Wheaton Precious Metals (TSX: WPM) published its 2022 Sustainability Report, detailing its ongoing commitment to strengthening its environment, social and corporate governance (ESG) strategies.

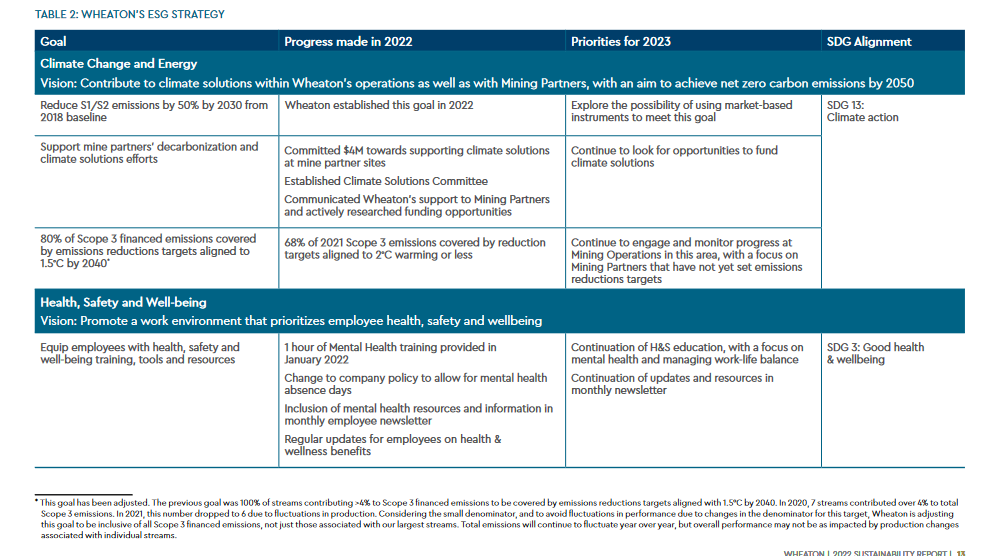

Released on Monday, the 2022 report includes updates on Wheaton’s ESG strategy, targets, and commitments, along with an updated materiality assessment using a ‘double materiality’ approach.

A double materiality approach is a concept used in sustainability and corporate reporting that considers both financial materiality and environmental or social materiality. Financial materiality focuses on the impacts of environmental, social, and governance (ESG) factors on a company’s financial performance and its ability to create long-term value. It examines how ESG issues can influence the company’s financial condition, risk profile, and operational performance.

Notably, Wheaton has introduced a sustainability linked element in connection with the revolving credit facility, showcasing its dedication to ESG practices and governance.

Regarding the environment, the report delves into Wheaton’s efforts to achieve net-zero carbon emissions by 2050.

“At Wheaton, we recognize the responsibility we have to positively contribute to our communities and support industry best practices in ESG,” said Randy Smallwood, Wheaton’s president and chief executive officer.

“We believe that sustainability is a journey that requires an unwavering commitment to progress, and we can only succeed by doing this together. I am incredibly proud of Wheaton’s performance and continued leadership in ESG.”

It highlights the progress made thus far, with a particular focus on Scope 3 financed emissions. A noteworthy achievement is that 68 per cent of the Scope 3 financed emissions in 2021 are covered by emissions reductions targets aligned to 2 degrees celcius or less.

Image via Wheaton Precious Metals.

Read more: Newcrest accepts Newmont’s latest takeover bid for US$19.2B

Read more: Calibre Mining’s discoveries at Eastern Borosi hold promise for extended lifespan

Wheaton distributed over $5.9M to over 100 charitable causes

In terms of diversity, equity, and inclusion, the company has set a new goal to increase the percentage of gender diversity and visible minorities throughout Wheaton, including leadership positions. The report also emphasizes Wheaton’s dedication to advancing diversity and inclusion initiatives.

Wheaton’s Community Investment Program is highlighted, revealing its significant impact on charitable causes and initiatives globally. Over $5.9 million was distributed throughout the year in support of more than 100 charitable causes. Since the inception of the Community Investment Program in 2009, Wheaton has contributed over $38 million to local charities and mining communities, showcasing its commitment to supporting and positively impacting the areas in which it operates.

The report underscores Wheaton’s responsible investment decisions and due diligence practices. Notably, 100 per cent of new streaming agreements in 2022 were screened for ESG issues and risks, demonstrating the company’s commitment to sustainable investments. Furthermore, 85 per cent of Wheaton’s mining partners have committed to implementing one or more industry sustainability standards, representing 89 per cent of the attributable 2022 production.

Wheaton’s efforts and commitment to ESG practices have earned it recognition in the industry. The company has been rated as ‘ESG Industry Top-Rated’ in the precious metals sector and ‘ESG Global 50 Top Rated’ out of over 15,000 multi-sector companies by Sustainalytics.

It has also achieved an ‘AA’ rating by MSCI and a ‘Prime’ rating by ISS. Additionally, Wheaton has been recognized as one of the Best 50 Corporate Citizens in Canada by Corporate Knights. Its B score on CDP’s Climate Change Questionnaire further acknowledges its dedication to addressing climate change.

Image via Wheaton Precious Metals.

)

Read more: K92 Mining posts record Q1 results, beats mill expansion targets

Read more: Liberty Gold reports increased revenue, updated resource estimate in Q1

Company will release a separate climate change report

The information and data presented in Wheaton’s 2022 Sustainability Report were derived from authoritative frameworks such as the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), and the Task Force on Climate-Related Financial Disclosures (TCFD). To provide a comprehensive account of climate-related matters, Wheaton will publish a separate Climate Change Report later this year, aligned with the TCFD guidelines. This forthcoming report will offer detailed disclosures specifically focused on climate-related aspects.

Wheaton Precious Metals shares rose 0.2 per cent on Monday to trade at $68.41 on the Toronto Stock Exchange.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com