Canadian cannabis retailer Nova Cannabis Inc. (TSE: NOVC) (OTCMKTS: NVACF) continues to see sales increase as it completes its shift towards a low-cost consumer model.

On Monday, the company released its results for the first quarter ended March 31, with sales up 171 per cent to $49.8 million from $18.4 million during the first quarter of 2021. In the first quarter, sales were up 5 per cent from $47.6 million in Q4 2021.

The company attributed the increase to 27 new retail cannabis that have been opened since March 31, 2021, as well as increased sales from stores that were re-branded to the Value Buds discount banner.

Nova now has 80 stores open, an increase of six stores since Jan. 1 and 44 since the end of 2020, and all of its legacy Nova-branded stores have now been converted to Value Buds locations.

Read more: Nova Cannabis’s board of directors, CEO resign as Sundial acquisition closes

Read more: Nova Cannabis boosts annual sales 112% to $134.4M

“The company’s Value Buds stores experienced strong sales through the first quarter of 2022, and gross margin improved sequentially from the fourth quarter of 2021,” Nova CEO Marcie Kiziak said in a statement.

“Those results are a direct correlation of the consolidation and rationalization in the industry, which our disruptive pricing strategy was designed to withstand.”

Nova reported a gross margin of $9.4 million during the first quarter, a 95 per cent increase from $4.8 million during the same period in 2021.

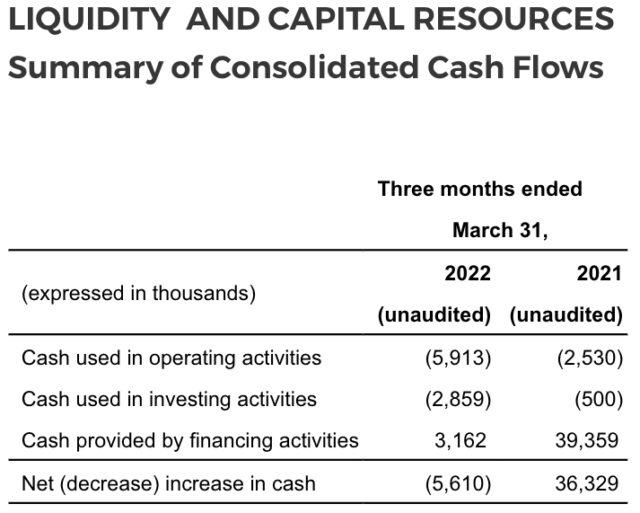

The company increased its revolving credit facility from a maximum of $5 million to a maximum of $10 million. At the end of the first quarter the company had $4.9 million in cash.

Chart via Nova Cannabis

In October, Sundial Growers Inc. (Nasdaq: SNDL) made a $346 million deal to buy all common shares of liquor and cannabis store giant Alcanna Inc., Nova’s majority shareholder. In February the companies agreed to extend the closing date to March 30 to complete required closing matters.

Last January, Alcanna spun off its cannabis retail operations and merged with YYS Corp. to create Nova.

Nova posted an operating loss before depreciation, impairment and other costs of $0.2 million compared to $0.1 million for the first quarter of 2021.

For the three months ended March 31, the company recorded a net loss of $3.5 million compared to a $2.2 million net loss in the first quarter of 2021. Included in this loss was $1.6 million of costs that were incurred as a result of the closing of the Sundial-Alcanna transaction.

Read more: Value Buds’ low-cost model spikes sales for Nova Cannabis

Read more: Sundial sees Q4 revenue jump 63% to $22.7M

“It is our commitment to continue to improve operational efficiency and discipline in managing our retail stores while selling good cannabis affordably,” Kiziak said, “and continue our trajectory as one of Canada’s largest and fastest growing cannabis retailers by bringing best value prices to the heart of the cannabis market and encouraging greater migration from the illicit market.”

Nova appointed Kiziak as its chief executive officer on March 31.

Company stocked closed down nearly 11 per cent Tuesday to $1.46 on the Toronto Stock Exchange.

ryan@mugglehead.com