Sol Strategies (CNSX: HODL) intends to list on the NASDAQ after its stock soared by approximately 2,336 per cent in Canadian dollars since July.

Announced originally on Thursday, the company wants to move to the NASDAQ to take advantage of the broader investor base, increased liquidity options and the greater brand visibility the American exchange offers.

Since its last disclosure report, the company has strengthened its commitment to the Solana ecosystem. As of Dec. 11, it holds over 142,000 SOL tokens valued at CAD$46 million and has acquired four additional Solana validators.

Staking now plays a central role in Sol Strategies’ strategy. It has delegated nearly one million SOL tokens, worth over 300 million dollars, to its validator fleet, including what appears to be its entire SOL stockpile.

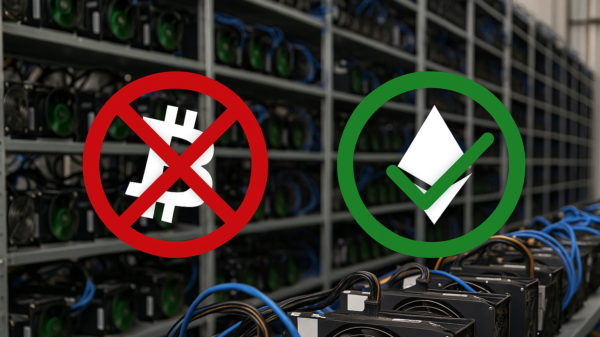

Solana is a high-performance blockchain designed for decentralized applications (dApps) and cryptocurrencies, known for its fast transaction speeds and low fees. Unlike Bitcoin (BTC), which uses a Proof of Work (PoW) consensus mechanism that relies on energy-intensive mining, Solana operates on a unique system combining Proof of History (PoH) and Proof of Stake (PoS).

Solana provides a way to timestamp transactions before they are added to the blockchain, creating a historical record that proves when an event occurred. After which, participants, called validators, can “stake” their cryptocurrency as a sort of deposit.

The network picks validators to approve transactions, usually based on how much they’ve staked. In return, validators earn rewards like transaction fees or new tokens. For companies like Sol, this is a way to make money by holding and staking large amounts of SOL tokens.

Read more: Will Vancouver become Canada’s first Bitcoin friendly city?

Read more: Hawk Tuah girl lands in hot water over crypto rugpull

Company has made a complete pivot to Solana since July

Once known as Cypherpunk Holdings, SOL was one of a small gentrified list of publicly traded companies involved in offering investors a chance to get exposure to BTC without needing to actually go through the trouble of holding and protecting the asset.

Now that Bitcoin exposure is readily available through crypto exchanges, brokerages, and derivatives bundled into exchange-traded products, the company appears to be betting on growing demand for exposure to the Solana ecosystem.

Since Leah Wald took over as CEO in July, the company has steadily reduced its once substantial BTC holdings and other investments. It now holds only about 3 BTC, a sharp drop from the hundreds of coins it previously owned.

Wald said Sol Strategies is exploring investment opportunities in Solana-focused projects and startups. The firm has gradually reduced its venture portfolio, with private equity and venture capital investments now accounting for about CAD$442,000 of its holdings.

Since rebranding to focus on Solana in September, Sol Strategies has concentrated on purchasing and staking SOL while operating validators on the Solana blockchain.

This strategic direction lets investors gain exposure to the growth and innovation within the Solana ecosystem without the complexities of directly managing cryptocurrency assets. By pursuing this approach, Sol Strategies aims to bridge the gap between public markets and decentralized finance.

.