Amidst the ongoing escalation of the Hamas-Israel conflict, Tom Palmer, the CEO of Newmont Gold, warns of the possibility of gold prices surging to historic highs.

“There are certain scenarios that you could see it pushing up through record highs,” Palmer said during an interview with Financial Times. “Unfortunately, those scenarios for our society aren’t great.”

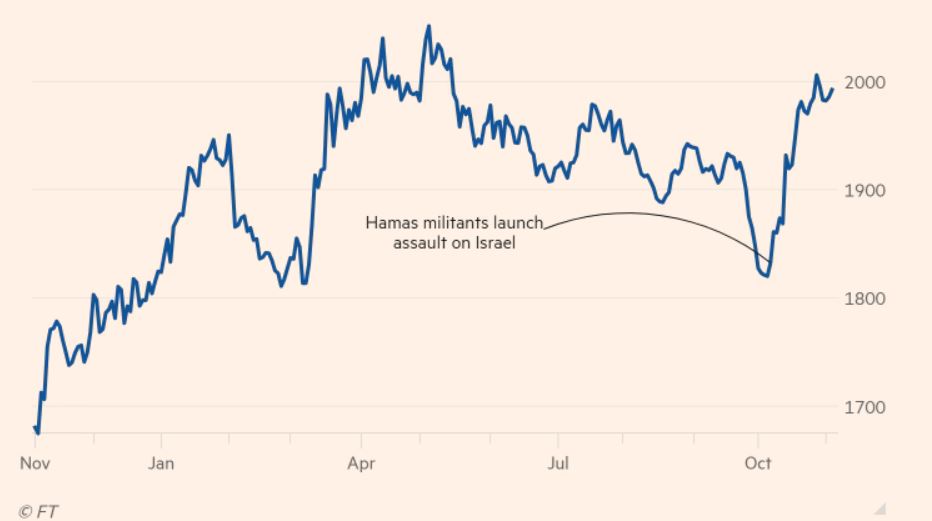

Gold prices have seen ups and downs, but the metal reached an all-time high of $2,072 per troy ounce in August 2020 due to the Covid pandemic. When political uncertainty leads to market turbulence, gold often becomes a safe-haven asset for investors seeking stability, driving up its price.

This week, a report from the World Gold Council revealed a remarkable 66 per cent surge in demand for gold bars and coins in China during the third quarter, reaching 82 metric tonnes, even in the face of elevated gold prices. This figure represents a 16 per cent year-over-year increase.

Even though interest rates are going up, which usually makes gold prices go down because the commodity doesn’t pay interest, the price of gold is being supported by central banks buying it and strong consumer demand in China.

Central banks are buying more gold due to political instability in the Middle East and the Ukraine war. Since the Israel-Gamas conflict started last month, gold prices have almost surpassed the 2020 record and settled at around $1,992 a troy ounce.

Palmer’s interview followed Newmont’s successful acquisition of Newcrest Mining, marking the largest deal in the history of gold mining companies.

“This transaction is the largest in the gold industry and among the largest in the mining industry,” Palmer said. “Half of the world’s top gold mines will be in our portfolio.”

The acquisition helps Newmont become more involved in producing copper, a vital metal for the shift to clean energy.

Gold prices have surged since the Israel-Hamas conflict erupted. Graph via Financial Times.

Read more: Increase in gold demand points to strong global market: World Gold Council

Read more: Gold demand weakens in Q3 but remains above historical averages

Read more: Global gold mining market to reach $260B at a 3.5% CAGR: Zion Market Research

Israel-Hamas conflict has limited impact on gold prices, analyst says

With the increased demand for gold during political instability, analysts anticipate that physical gold and gold-backed securities, like bonds and mutual funds, will likely perform well.

Manav Modi, an analyst at MOFSL specializing in commodities and currencies, told Business Today that the recent conflict between Israel and Hamas has already led to a rise in gold prices, and any further escalation of unrest in different regions could continue to provide support to gold prices, albeit at somewhat lower levels.

However, it’s important to note that the Israel-Hamas conflict has had a limited impact on gold prices. While this war has contributed to a roughly one per cent increase in gold prices, the overall market sentiment doesn’t show significant risk aversion, according to analysts.

Sharekhan analyst Praveen Singh told Business Insider that the primary factors driving gold’s rise are a sharp decline in U.S. yields and a weaker dollar. Singh also suggests that unless the conflict involves other countries –such as Iran– gold may struggle to sustain a rally beyond $1,900.

Manoj Jha, a former director of the All India Gems and Jewellery Domestic Council, told Times of India that when gold prices increase, people tend to purchase more in anticipation of potential gains.

“We don’t think gold prices will rise significantly from the current levels even though incidents like the Hamas-Israel war do lend an upward pressure on prices,” Jha added.

Read more: Calibre Mining intercepts high-grade gold below Jabali mine, identifies 3 new gold targets

Read more: Calibre Mining Q3 gold production numbers exceed analyst expectations: Canaccord Genuity

Mid-tier gold producers, vital in the gold mining chain

Mid-tier gold producers serve as a vital link in the gold mining chain, providing stability, investment opportunities and responsible mining practices. They contribute to resource development, job creation, and economic growth, making a significant impact in both the industry and the communities where they operate.

Rising gold prices can enhance the appeal of their projects, potentially attracting more investment and financing opportunities.

Several mid-tier Canadian gold producers listed on the Toronto Stock Exchange have seen substantial share price gains year-to-date. These include Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF) leading the way with an impressive 68.13 per cent increase, followed by Dundee Precious Metals (TSX: DPM) at 30.56 per cent, Lundin Gold (TSX: LUG) at 29.12 per cent, and Kinross Gold (TSX: K) at 27.46 per cent.

Calibre Mining is a sponsor of Mugglehead Magazine coverage