Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) is increasing its gold production guidance for the year after seeing positive results in its last quarter.

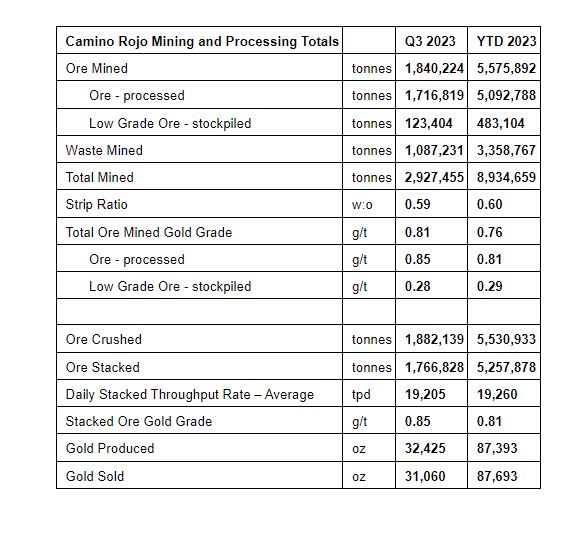

The gold miner announced its interim operational update for the third quarter ended Sept. 30 this year and reported that its Camino Rojo oxide mine in Zacatecas, Mexico produced 32,425 ounces of gold and sold 31,060 ounces in the same quarter.

Camino Rojo showed unexpected results which have led the company to increase its full-year gold production guidance to 110,000-120,000 ounces from its original guidance of 100,000- 110,000 ounces.

Company stock saw a 3 per cent increase on Monday to $4.58 on the Toronto Stock Exchange.

Table via Orla Mining.

Read more: Orla Mining finds high-grade gold mineralization in Mexico

Read more: Orla Mining environmental impact assessment draws opposition in Panama

The company reported US$132.7 million in cash and US$36.7 million undrawn on its revolving credit facility for a total of US$169.4 million. After the quarter ended, the company repaid US$25 million towards its revolving credit facility, reducing the balance outstanding under the facility to US$88.4 million.

The company’s Camino Rojo project is a large gold and silver open-pit and heap leach mine. The company also fully owns the South Railroad project which includes a pre-feasibility-stage, open-pit, heap leach gold project, a copper-gold sulphide resource and various exploration targets.

Orla Mining has other two projects including South Railroad, located in Nevada, United States and Cerro Quema, located in Los Santos Province, Panama.

Orla Mining Provides Third Quarter 2023 Operational Results and Increases 2023 Annual Gold Production Guidancehttps://t.co/m6ibHuTAGC$OLA.TO $ORLA #gold #mining #production #exploration #guidance pic.twitter.com/1BbIMV82Bg

— Orla Mining (TSX: $OLA.TO) (NYSE: $ORLA) (@MiningOrla) October 16, 2023

Read more: Calibre Mining publishes open pit gold estimate for Cerro Volcan Gold, Nicaragua

Read more: Calibre Mining expands high-grade gold mineralization zones within Limon mine complex

Nevada and Latin America have emerged as promising destinations for land packages rich in high-grade gold deposits, and Canadian companies actively engaged in these regions have been making significant strides in their exploration and mining endeavours.

Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF) has operations in Nevada and Nicaragua and recently reported an increase in its cash flow by 72 per cent since the beginning of the year and 26 per cent in the last quarter. This is the fourth time the company has achieved a consolidated quarterly gold production, reaching over 73,000 ounces of gold.

This represented a substantial 50 per cent increase in gold production compared to the same period in 2022, when production stood at approximately 49,000 ounces.

Calibre Mining stock stayed flat on Monday at $1.5 on the Toronto Stock Exchange.

Calibre Mining Corp. is a sponsor of Mugglehead News coverage