Calibre Mining (TSX: CXB) (OTCQX: CXBMF) had a very successful start to 2023, improving its gold production rate by 20 per cent year-over-year and increasing its cash balance by 32 per cent over the past three months to US$77 million.

The Vancouver-based junior mining company reported operating results for the half and quarter ending June 30 on Tuesday and had a 15 per cent year-over-year increase in gold production in Q2, generating 68,776 ounces. Nicaragua accounted for the majority of gold at 58,392 ounces and Nevada produced the remaining 10,384 ounces.

Calibre also reported a 20 per cent year-over-year increase in year-to-date (YTD) gold production for H1, producing 134,526 ounces. The company says it remains on schedule for delivering on its production guidance of 250,000-270,000 ounces for the year.

Calibre started mining the high-grade Guapinol open-pit at Eastern Borosi in April and began sending ore to the Libertad mill in mid-May. This development was a key factor in Calibre’s success this year and recent reports from the Bank of Montreal Financial Group (TSX: BMO) and Bank of Nova Scotia (TSX: BNS) have indicated that the initiation of open-pit mining at Eastern Borosi and Pavon Central will continue to positively contribute to the company’s production results for the remainder of the year.

Recent high-grade drill results from Calibre’s operations in Nicaragua include 18.09 g/t gold over 5.7 metres and 4.45 g/t Au over 20.9 metres at the Limon Mine Complex. The company also reported significant intercepts at the Palomino target in Nevada’s Eureka trend including 3.84 g/t Au over 15.2 metres and 4.19 g/t over 13.7 metres.

Read more: Gobsmacked by Calibre Mining’s high grades from Palomino, Nevada: Haywood Securities

Read more: Calibre Mining’s Nicaragua operations to accelerate 2023 gold and cash flow: Scotiabank report

Calibre had numerous positive exploration results in Q2

In addition to Calibre’s operations in Nicaragua and Nevada, the company recently intercepted significant lengths of gold mineralization at the Golden Eagle project in Washington state. These results include 2.98 g/t Au over 87.17 metres and 3.7 g/t over 48.55 metres.

Calibre published its 2022 sustainability report last month outlining the company’s sustainable and socially conscious practices in the countries that it operates.

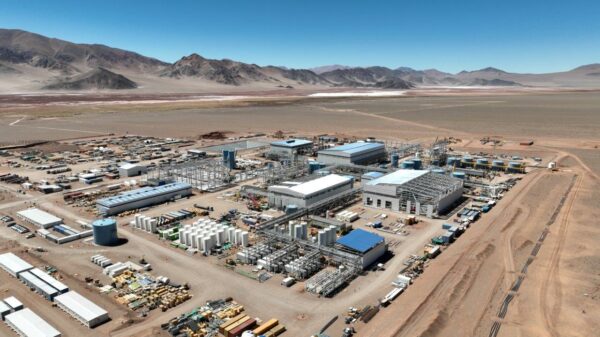

“During the quarter we announced numerous positive exploration results. Given our demonstrated ability to convert discovery into production, I expect our investment will continue to result in additional shareholder value as we leverage the significant surplus capacity available at the Libertad processing facility,” said Calibre’s President and CEO Darren Hall.

Calibre’s senior vice president of corporate development was recently featured in an interview with the Korelin Economics Report to discuss the recent developments in Nicaragua.

Ryan King, Senior VP of Corporate Development and IR at Calibre Mining, joins The Korelin Economics Report – #kereport to recap the ore deliveries to the Libertad processing plant since May. #interview #newshttps://t.co/5SFUKw3t6G

— Calibre Mining Corp. (@CalibreMiningCo) July 10, 2023

The company will be releasing its second quarter and YTD financial results on August 9.

Calibre’s shares rose by 1.31 per cent Tuesday to $1.55 on the Toronto Stock Exchange where they have been on a steady incline since the beginning of the year, rising by 70.33 per cent.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com