Canopy Growth Corp. (TSX: WEED) is making big changes to its Acreage Holdings, Inc. (CSE: ACRG.U) acquisition deal due to “volatile financial market conditions” and economic challenges.

On Thursday, the Canadian weed giant said it will now pay US$843 million to acquire New York-based Acreage in a deal that is contingent upon the U.S. federal government legalizing cannabis sales. That’s down from Canopy’s original $3.4 billion takeover offer that was approved by Acreage shareholders last June.

Read more: Acreage, Canopy shareholders overwhelmingly approve contingent deal

That price could change again when the deal is triggered because its value hinges on Acreage’s share price.

Canopy said the new deal gives Acreage shareholders better “upside potential” because it’s better aligned with increasingly tighter market conditions.

Despite surging 20 per cent on Thursday, Acreage shares are still down 50 per cent year-to-date. Meanwhile, Canopy shares have fallen around 16 per cent over that same time.

For Canopy CEO David Klein, the amended deal is key for its U.S. strategy moving forward.

“The United States is going to be a core market for Canopy Growth and this new agreement solidifies our path forward with Acreage,” Klein said in a statment. “I am excited to bring our relationship with Acreage back to centre stage in our U.S. strategy.”

Canopy Growth & Acreage Holdings Agree to Modify Plan of Arrangement as Canopy Growth's U.S. Expansion Continues

Details here: https://t.co/YN1GzgKXdh

Here's to #FutureGrowth pic.twitter.com/ukV19ddnqX

— Canopy Growth (@CanopyGrowth) June 25, 2020

Canopy CEO expects US legalization in 2022

Klein said the Acreage deal will help it get Canopy’s cannabis 2.0 brands to the U.S., including its “exciting beverage products.”

At a virtual investor meeting this week, the CEO predicted the addressable legal cannabis market will reach $70 billion globally by 2023, up from $10 billion this year.

Klein says much of that growth will come from the U.S. legalizing weed at the federal level by 2022 and new rules being issued for CBD food and drink products.

Canopy noted that the new deal with Acreage will give the U.S. company incentive to focus on running an efficient business until legalization triggers the acquisition. Due to terms of the original deal, the company isn’t allowed to back out of the agreement.

The new deal includes an up-front payment from Canopy to Acreage valued at US$37.5 million. That comes after Acreage last week signed off on a US$15 million loan with a 60 per cent interest rate.

Read more: Acreage Holdings signs off on loan with 60% interest rate

Acreage, which operates in 20 states, reported a US$50.6 million net loss on sales of US$21.1 million in its latest quarterly report. Analysts have cited the U.S. operator among a number of cannabis companies that face liquidity issues.

In connection to the new deal, Acreage CEO Kevin Murphy said he is stepping down immediately but will stay on as chairman. Former health care executive Bill Van Fassen, who also sits on Acreage’s board, will fill in as interim CEO until a permanent replacement is found.

Canopy said it will also loan Acreage up to US$100 million to bolster its U.S. hemp operations. But the funds cannot be used for the company’s cannabis-related operations until laws change in the U.S.

Once the takeover deal gets the green light, Acreage shareholders will receive 70 per cent of a fixed share and 30 per cent of a floating share for each Acreage share they hold. Canopy said it will swap 0.3048 of a Canopy share for each fixed Acreage share, with the option to buy the floating Acreage shares for a price equal to their 30-day volume average weighted trading price, set at a minimum of US$6.41 per share, payable in cash or shares at Canopy’s option.

In April of 2019, the companies originally agreed to pay to pay 0.5818 of a Canopy share for each Acreage share.

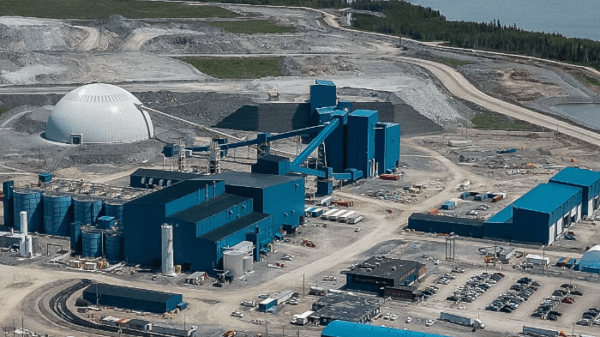

Top image via Canopy Growth

jared@mugglehead.com

@JaredGnam