The Kingdom of Saudi Arabia is in talks with Pakistan to buy one of the largest underdeveloped copper-gold projects in Pakistan which is partially owned by the gold giant Barrick Gold Corporation (NYSE: GOLD) (TSX: ABX).

“Saudi wants to buy some stake (in Reko Diq). We don’t know how much. So, those conversations are ongoing, and we are supportive of them, but we’re not there to get into the middle of it,” said Barrick’s CEO Mark Bristow in a Reuters interview following the release of Barrick’s Q3 2023 results.

As part of the proposed agreement, Saudi Arabia would purchase a stake in Reko Diq in collaboration with the Pakistani government. Barrick owns 50 per cent of the project, while the government and the province of Balochistan own the remainder.

“That’s something that is in the hands of the Pakistan government to come to a decision on,” Bristow told Reuters. “We would support any decision that’s made by the Pakistan government with the Saudis.”

The Reko Diq $7 billion project is located in the province of Balochistan, Pakistan and is set to be constructed in 2025 and targets production by 2028. Barrick says the project will rank among the world’s top 10 copper producers when it reaches full production.

Naguib Sawaris, an Egyptian gold billionaire, said in September he wanted to buy a piece of Reko Diq but Bristow dismissed his intention.

Read more: Barrick Gold invests $2B in copper mine expansion set to revive Zambia’s copper industry

Read more: Barrick Gold drills in Dominican Republic as part of earn-in agreement

Barrick reports improved production and positive long-term growth forecast in Q3

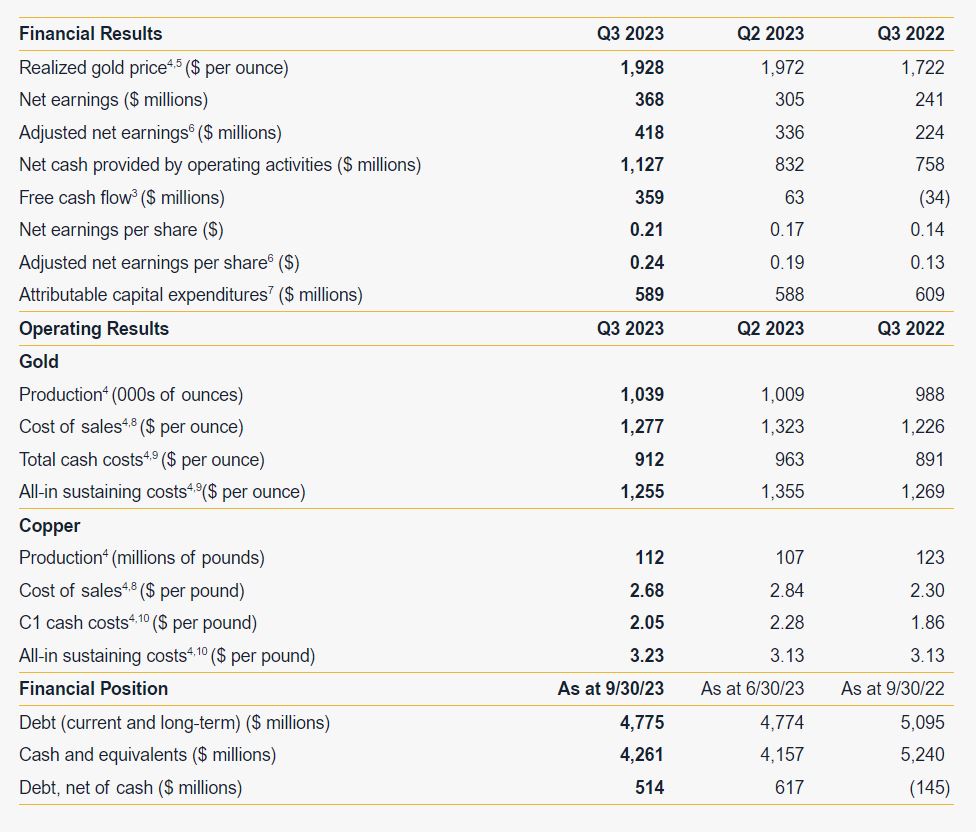

As for the company’s third-quarter results, Barrick reported improved production at lower costs and confirmed its long-term growth forecast.

Gold production during the third quarter outpaced the second quarter, primarily because its Democratic Republic of Congo and Nevada mines improved their performances. The production ramp-up at Pueblo Viejo is progressing more slowly than initially anticipated but Barrick said the 2024 production projection for Pueblo Viejo still exceeds 800,000 ounces.

Despite the anticipated improvement in the second half, the company expects that gold production will slightly fall short of the lower end of the annual guidance range. On the other hand, copper production is well on course to meet both its production and cost guidance.

Read more: Calibre Mining intercepts high-grade gold below Jabali mine, identifies 3 new gold targets

Read more: Calibre Mining Q3 gold production numbers exceed analyst expectations: Canaccord Genuity

Financial and Operating Highlights of the third quarter ended Sept. 30. Table via Barrick Gold.

In the latest quarter, the company’s operating cash flow increased by 35 per cent, reaching more than $1 billion. Free cash flow also increased by $296 million from the previous quarter, totalling $359 million. The company reduced its debt to $514 million, with nearly no net leverage.

“Mining is a long game and we don’t manage Barrick by the quarter—our projection for a 30 per cent increase in the production of gold-equivalent ounces by the end of this decade remains intact,” Bristow said.

Barrick expects its fourth quarter to be even stronger but sees gold production for the year marginally below the low end of forecasts. Its estimates range between 4.2 -4.6 million ounces due to the slow ramp-up at its Pueblo Viejo mine in the Dominican Republic.

The race to secure critical minerals for the global energy transition is gaining momentum. As countries worldwide seek to reduce their reliance on fossil fuels and transition to cleaner, more sustainable energy sources, the demand for essential minerals like copper and gold is soaring.

Bornface mwale

March 17, 2025 at 6:24 am

Looking for employment as mining truck