Canadian cannabis producer Sundial Growers Inc. (Nasdaq: SNDL) saw net revenue increase during the fourth quarter, resulting from a lower inventory impairment provision and a more favourable sales mix of higher-margin products.

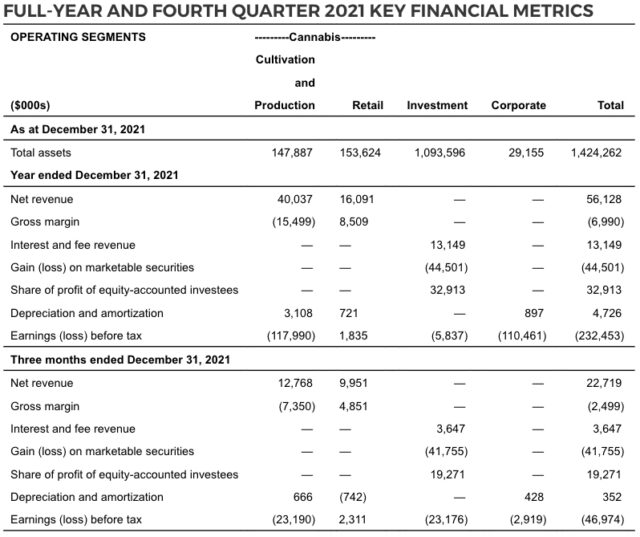

On Thursday, the Calgary-based company reported its financial statements ended Dec. 31, posting revenue of $22.7 million during the fourth quarter, a 63 per cent jump from the fourth quarter of 2020.

Cannabis production revenue reached $12.7 million, a 56 per cent increase from the previous quarter, while retail revenue for the quarter was $10 million.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) increased to $18.4 million during the fourth quarter, a 75 per cent increase from $10.5 million during the previous quarter.

Sundial reported a gross margin loss of $2.5 million for the fourth quarter of 2021, compared to a loss of $4.7 million in the fourth quarter of 2020.

The company had a net loss from continuing operations of $54.8 million during the fourth quarter.

Read more: Sundial stock jumps on Q3 earnings of $11M

Read more: Nova Cannabis’s board of directors, CEO resign as Sundial acquisition closes

Sundial reported net revenue of $56.1 million for the fiscal year, an 8 per cent drop year-over-year from $60.9 million in 2020.

The firm’s gross margin improved to a loss of $7 million for 2021, compared to a loss of $49.9 million during the previous year.

Sundial reported an adjusted EBITDA from continuing operations of $32.1 million for the full year, compared to a loss of $25.6 million during the previous year.

“2021 was a transformational year for Sundial,” Sundial CEO Zach George said in a statement. “We increased the sustainability of our business model, establishing a strong balance sheet, positive adjusted EBITDA results, and significant improvements in gross margin.”

Chart via Sundial

Sundial posted a net loss of $230.2 million from continuing operations during 2021, compared to a $206.3 million net loss in 2020.

The company ended the quarter with $1.1 billion in cash, marketable securities, and long-term investments. As of April 25, the firm said it had $377.7 million of unrestricted cash with no outstanding debt.

In March, the company closed a deal with liquor and cannabis seller Alcanna Inc. for $346 million, creating the largest private-sector cannabis and liquor retail network in Canada.

Read more: Sundial to buy weed retailer Inner Spirit for $131M

Read more: Sundial set to buy liquor and pot retailer Alcanna for $346M

“We continue to focus on improvements to our supply chain and manufacturing processes, against a competitive and challenging operating environment in Canada,” George said.

“We are beginning to see positive momentum across all of our key operating segments and remain committed to our goal of becoming free cash flow positive within the 2022 calendar year.”

Sundial stock dropped nearly 4 per cent Thursday, falling to $0.51 on the Nasdaq.

ryan@mugglehead.com