Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF) reported remarkable third-quarter gold production, surpassing both its internal projections and the expectations of industry analysts.

According to a recent report from Canadian equity research firm, Canaccord Genuity, Calibre’s consolidated production of 73,485 ounces for Q3 surpassed Canaccord’s estimate of 70,200 ounces by approximately 4 per cent. On a quarterly basis, production increased by around 7 per cent quarter-over-quarter.

Furthermore, production in Nicaragua amounted to 63,756 ounces, exceeding the firm’s 60,100-ounce estimate by approximately 6 per cent and showing a 9 per cent increase quarter-over-quarter.

This achievement is due to enhanced production capacity and increased ore deliveries from the Eastern Borosi mine to the Libertad mill. Nevada production totalled 9,729 ounces, slightly falling short of Canaccord’s 10,300-ounce estimate, while quarterly production increased by approximately 6 per cent quarter-over-quarter.

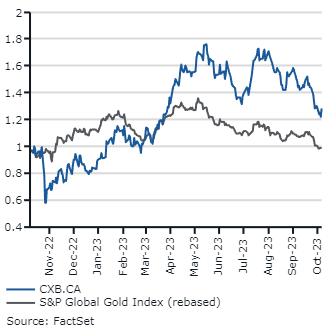

Price fluctuations related to S&P Global Gold Index

As a result, Canaccord gave Calibre a BUY rating at a CAD$2.50 target price.

They came to this number through by applying a factor of 0.70 to estimate the value of Calibre’s assets and subtracted the company’s debts.

Canaccord noted that the company’s cash position is also approximately $97 million, marking a 26 per cent increase quarter-over-quarter and a 72 per cent increase year-to-date.

“With another impressive operational quarter and Eastern Borosi now delivering high-grade ore to the Libertad Mill, we believe Calibre is well-positioned to meet the high end of its 2023 production guidance,” said the report.

Read more: Calibre Mining’s Nicaragua operations will fuel company growth on all fronts: PI Financial

Read more: Calibre Mining outshines expectations with robust Q3 gold production: BMO Capital Markets

Record gold production impresses analysts

In a recent report from the analytics division of the Bank of Montreal Financial Group (TSX: BMO), analysts have reaffirmed their “Outperform” rating on the company and have established a target price of C$2.00. Analysts Brian Quast and associate Andrew Lennie highlighted the company’s consistent track record of outperformance, which is attributed to strong results in its Nicaragua operations.

Calibre’s gold production for Q3 2023 outperformed BMO’s 68,000 ounce projections by 6.5 per cent, and included an 8 per cent increase over consensus expectations at 68,000 ounces.

The company’s outstanding performance was notably influenced by its operations in Nicaragua. Nicaragua played a crucial role in contributing to gold production, delivering a total output of 63,800 ounces, surpassing the projected 58,500 ounces. In contrast, production from the Nevada operations slightly underperformed, yielding 9,700 ounces instead of the expected 10,700 ounces.

Analysts from various banking institutions and market analysis firms, such as PI Financial, the Toronto-Dominion Bank (TSX: TD), the Bank of Nova Scotia (TSX: BNS), and Cormark Securities, have all made predictions that Calibre’s stock price is expected to range between $2.00 and $2.50 in the coming 12 months.

Shares of Calibre Mining rose 0.7 per cent to $1.48 on Tuesday on the TSX Venture Exchange. This represents a 17 per cent increase over September’s low of $1.22.

.

Calibre Mining is a sponsor of Mugglehead news coverage

.