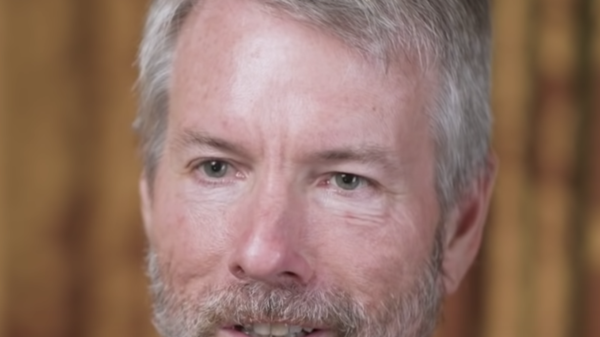

Vancouver could be known as a “Bitcoin-friendly city” in 2025 and beyond, if Mayor Ken Sim has his way.

Mayor Sim proposed a motion for the city to explore holding Bitcoin as a reserve asset. Introduced originally in late November, the motion is called “Preserving the city’s purchasing power through diversification of financial resources: Becoming a Bitcoin-friendly city.”

It seeks to evaluate how Bitcoin could help diversify Vancouver’s financial resources and protect its purchasing power during economic uncertainty. Potential uses for Bitcoin should the motion pass could theoretically include potentially accepting taxes and fees in Bitcoin.

It would also direct staff to look into “the potential conversion of a portion of the city’s financial reserves into Bitcoin to preserve purchasing power and guard against the volatility, debasement and inflationary pressures of traditional currencies.”

The formal introduction of the motion is planned for December 11, 2024. If passed, Vancouver could become one of the first cities to adopt Bitcoin in this capacity.

Werner Antweiler, a professor of economics at UBC’s Sauder School of Business, noted the risks inherent in Sims proposal.

“The volatility in Bitcoin is in the same league as some of the highest volatility tech stocks like Tesla and NVIDIA and others,” he said.

“It is a speculative asset like any other stock, the value can go up and does go down and there is no guarantee it is preserving its value.”

Antweiler noted that bringing Bitcoin onto the city’s ledger would likely require changes to provincial legislation. The Vancouver Charter and Community Charter, which govern municipal operations in B.C., contain specific provisions regarding how cities manage their finances.

Read more: Hawk Tuah girl lands in hot water over crypto rugpull

Read more: Beyond Bitcoin: A Mugglehead roundup

Vancouver has a rich history with Bitcoin

If Vancouver proceeds with these plans, it could become one of the first cities in Canada to officially adopt Bitcoin in public finance, potentially setting a precedent for other municipalities. This could also stimulate further cryptocurrency adoption, making Vancouver a focal point for crypto businesses and enthusiasts. The city’s initiative aligns with global trends where cities like El Salvador have already made Bitcoin legal tender, showing a pathway to broader acceptance.

Vancouver has a rich history with Bitcoin, marking its territory with several pioneering moves. It hosted the world’s first Bitcoin ATM back in 2013, and since then, the city has been home to numerous blockchain and cryptocurrency startups, including notable companies like Dapper Labs, creators of NBA Top Shot.

The mayor’s plan is not just about financial innovation but also taps into environmental benefits.

North Vancouver has already shown the way by using heat from Bitcoin mining to warm buildings, reducing greenhouse gas emissions. This innovative use of mining heat for district heating has set a precedent, with North Vancouver becoming the world’s first city to utilize Bitcoin mining for such purposes starting in 2022.

Despite the enthusiasm, several hurdles remain, including legal frameworks that currently do not recognize cryptocurrencies as valid for municipal transactions. Legislative changes would be necessary, and there’s skepticism regarding the practical implementation and acceptance by the public and local businesses.

.