Amid an oversupplied Canadian market, two mega-producers — Tilray Inc. (Nasdaq: TLRY) and Aphria Inc. (TSX: APHA) — are combining operations to create a new global giant in the fast-moving industry.

On Wednesday, both companies said the blockbuster all-stock deal will create the world’s largest global cannabis company in terms of pro forma annual revenue of $874 million. The combined business will boast an equity value of around $5 billion once the deal closes in the second quarter of 2021, according to a statement.

As the news hit, social media surged with skepticism over how two bloated producers could combine to become anything better. And while the new entity will be listed under Tilray’s name and ticker, analysts say it’s that “lame duck” company that stands to gain more from the merger. The move could also foreshadow more consolidation in Canada’s turbulent sector.

Under the terms of the agreement, Aphria shareholders will get 0.8381 shares of Tilray for each common share of Aphria they hold. As a result of the exchange ratio, Aphria shareholders will own around 62 per cent of the combined company, resulting in a reverse acquisition of Tilray. Aphria will pay a 23 per cent premium to Tilray’s Dec. 15 closing price of $7.87.

The new company will keep Tilray’s name and trade under TLRY on the Nasdaq.

Tilray stock surged 18.5 per cent Wednesday to US$9.33 on the Nasdaq. Shares of Aphria closed one cent down to $10.31 on the Toronto Stock Exchange on the day.

Irwin Simon, Aphria’s acting CEO and chairman, will keep both roles and lead the new megafirm. The combined company’s board of directors will appoint nine seats, seven being taken by Aphria directors. Tilray’s current CEO Brendan Kennedy will occupy one of the remaining two seats.

“We are bringing together two world-class companies that share a culture of innovation, brand development and cultivation to enhance our Canadian, U.S., and international scale as we pursue opportunities for accelerated growth with the strength and flexibility of our balance sheet and access to capital,” Simon said in the statement.

A new Canadian market leader and global cannabis giant

Based on their most recent quarterly results, Aphria and Tilray report they would have held a 17 per cent share of the Canadian cannabis market — the most of any licensed producer.

The companies expect the merger will result in roughly $100 million in cost savings in the key areas of: cultivation, production, product buying, sales, marketing and corporate expenses.

Ontario-based Aphria will produce the bulk of the combined companies pot at its 1.3 million square-foot greenhouse in Leamington, according to the statement. The facility will provide additional volume for Tilray’s brands while replacing the need to buy wholesale weed from outside sources. Tilray’s processing facility in London, Ont., will give Aphria extra capacity to boost output for branded cannabis 2.0 products like edibles and drinks, they said.

The merger deal comes at a time when larger Canadian producers are shutting down production facilities amid a major supply-demand imbalance. In August, producers held almost 900,000 kilograms of unpackaged production and inventory, according to Health Canada’s most recent data. The oversupply scenario has led to rumours of incoming consolidation in the country’s two-year-old cannabis industry

For Aphria, one of the jewels of the deal will be getting access to Tilray’s world-class EU-GMP production facility in Portugal, according to BCMI analyst Chris Damas.

“The best Tilray assets in my view have always been the Portugal integrated medical cannabis facility and Manitoba Harvest,” he said in a Wednesday note.

The companies said the deal will make them a major player in the global pot sector.

British Columbia-based Tilray has sizable operations in Australia, Germany and the U.K. Meanwhile, Aphria owns CC Pharma, a major German pharmaceutical distribution business.

While the deal gives Aphria better access to Europe, it helps improve Tilray’s balance sheet and gives it better footing in Canada, Damas notes.

“Tilray was a lame duck in Canada going nowhere in my humble opinion,” he writes.

In an effort to stay liquid last month, Tilray agreed to covert $124.3 million of senior notes. Meanwhile, Aphria has generated positive adjusted EBITDA over the last six quarters and held $400 million in cash and cash equivalents as of Aug. 1.

Tilray and Aphria also said they see their merger as a way to get more access in the lucrative U.S. market. Last month, Aphria purchased Sweetwater Brewing Company, an Atlanta-based craft brewer that infuses hemp into beer products sold in 27 states. The combined U.S. operations will focus on Sweetwater and Tilray’s Manitoba Harvest, which makes branded hemp and CBD products.

“When U.S. regulations allow, the combined company expects to be well positioned to compete in the U.S. cannabis market given its existing strong brands and distribution system in addition to its track record of growth in consumer-packaged goods and cannabis,” they said in the statement.

Read more: Analyst lukewarm on Aphria’s US$300M Sweetwater acquisition

The deal will require approval from both Aphria and Tilray shareholders in upcoming special meetings. The two companies will also need to seek regulatory approvals in Canada, the U.S. and Germany.

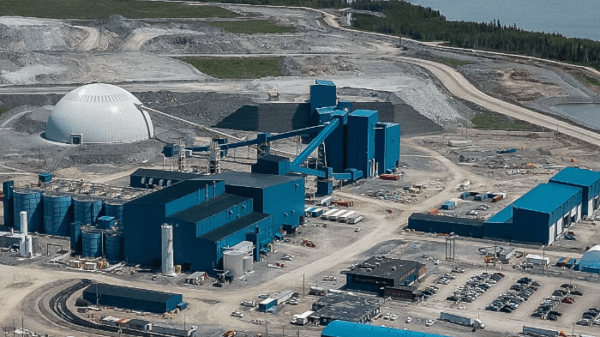

Top image via Tilray

jared@mugglehead.com