While recreational markets are the dominant source of sales in U.S. states with mature legal cannabis legislation, patients generally stay faithful to medical channels, according to Headset.

That’s because patients accessing the medical stream have a number of advantages, including lower taxes, higher potency products and more informed staff.

In a new report, the Seattle-based data firm outlines the path every American jurisdiction to fully legalize cannabis has taken so far, from the introduction of medical access to an adult-use market.

Most have followed a similar trend of a relatively stable group of cannabis patients with a slight growth trend overtime. Then when states legalize adult use, sales growth is dramatic over the first several years.

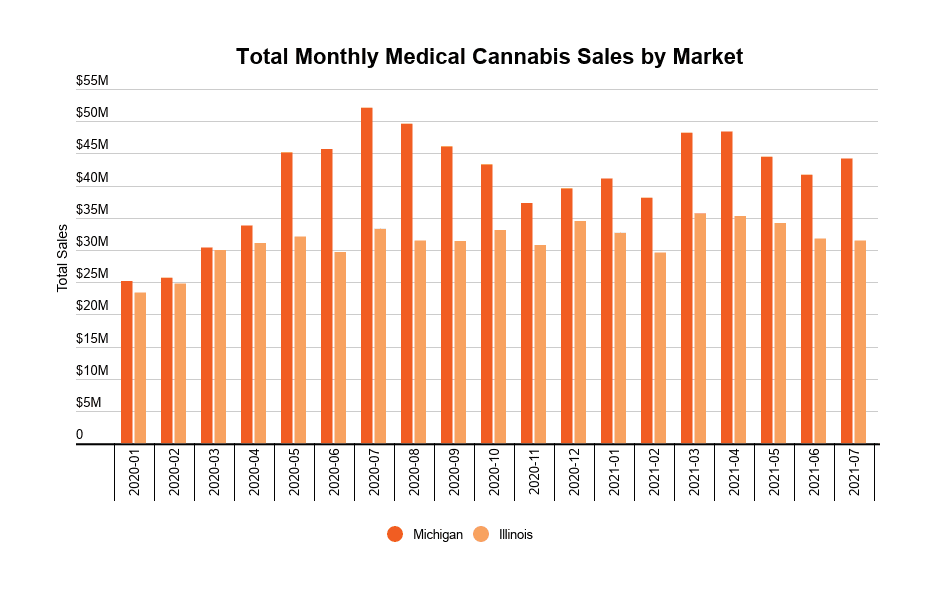

State medical sales show a slight upward trend overtime after programs come online. Chart via Headset

According to Headset, medical sales in Illinois have held fairly steady over the last two years, increasing only 35 per cent to US$31.5 million in July 2021 from US$23.4 million in January 2020.

Read more: Cannabis flower likely to remain dominant consumer choice: Headset

Read more: Headset ups 2021 US pot market prediction to top $30B

Michigan’s medical sales have been slightly more volatile. Sales in that state grew 75 per cent from January 2020 to July 2021, which the data firm notes is a respectable increase in most industries, but nothing compared to the state’s own massive growth in recreational sales.

As has become expected with any new cannabis market, both states have seen “tremendous” sales growth since launching their adult-use programs.

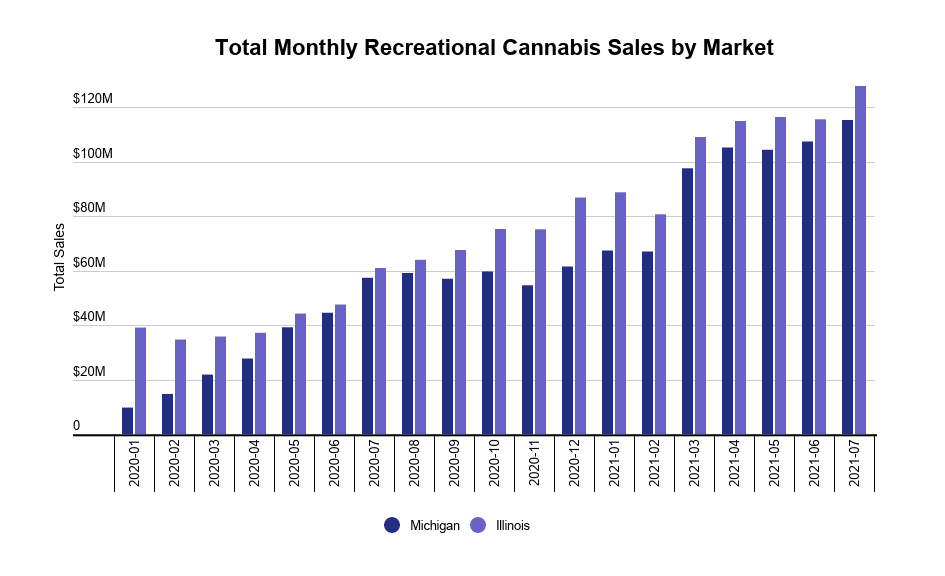

Adult-use sales have skyrocketed in new state markets. Chart via Headset

Recreational sales in Illinois have grown by 226 per cent to US$127.8 million in July 2021 from US$39.2 million in January 2020, Headset says.

Michigan’s recreational program got off to a slower start. Adult-use sales grew from just $9.8M in January 2020, growing 1,077 per cent to $115.3M this July.

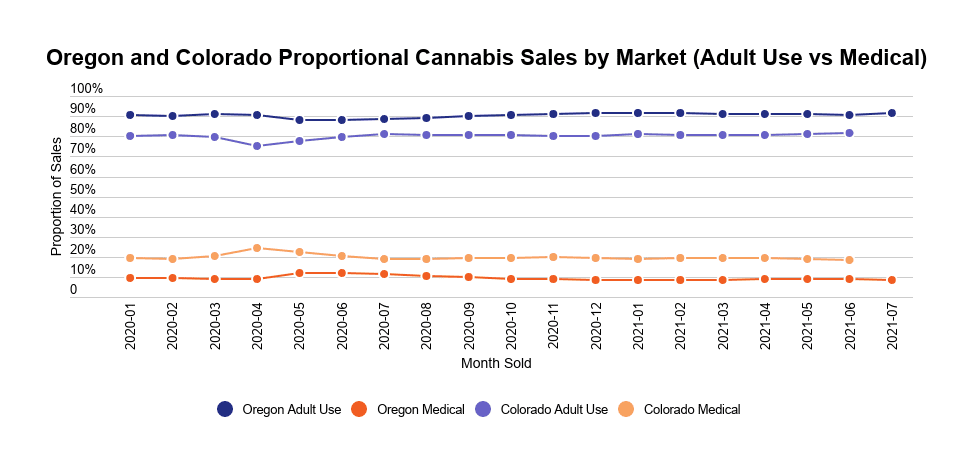

Looking at mature markets in Oregon and Colorado reveals that medical sales stabilize at around 10–20 per cent of sales.

Oregon’s medical sales have contributed 8–12 per cent of total sales each month since the beginning of 2020, Headset notes. Colorado’s medical sales have been even more stable, between 18–20 per cent over the last twelve months.

With adult-use sales starting in 2014 and 2015, respectively, Colorado and Oregon’s medical market share of total sales have stabilized at around 10–20 per cent. Chart via Headset

Why do patients stick around? The firm highlights three key reasons.

First off, patients pay less taxes. In Michigan, adult-use purchases are taxed with the state-wide 6-per-cent sales tax as well as a 10 per cent marijuana excise tax, whereas medical purchases are only subject to the 6-per-cent sales tax. In Oregon, medical purchases aren’t taxed at all while recreational buys are subject to a 17-per-cent cannabis excise tax.

Medical users also have access to higher-THC products, depending on state laws. In Washington, recreational edibles are limited to 100 milligrams of THC per package and 10 milligrams of THC per serving. But a “high THC” product — available only to medical patients — may contain up to 500 milligrams of THC per package and 50 milligrams of THC per serving.

American cannabis patients are generally handled by better staff too. In Washington, Headset notes a program for cannabis retail employees to become certified medical marijuana consultants. It requires 20 hours of training and enables recreational cannabis retailers to earn medical endorsements.

In contrast, medical sales have trended downwards in Canada. With virtually no physical access points, products subject to the same excise and spotty coverage from insurers, patients accessing the country’s medical cannabis streams has decreased over time.

Read more: Canada’s flawed medical cannabis regime sees drop in client registrations

Read more: Sunnybrook Hospital’s medical cannabis program paves way for better patient access

Both medical and recreational consumers also cite potency limits on Canadian regulated products as a reason why so many stick to the illicit market.

Patient registrations with Canadian producers has fallen 15 per cent to 292,399 in March 2021 from 345,520 in October 2018.

nick@mugglehead.com