Calibre Mining (TSX: CXB) (OTXQX: CXBMF) will achieve the high-end of its production guidance this year, generating up to 275,000 ounces of gold, according to a new analyst report by Toronto-Dominion Bank (TSX: TD).

This month, analysts Steven Green and Luke Bertozzi released a report on the Nevada and Nicaragua-focused miner and gave a share target price of $2.25 within one year given its successful production results during the third quarter of 2023.

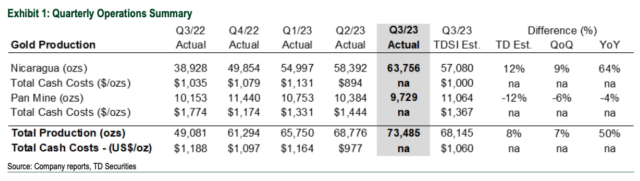

Calibre exceeded the analysts’ Q3 gold production estimate by 8 per cent, producing 73.5 kilo ounces. In Nicaragua specifically, Calibre beat the their production estimate by 12 per cent, generating 63.8 kilo ounces.

Green and Bertozzi say the company’s production success in Central America is primarily attributable to its Eastern Borosi operation sending ore to the La Libertad mill for the duration of an entire quarter for the first time in Q3 this year.

The gold mining company’s stock has steadily risen by more than 61 per cent over the past year and is currently trading for $1.50 on the Toronto Stock Exchange. The bank foresees that trend continuing in the coming months with an estimated 74.4 per cent total return over the course of the next 12 months.

In addition to qualifying for Toronto Stock Exchange listing as an early-stage mining company, Calibre has also met criteria for listing on the OTCQX top-tier market from OTC Markets Group Inc. (OTCQX: OTCM) — a superior trading platform than OTC Pink and OTCQB.

“Calibre presents a compelling investment opportunity with its consistent delivery of strong free cash flow, ongoing reinvestment in exploration and growth, and commitment to conducting operations in a responsible, sustainable, and transparent manner,” said the gold miner’s CEO Darren Hall.

Read more: Orla Mining increases annual gold production guidance after positive Q3 results

Read more: K92 Mining breaks records for daily processing in Q3 with 1,542 tonnes per day

Calibre’s cash balance continues to grow

“Calibre’s strong free cash flow continues,” said the analysts. The company’s cash balance rose sequentially by 26 per cent to $97 million during this year’s third quarter and by 72 per cent since the beginning of 2023.

Calibre will be releasing its Q3 financials after market close on Nov. 7 and will be holding a conference call the following day.

On Thursday, the company announced that it would be making a normal course issuer bid (NCIB) to repurchase up to 10 per cent of its shares.

“Given our robust cash position we will review the opportunity over the next 12 months to purchase up to 10 per cent of our public float,” said Hall in a statement.

“We believe that the purchase of Calibre common shares under the NCIB is a responsible use of available cash and in the best interests of the company, since the market prices, from time to time, may not reflect the value of the Calibre’s business,” he added.

Calibre has the potential to increase resources, grade and confidence around our sites. #Mining #growth #CalibreMining #goldmining #MiningNews #production #resources #Sustainability #SafetyFirst #Gold pic.twitter.com/dEdzN43xyn

— Calibre Mining Corp. (@CalibreMiningCo) October 18, 2023

Read more: Calibre Mining’s Q3 gold production on track to meet upper-end of guidance: Scotiabank report

Read more: Calibre Mining remains an excellent operator with ample exploration targets: Cormark Securities

Analysts’ from the Bank of Nova Scotia (TSX: BNS) also said that they expected Calibre to achieve or even surpass the high-end of its gold production guidance this year in a recent report. They gave Calibre a one-year share target price of $2.00.

Additionally, an analysis from the financial firm Cormark Securities indicated that Calibre’s recent success would position it to trade at a premium to peers. The firm’s analysts’ said Calibre was an excellent operator with ample near-mine exploration targets.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com