Calibre Mining Corp.’s (TSX: CXB) (OTCQX: CXBMF) latest findings at Eastern Borosi Mine Complex in Nicaragua could extend the lifespan of the mine.

The latest results published on Wednesday involve findings from outside the current reserves. The Eastern Borosi it is currently being mined for high-grade ore to feed the surplus processing capacity at the Libertad mill, which is part of Calibre’s hub and spoke strategy.

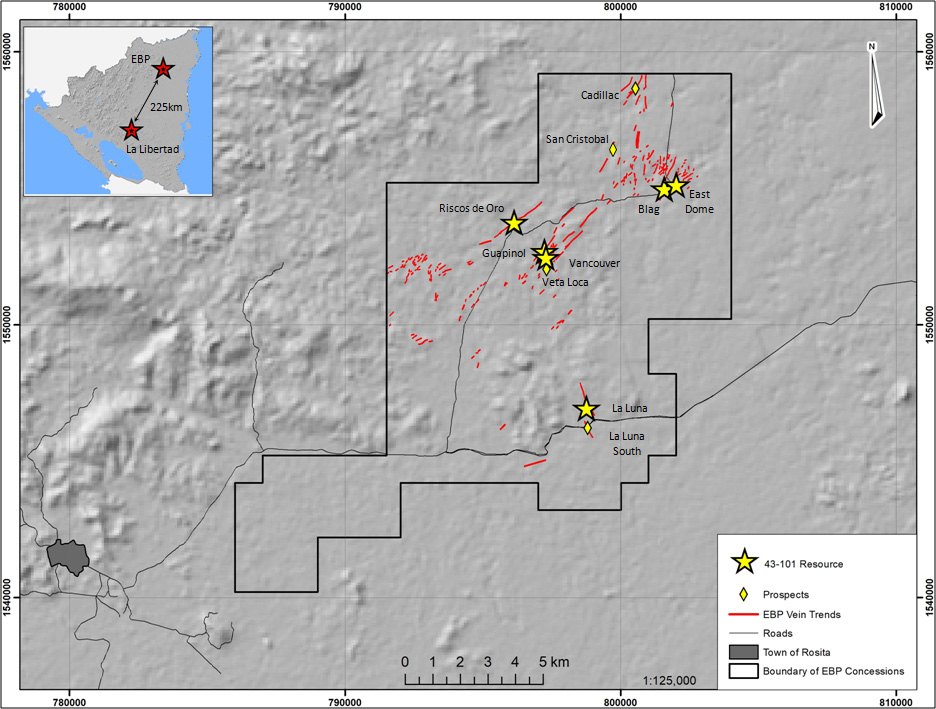

The Eastern Borosi land package covers an area of 176 square kilometres and includes both open pit and underground resources. The known resources within the package include Riscos de Oro, East Dome, Blag, La Luna, and the currently operational Guapinol/Vancouver open pit mine.

These deposits consist of several gold-silver vein systems characterized by low sulphidation. At present, Eastern Borosi has an indicated mineral resource of 1.031 million tonnes with an average gold grade of 8.48 g/t, totalling 281,000 ounces of contained gold.

Additionally, there is an inferred mineral resource of 2.895 million tonnes with an average gold grade of 3.18 g/t, amounting to 296,000 ounces of contained gold.

Highlights of the Eastern Borosi infill drill program include:

-

12.9 g/t Au over 8.5 metres Estimated True Width (ETW) including 23.30 g/t Au over 1.6 metres ETW and 35.50 g/t Au over 1.24 metres ETW in Hole BL-23-097.

-

10.61 g/t Au over 7.2 metres ETW including 27.47 g/t Au over 2.3 metres ETW in Hole BL-23-099.

-

7.1 g/t Au over 5.0 metres ETW including 14.75 g/t Au over 2.3 metres in Hole BL-23-102.

The ETW for the reported vein intercepts are calculated using 3D models of the veins. To determine the estimates, the company measured the thickness of the modelled veins in cross-section, perpendicular to the vein margins and through the midpoint of the drill hole intercept.

The percentage differences between the individual ETWs and the lengths of the intervals drilled will vary across different drill holes due to factors such as the inclination of the drill hole, variations in the direction and angle of the veins, and the overall shapes of the various vein systems.

Project map for Eastern Borosi. Image via Calibre Mining.

Read more: Calibre Mining starts drilling high-grade gold at Eastern Borosi open pit

Read more: Calibre Mining reports record gold production in Q1 2023

Eastern Borosi shows multiple different deposit types

“Over the past few years, we have significantly expanded our 100 per cent owned Atlantic region land package, now at 7,281 square kilometres,” said Darren Hall, president and CEO of Calibre Mining.

“Prior to the B2Gold transaction in 2019, the Company discovered the near surface, Primavera copper-gold porphyry system where the Company is advancing target delineation work.”

Calibre Mining owns a large 7,281 square kilometre land package surrounding the Eastern Borosi project. This land package has the potential for various deposits, including porphyry, skarn, and epithermal vein deposits. Notable deposits within the area are Primavera and Cerro Aeropuerto, both containing an inferred mineral resource.

Primavera is a gold-copper porphyry deposit and has an inferred mineral resource of 44,974,000 tonnes. The deposit contains 0.54 g/t gold, 1.15 g/t silver, and 0.22 per cent copper, resulting in 782,000 ounces of gold, 1,661,000 ounces of silver, and 218,670,000 pounds of copper. The gold equivalent grade is estimated at 0.84 g/t.

Cerro Aeropuerto is characterized by gold and base metal-bearing quartz and replacement-style skarn mineralization. It contains an inferred mineral resource of 6,052,000 tonnes with grades of 3.64 g/t gold and 16.16 g/t silver, resulting in 707,750 ounces of gold and 3,144,500 ounces of silver. The gold grade equivalent is estimated at 3.89 g/t.

Calibre shares remained flat on Thursday at $1.64 on the Toronto Stock Exchange.

Calibre Mining is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com