As head of sales and marketing at Aphria Inc. (TSX: APHA) (Nasdaq: APHA), Bernie Yeung is tasked with convincing consumers to buy his company’s brands over hundreds of others.

With a strong legacy market, picky customers and more producers entering Canada’s hyper-competitive cannabis market each week, carving out a bigger slice of the pie is no cake walk.

Unlike many of its peers, Aphria is a large company in the weed space that’s managed to grow sustainably. In January, the firm posted record revenues, but the majority of growth came from its European pharmaceutical business.

Read more: Aphria stock hits 2-year high on record Q2 sales

Its net cannabis revenues increased just 7 per cent. In the cutthroat sector, any growth at all feels like a win, but with a market cap of nearly $6.5 billion, analysts except Aphria to capture more market share at home.

With over a decade of experience marketing for large food and beverage firms, Yeung reflects the evolution of his company and a paradigm shift of the industry at large to international consumer packaged goods.

In the following interview, he shares his views on battling price compression, identifying regional idiosyncrasies and how he’s preparing for the looming merger deal with rival Tilray Inc. (Nasdaq: TLRY) to become the world’s biggest weed firm.

Read more: Tilray and Aphria unveil merger plan to create world’s biggest weed firm

Read more: Analyst lukewarm on Aphria’s US$300M SweetWater acquisition

Bernie Yeung is Aphria’s senior VP of sales and marketing. Before his time in the cannabis industry, he led marketing efforts for major beverage firms like Brown-Forman and Canada Dry Mott’s. Submitted photo

Interview text has been edited for length and clarity.

Given that 2.0 products have now had a full year to settle in, do you think we’re looking at a somewhat stable market now when it comes to segmentation by category?

Yeah, I would say the category segmentation in terms of the categories are relatively in the right position. The biggest changes that I’m

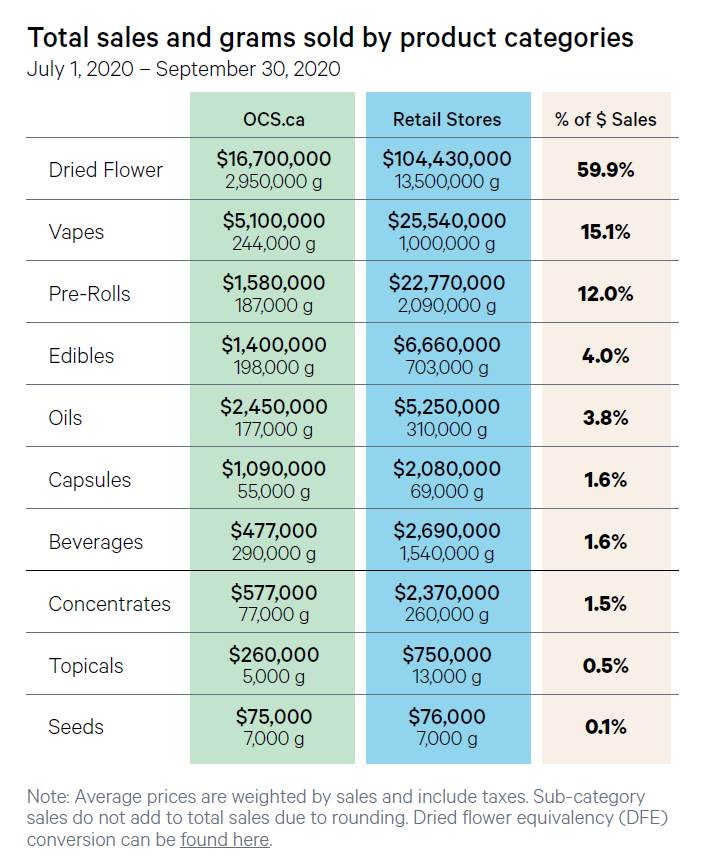

Categories have matured since 2.0 products launched at the beginning of 2020, but analysts think categories like vapes and edibles still have room to grow. Data via OCS

seeing, as we look at the categories, whether it’s 1.0 or 2.0 is really around price compression.

We know the illicit market has particular products. I’ve always been a big cannabis consumer and I can tell you, the way the market is going, it really has producers trying to find the right value proposition for the brands.

For example, I’m a believer of having the right price-value equation and value exchange for consumers. But I don’t believe in being on the bottom. However, a lot of that is happening.

There are a lot of things that are shifting all of the segments to the left. For example, if a price point for vapes on average was $37 in the market, the average price is going down to $30.

Given how tight margins are, how do you keep adjusting and staying on your toes when it comes to price compression?

When margins continue to shrink, you need to look at different ways to reduce cost. The first thing I would say that we personally don’t do and what will not change is product quality.

What goes into our vapes? Distillate botanical terpenes. For those products, they’re full spectrum and they’ll stay full spectrum.

We don’t use cutting agents; we’ll never use cutting agents. I’m a stickler for the quality of the cartridge itself. That’s critical because it’s the consumer experience.

So, where you have to really reduce cost is in packaging: whether it’s the box or the tube, finding efficiencies as you look to reduce costs with buying in volume and scale. We look at all aspects of the packaging that we can trim some cost on, but in terms of the final product the consumer consumes, that’s the piece that we believe at Aphria has to stay whole and will always stay whole.

According to the OCS, its average price per gram has dipped below the illicit market.

So do you have any numbers on your individual branded products you can share?

From a high level, the Good Supply brand is the number one vape in the country. Depending on the province, we’re typically between the high 18, 19 to 22 per cent of the entire vape category.

Broken Coast being a full spectrum offering, strain-specific — that continues to be a focus. For Good Supply, balancing flavor with the appropriate kind of cannabis balance of those notes is critical. We have those and we have Solei, Riff and Bingo.

As we look at our category segments I would say on the flower side as well we continue — depending on which segment you look — to be a market leader in dry flower, which represents 60 per cent of all cannabis retail sales today.

From province to province, could you comment on where you see idiosyncrasies and how you’ve shifted your strategy to meet those over time?

You’re based out of Vancouver. If you were to look at a particular category, like vapes, there’s a 20 per cent vape tax in B.C. So that is obviously something that impacts the conversion of consumers from the illicit market to the legal market.

But each province behaves very differently. Let me give you an example from west to east.

B.C. is very focused on lower price products. That stuff typically moves the volume. However, that consumer is a very knowledgeable cannabis connoisseur: they understand strains, they understand potency, they understand terpene profile, they understand certain product characteristics that differentiate.

They can read through the lines from products that are just blends versus products that are good.

I would say they’re very educated in B.C. They know what they want.

In a province like Alberta, where it’s a larger market, you have more than 600 stores. The most retail brick and mortar.

The consumer requires a little bit more education in terms of some of the categories. They’re they’re open to trying many different things. So, their shopping basket is a little bit different: they’ll buy a couple pre-rolls, buy some flower, they’ll maybe buy a vape.

Canadian cannabis sales have continued to climb since Sept. with a record $298 million in December. Canada’s most populous province, Ontario, continues to lead the pack with monthly retail sales in excess of $90 million. B.C. is lagging the most in legal sales among major Canadian jurisdictions. Chart via OCS

There continues to be pressures there in terms of price, but at the same time they’re very focused on flavor and making sure they find an offering that’s suitable for them.

Moving to Ontario, the largest market in Canada, it is a very, very aggressive market. I would say all of them are but to give you some line of sight, their price-per-gram in the super economy segment is under five bucks a gram. That’s typically in the larger formats, whether it’s 7, 15 or 28 gram offerings.

They’re all unique in the way we position our brands. Which strains we lean in on, more or less, is how we look at the consumer preferences and ultimately shape what is the most important for that to win in market share.

In light of analysts’ concerns that Aphria could better capitalize on the domestic market, will your strategy shift at all to do this — especially considering margins are tight already and the market is so competitive?

You’re right about analysts. They continue to want us to grow where we are the market leader in Canada.

But as you continue to try to grow, it gets more challenging, especially when there’s a lot more producers coming in. There are other brands going for value in price: large format, high potency, low price. We obviously have some brands that go after that.

But where I look strategically and skate where the puck is going, and what we’re really good at — you’ll see our Good Supply strain-specific offerings. They continue to demand a price premium over sativa or indica blends that aren’t strain specific.

Expect to see more of that as we as we look to bring new strains and offerings into the market that differentiate us.

Part of the battle for big licensed producers is figuring out what to do with excess inventory. Aphria recorded $321.5 million in inventory in its Q2 2021 report. Submitted photo

I’m a believer of not being “me too.” One of the things that I always look at is: where’s the industry going? What are the biggest size-of-prize opportunities and categories?

Today, we’re a leader in dried flower, pre rolls, vapes, oils — some of the larger categories. You’ll expect to see us in there and concentrates as well as other categories soon down the road.

Where we’re really going to grow our revenue is looking at consumer preferences, looking at the size of those categories, and ultimately creating products that are just a “me too,” but have true differentiation. That’s kind of how we win with marketing.

There are constraints, the lockdown has limited even more opportunities, such as creating education in festivals and live events that are legal age plus.

People say they’re restricted. I’ll be honest with you. Coming from beverage-alcohol 19-plus environments, you just have to know how to play within the guardrails.

It’s being creative and thoughtful about: How do we reach the consumer, engage with them and ultimately share with them why our brands are better.

With the big merger coming in, I’m curious how it will affect your role directly, and the impact it will have on the new entity’s marketing approach overall.

Obviously there are still a couple more steps that need to happen to finalize the reverse takeover or merger.

I would say in terms of our overall strategy, where we’re looking is the Tilray portfolio in Canada and particularly how it rounds out where we have gaps. We don’t have beverages today. We don’t have that edibles today.

At the same time, we have strengths that complement their portfolio, like the categories I spoke about: dried flower, pre rolls, etc.

When you put the two together, they’re very complementary.

Really what we’ve got to do is exactly what you said earlier: we need to look at our categories, look where the gaps are, look at where we’re over-indexing and under-indexing, and ultimately build a plan to accelerate our market share growth.

We’re in a market share leadership position today and in my expectation, and the team’s expectation, is to continue to be number one and grow. That would be the same on the global side outside of Canada, as we look for opportunities. I’m very excited to work through it, and there’s still a lot of work to do over the next little while.

I think once everything closes, and [Aphria CEO Irwin Simon] has commented on this many times: I think everyone’s going to see a great new team that ultimately comes together and is very creative.

Growing flower in bulk gives obvious price advantages, especially given that a large portion of consumers are focused on value offerings / Top image of Aphria’s facility in Leamington, Ont. Submitted photos

nick@mugglehead.com