Calibre Mining Corp.’s (TSX: CXB) (OTCQX: CXBMF) strong production record and free cash flow position the company shares to trade at a premium to peers, according to a recent analysis.

In a report by the independent investment dealer Cormark Securities Inc., analysts Nicolas Dion and Nolan Wilson highlighted Calibre’s strong and fourth production record in a row.

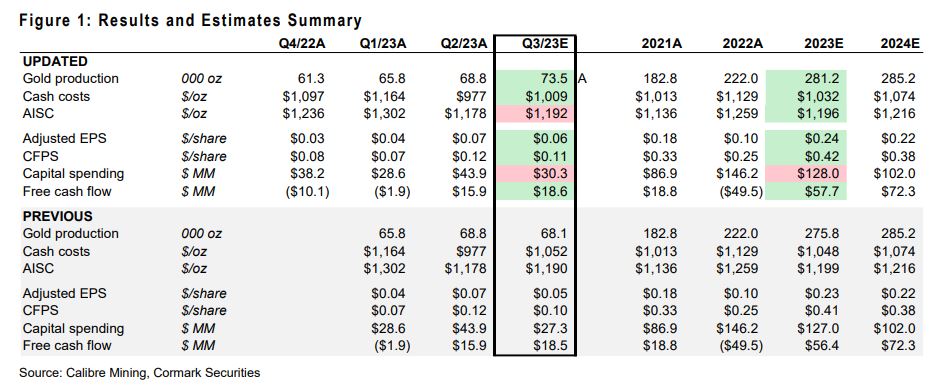

During the third quarter of this year, Calibre produced 73,485 ounces of gold, a 6.8 per cent increase from the last quarter. Production was bolstered by strong performance in Nicaragua with 63,756 ounces and 9,729 ounces in Nevada.

The year-to-date (YTD) production was 208,011 ounces of gold which placed the company on track to beat its yearly guidance of 250,000-275,000 ounces. The fourth quarter is poised to be the strongest quarter of the year due to the increasing high-grade results from Eastern Borosi.

“Calibre remains an excellent operator with ample near-mine exploration targets,” wrote the analysis in the report.

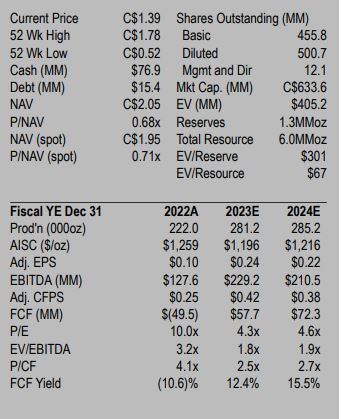

“Shares trade at a slight premium to peers on our Net Asset Value (NAV), though remain inexpensive on cash flow and free cash flow (around 12 per cent FCF yield in 2023E), owing to a relatively short production profile at current levels (at least on paper).”

Table via Cormark.

Calibre had $97 million in cash at the end of the third quarter of 2023 which is an increase of $20 million compared to the second quarter of 2023.

Cormark said it expects the company to spend a significant portion of its capital expenditures (capex) and exploration budget in 2023.

Cormark recommends buying the stock at C$2.0 as the company is expected to outperform.

Read more: Calibre Mining reports record breaking sales and increased net income in Q2

Read more: Calibre Mining expands resources from open pit at Nevada’s Pan Gold Mine

In September, Cormark analyzed Calibre’s published maiden resource from its Volcan deposit at La Libertad which totalled 161,000 oz of gold at approximately 2.2 g/t. The company reported indicated resources to be 30,000 ounces at 1.83 g/t indicated and 131,000 ounces at 2.28 g/t inferred.

“Volcan is yet another example of Calibre’s ability in recent years to find new deposits, which has helped more than offset reserve depletion,” analysts wrote.

Calibre has two producing mills in Nicaragua including El Limon and La Libertad. The company acquired assets from B2Gold Corp. (TSX: BTO) (NYSE AMERICAN: BTG) (NSX: B2G) in 2019 with exploration in mind and has been successful ever since.

Its hub-and-spoke strategy aims to fill excess capacity in the La Libertad mill from the company’s other deposits.

Other firms have similar “buy” ratings for Calibre, Canaccord Genuity has set C$2.50 as a target price because of its high success in the quarter while Bank of Montreal Financial Group’s (TSE: BMO) Capital Markets division has also maintained the outperform rating and a target price of C$2.00.

Calibre Mining is a sponsor of Mugglehead news coverage