Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF) saw an increase in mineral resources and reserves of 16 per cent at its operations in Nicaragua and 23 per cent increase at its operations in Nevada.

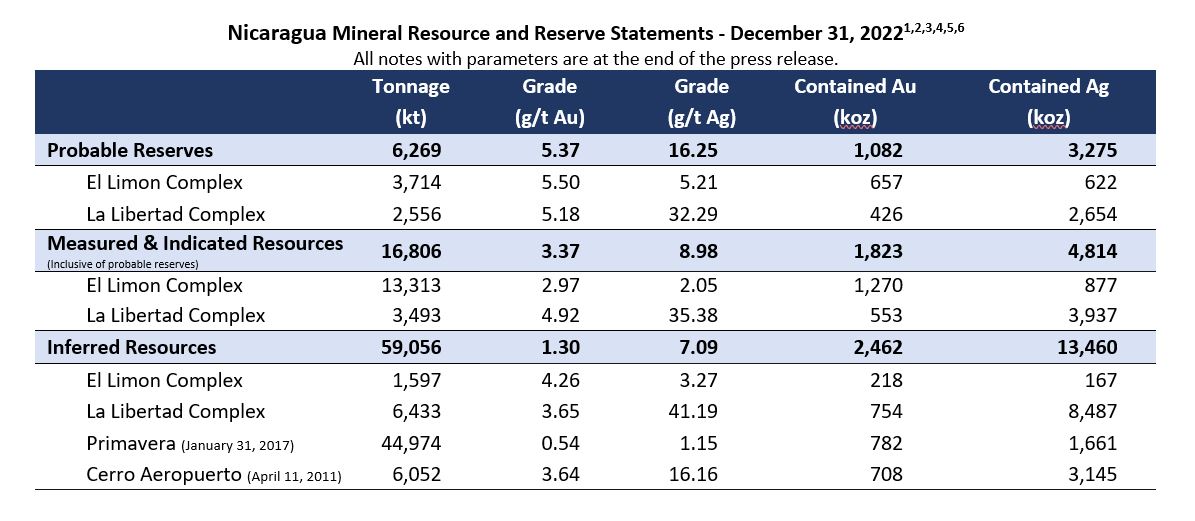

The Vancouver-based gold mining company announced its updated mineral resources and mineral reserves results for its operations in Nicaragua and Nevada on Monday. It reported that its Nicaraguan mineral reserve grade has increased to 5.37 grams of gold per tonne from 4.62 g/t in 2021 and the reserves have seen a 278 per cent increase to around 1 million ounces of gold, net of depletion since the 2019 acquisition.

This marks the largest mineral reserve estimate in 12 years, with a record gold grade of 5.37 g/t for the combined assets. The discovery of the Panteon North maiden mineral reserve in May 2022 added about 244,000 ounces (0.8 million tonnes at 9.45 g/t Au) to the Nicaraguan mineral reserves. This trend towards higher grades is expected to result in lower per-ounce costs.

According to Calibre, there are several high-grade expansion opportunities at Limon this year, such as the Panteon VTEM Gold Corridor and Talavera extension, and at Libertad, including Veta Azul and Volcan, which were not included in the Company’s 2022 Mineral Resource statement.

It also has opportunities for additional mineral resource expansion and grade increase at its Eastern Borosi project, particularly at Blag, La Luna, and East Dome, as well as Riscos de Oro Southwest and Northeast extensions.

The company has conducted first-pass drilling at the recently permitted Buena Vista and La Fortuna concessions, which are located near the Limon and Libertad mine complexes, respectively. It is currently undertaking a 60,000-meter drill program.

Table via Calibre Mining.

Read more: Calibre Mining gold discovery could breathe life into historic mining community

Read more: Calibre Mining budgets $29M for 2023 exploration in Nevada and Nicaragua

In Nevada, the pit-constrained mineral reserves at the Pan Mine have grown by 23 per cent to 234,000 ounces of gold, net of depletion. Additionally, there has been a 12 per cent increase in the measured and indicated mineral resource at Pan Mine to 359,000 ounces of gold.

The company says there are several discovery opportunities along a five-kilometre trend south of the Pan resource area, with a focus on the new Coyote discovery that showed promising results from recent drilling.

Calibre plans to conduct further drilling in this area and in the meantime, it has started a 40,000-meter drill program, and a generative program involving mineral alteration classification and structural interpretation.

Table via Calibre Mining.

Read more: Calibre Mining finds robust drill results from Golden Eagle project

Read more: Calibre Mining offers a ‘very attractive’ value-risk proposition: Haywood Securities

“Since acquiring our Nicaraguan assets in Q4 2019, the teams’ commitment has created significant value. Year-over-year we have discovered new, high-grade deposits, increasing overall reserve ounces and grades,” CEO Darren Hall said.

In 2022, the discovery and delineation of the high-grade ore shoot at Panteon North resulted in 810,000 tonnes at a grade of 9.45 g/t Au for approximately 244,000 ounces of Mineral Reserves, a significant achievement for the team, Hall explained.

The company is currently running a drill program with multiple rigs to follow up on recent findings. These include 11.61 grams of gold per tonne over a 9.3-meter span found along the VTEM Gold Corridor about 1.5 kilometres northeast of Panteon North.

This discovery suggests there may be another opportunity for high-grade deposits that weren’t included in the company’s 2022 Mineral Resource and Mineral Reserve statement.

“The 2022 Nevada programs yielded a 23 per cent increase in Mineral Reserves, net of depletion. This, in combination with the discovery of a new Coyote zone proximal to the operating open pit mine, demonstrates the additional upside that exists,” Hall said.

Calibre’s stock went up by one per cent on Tuesday to $1.01 in the Toronto Securities Exchange.

Calibre Increases Nicaraguan Mineral Reserve Grade by 16% and Nevada Mineral Reserves Grow by 23%, Net of Production Depletion. #pressrelease #news #GOLD #exploration #Mining https://t.co/XtNaUU41XX

— Calibre Mining Corp. (@CalibreMiningCo) February 14, 2023

Calibre Mining is a sponsor of Mugglehead Magazine news coverage

Natalia@mugglehead.com