Wheaton Precious Metals Corp. (TSX: WPM) will gain a long-term supply of gold and exploration potential in Ecuador through a millions-worth streaming agreement with Lumina Gold Corp.’s (TSXV: LUM).

On Tuesday, Wheaton Precious Metals International Ltd., a subsidiary of the Vancouver-based precious metals streaming company, announced it will pay Lumina $300 million in total upfront cash, including $48 million available pre-construction for its Cangrejos gold-copper project in Ecuador.

Under the agreement, the remaining $252 million will be paid in equal installments during construction of the Cangrejos mine, as long as Lumina meets standard conditions in the agreement like receiving key permits. Wheaton will make payments to ensure Lumina has sufficient funding to develop the mine while production payments are still ramping up.

Wheaton will make ongoing production payments for gold ounces delivered from the open-pit project.

The stream will allow Wheaton to purchase 6.6 per cent of the payable gold from Cangrejos, located in El Oro Province, until 700,000 ounces have been delivered. After that, the stream will drop to 4.4 per cent for the remainder of the mine’s life.

Wheaton estimates the stream will yield an average of 24,000 attributable ounces annually for the first 10 years of production and 24,500 ounces per year over the 26-year mine life. The company said the agreement has the potential to provide accretive growth.

“The Cangrejos Project is an excellent addition to Wheaton’s existing portfolio of high-quality, low-cost assets as it should provide accretive, long-term growth as well as significant exploration potential,” Wheaton president and CEO Randy Smallwood said in a statement.

Wheaton will make ongoing production payments of 18 per cent of the spot price of gold until its upfront deposit has been depleted, after which the rate will increase to 22 per cent for the duration of the agreement.

The transaction includes several guarantees and security provisions, including a completion test to ensure the project meets Wheaton’s standards before the full deposit is paid. Wheaton also obtained the right of first refusal on any future gold and silver streams from the project.

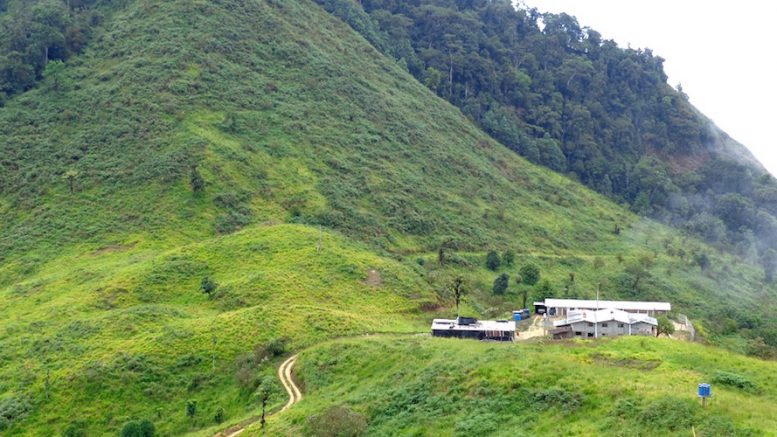

Location of Los Cangrejos. Photo via Lumina.

Read more: Wheaton Precious Metals 2022 sustainability report shows dedication to progress

Read more: Calibre Mining’s discoveries at Eastern Borosi hold promise for extended lifespan

If there is a change of control at Lumina within 12 years of initial production, the company may buy back one-third of the gold stream.

Lumina recently completed a preliminary feasibility study for Cangrejos, which hosts the largest primary gold deposit in Ecuador. The project is expected to be a low-cost mine with a production profile of more than 300,000 gold equivalent ounces per year over its first decade, according to Lumina.

Wheaton believes Cangrejos has the potential for expanding reserves and resources beyond the current estimate. The project adds approximately 760,000 ounces of proven and probable gold reserves, 250,000 ounces of measured and indicated gold resources and 160,000 ounces of inferred gold resources to Wheaton’s portfolio.

Wheaton has $800 million in cash and ongoing cash flows from operations and an available $2 billion revolving credit facility to finance the transaction and meet existing commitments.

The company has a portfolio of streaming agreements for 22 operating mines and nine development projects around the world. Wheaton Precious Metals changed its name from Silver Wheaton Corp. in May 2017 to reflect its increased focus on gold assets.

Wheaton stock dropped by 1.93 on Tuesday to $65.64 on the Toronto Stock Exchange.