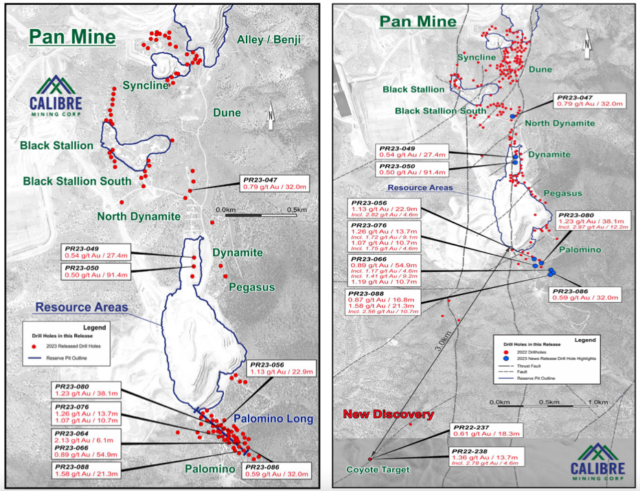

Calibre Mining (TSX: CXB) (OTCQX: CXBMF) has expanded its resources north and south from the open pit at its Pan Gold Mine in Nevada. The company reported high-grade drill results above its mineral resource grade.

The Vancouver-based junior mining company announced the new results on Tuesday, which come from the Dynamite North and Palomino targets. The intercepts from these two areas in combination with the new Coyote target south of the open pit continue to exhibit potential for increased resources and high grades at Pan.

High-grade drill results over significant lengths from the Palomino target reported by Calibre last month left analysts from Haywood Securities “gobsmacked” at the consistency of gold mineralization. The Pan mine is a Carlin-style open-pit operation located in the Battle Mountain – Eureka gold trend.

Newly assayed intercepts from Palomino and Dynamite North exceeding the site’s mineral resource grade of 0.4 g/t gold include the following:

- Hole PR23-080: 1.23 g/t Au over 38.1 metres including 2.97 g/t Au over 12.2 metres

- Hole PR23-088: 0.87 g/t Au over 16.8 metres and 1.58 g/t Au over 21.3 metres including 2.56 g/t Au over 10.7 metres

- Hole PR23-056: 1.13 g/t Au over 22.9 metres including 2.82 g/t Au over 4.6 metres

- Hole PR23-047: 0.70 g/t Au over 18.3 metres and 0.79 g/t Au over 32 metres including 2.31 g/t Au over 6.1 metres

- Hole PR23-050: 0.50 g/t Au over 91.4 metres

Palomino and other target areas. Maps via Calibre Mining

Read more: Calibre Mining reports high-grade discoveries at untapped regions in Panteon VTEM corridor

Read more: Calibre Mining reports 32% sequential cash balance increase to US$77M

Nevada is the world’s best mining jurisdiction to invest in, according to Canada’s Fraser Institute — an education and public policy think tank.

Calibre says it is on schedule for delivering on its 2023 production guidance of 250,000-270,000 ounces of gold.

“Today’s highly encouraging drill results expand upon our Palomino target results announced on June 21, 2023 and immediately surround the current open pit operations,” said Calibre’s President and CEO Darren Hall.

“We look forward to additional results as we continue to advance our discovery and resource expansion drill programs across the operation and mineral concessions where we have identified numerous highly prospective targets,” he added.

Calibre continues to present a compelling investment opportunity. #news #Mining #growth #CalibreMining #goldmining #MiningNews #production #resources #investments pic.twitter.com/8upGUdD0i2

— Calibre Mining Corp. (@CalibreMiningCo) July 31, 2023

Calibre reported a 32 per cent sequential increase in its cash balance at the end of Q2 this year, bringing its position to US$77 million. The company had a 15 per cent year-over-year increase in gold production for the quarter, generating 68,776 ounces.

The miner also reported high-grade drill results from its Limon Mine in Nicaragua earlier this month, including 15.64 g/t Au over 2.5 metres and 31.30 g/t Au over 1.4 metres. Recent reports from the Bank of Montreal Financial Group (TSX: BMO) and Bank of Nova Scotia (TSX: BNS) have indicated that the initiation of open-pit mining at Eastern Borosi and Pavon Central in the country will continue to positively contribute to the company’s production results for the remainder of the year.

Calibre shares dropped by 0.29 per cent Tuesday to $1.70 on the Toronto Stock Exchange but have risen by over 87 per cent since the beginning of this year.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com