nevada mining operation for 5 years

Calibre Mining (TSX: CXB) (OTCQX: CXBMF) is another Canadian gold producer that conforms to World Gold Council standards and the organization’s Responsible Gold Mining Principles.

Calibre generated approximately 222,000 ounces of gold from its operations in Central America and Nevada last year.

High-grade gold discoveries uncovered by the Vancouver company in Nicaragua during 2022 include the following:

- 52.59 g/t Au over 3.8 m Estimated True Width (“ETW”); 43.09 g/t Au over 3.3 m ETW

- 22.47 g/t Au over 4.9 m ETW; 17.80 g/t Au over 7.9 m ETW

Calibre’s stock dropped by 0.49 per cent today to $1.02 on the Toronto Stock Exchange.

Note: All holes were drilled at angles of 45 to 90 degrees at azimuths designed to intersect targeted structures as near as possible to perpendicular. Some drill holes and intercepts reported did not cross mineralization perpendicularly and therefore do not represent exact true widths.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com