Since Canada legalized recreational weed in 2018, once-hyped producer Cronos Group Inc. (TSX: CRON) (Nasdaq: CRON) continues to pile up losses and report weak revenue.

On Friday, the Ontario-based company posted a net loss of US$161 million for the first quarter ended March 31, on net revenue of only US$12.6 million.

The biggest factor behind the glaring red ink was a loss on revaluation of derivative liabilities of US$116.9 million, the firm noted.

When Cronos’s share price goes up, which it did during February’s Reddit-fueled pot stock rally, the company records a loss on the revaluation of warrants held by its major shareholder, Altria.

The U.S. Marlboro cigarettes maker invested US$1.8 billion for a 45 per cent stake in Cronos in late 2018, in hopes of benefiting from Canada’s move to legalize pot.

But Cronos has continued to burn through cash in each quarter since the major investment, pumping in millions to research and develop rare cannabiniods with its partner Gingko Bioworks.

Read more: Cronos stock drops on US$111.7M Q4 loss

Read more: Reddit traders send pot stocks to the moon — and back

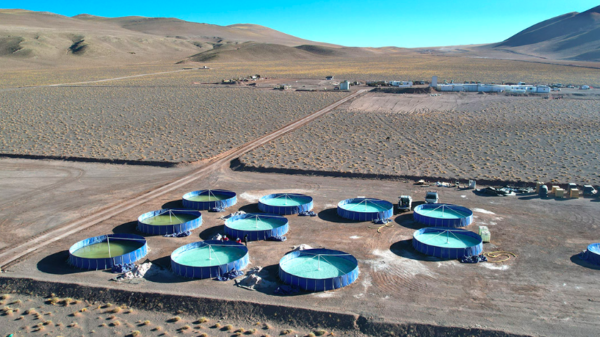

Ginkgo Bioworks is a Boston, Mass.-based biotech company founded in 2009 by scientists from MIT. It specializes in using genetic engineering to produce bacteria with industrial applications. Press photo

At the end of the first quarter, the cannabis company had cash and cash equivalents of US$1.02 billion.

The firm recorded an operating loss of $43.5 million for the first three months of fiscal 2021.

Adjusted earnings before interest, taxes, depreciation, and amortization came in at a loss of $37.1 million.

Cronos says it’s on the brink of commercializing synthesized cannabinoids

But Cronos says it’s on the brink of finally executing its vision of transforming the pharmaceutical and cannabis industries by way of cannabinoid innovation.

In April, the company’s joint venture with Boston-based Ginko received a processing licence from Health Canada, which Cronos says is a key component to commercializing the synthesized cannabinoids they’ve been producing.

“Receiving this licence is a great accomplishment and I am looking forward to bringing our innovative product pipeline to market over time utilizing this technology,” CEO Kurt Schmidt said in a statement. “This partnership is a global effort for our organization.”

Schmidt, who was appointed as CEO in September, says Cronos continues to focus on developing new products despite pandemic-related setbacks in the Canadian weed market.

In less than four months on the job, Schmidt racked up total compensation of US$10.1 million in 2020, with US$146,000 in weighted base salary, US$2.4 million in stock awards, US$7.3 million in option awards and another US$244,000 in non-equity compensation, according to a proxy statement filed with the U.S. Securities and Exchange Commission.

Cronos will launch edibles in the Canadian recreational market in the coming weeks under its Spinach brand, according to firm’s statement.

“Cronos Group approaches product launches with an aim to be the best, not necessarily the first,” the company says.

Total edible sales reached $109.2 million in 2020, according to Statistics Canada.

Read more: Crumbling Cronos enlists CPG CEO

Read more: Canadian pot production slows as supply eases to 1.1B grams

In the first quarter, Cronos said it sold US$7.5 million worth of product in Canada, which was primarily dried flower.

The company also recorded revenue of US$2.5 million in Israel’s medical cannabis market, where it sells pre-rolls, oils and dried flower under its Peace Naturals brand.

Sales in the U.S., where Cronos owns and operates the CBD brands Lord Jones and Happy Dance, dropped 31 per cent sequentially to US$2.4 million.

Overall, the firm’s first quarter revenues dropped 26 per cent from the prior three months when it recorded US$17 million.

Shares of Cronos rose 1 per cent Friday to $9.36 on the Toronto Stock Exchange.

But company stock has fallen 53 per cent since it reached an annual high of $19.77 on Feb. 10.

Top image via Lord Jones

jared@mugglehead.com