Even though Vancouver City Council passed a motion to consider the idea of it becoming a ‘bitcoin-friendly city’, the province itself still has a province-wide ban on mining Bitcoin until December 2025.

Mayor Ken Sim introduced the motion to make Vancouver a bitcoin-friendly city to the council, emphasizing bitcoin’s financial benefits and highlighting the advantages of bitcoin mining. However, the motion cannot influence mining because electricity regulation and BC Hydro’s operations fall under provincial jurisdiction.

The province banned Bitcoin mining in December 2022 due to energy concerns. Conifex Timber (TSE: CFF) (OTCMRKTS: CFXTF) challenged the policy in court, but the B.C. Supreme Court ruled that the policy was reasonable and aligned with public utility regulations. BC Hydro, which is the largest utility provider in the province, uses hydroelectric power to generate over 90 per cent of its electricity.

Earlier this year, B.C.’s legislature passed an updated version of the Energy Statutes Amendment Act, which was originally drafted after B.C. Hydro temporarily suspended bitcoin mining connections to the provincial grid. The updated Act grants the provincial government authority to regulate electricity service for crypto, allowing it to bypass the BC Utilities Commission.

The proposed ban on bitcoin mining in B.C. stems from concerns over its significant energy consumption, which critics argue strains the provincial power grid and exacerbates environmental challenges. The problem is that hydroelectric sources of power tend to be among the most environmentally friendly sources as they do not contribute in any meaningful way to climate change.

Read more: Sol Strategies goes all-in on Solana and enjoys massive 2,336% stock price windfall

Read more: Will Vancouver become Canada’s first Bitcoin friendly city?

Local bitcoin bans are far from unique

Conifer Timber, which had bitcoin mining farms scheduled for connection to the grid, argued in court that these conditions were “unduly discriminatory and unreasonable.” However, a provincial judge disagreed.

During the debate over the updated Act, lawyers from the lawfirm of McCarthy Tetrault noted that the leader of the provincial Green Party argued in the legislature that Liquified Natural Gas and emerging technologies like AI should face similar energy regulations as bitcoin mining. The party views these industries as having high energy use and limited economic benefits.

Local bitcoin mining bans are not unique. New York State has imposed a moratorium, with an exception for renewable energy. However, some states, like Arkansas and Montana, have introduced bills to protect bitcoin miners from what they consider “discrimination.”

Meanwhile, the argument about whether or not Vancouver should place its faith in Bitcoin continues on.

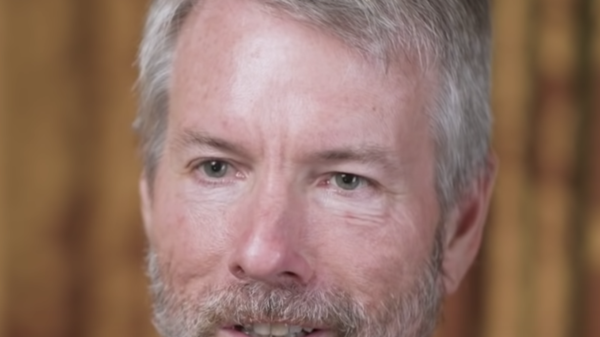

Frank Giustra, CEO of the Fiore Group, which manages private equity and companies in natural resources and entertainment, said that bitcoin has failed to prove itself as a hedge against inflation, as its value has collapsed intermittently since its inception in 2009. He argues that cryptocurrency advocates often overlook many of the risks that still exist.

“A year ago, bitcoin was trading at a third of its current value,” Giustra said. “And it has gone up and down over the years with tremendous volatility swings.”

“So, to use taxpayers’ money, I just thought it was a really a dumb idea, and I’m quite happy to say that in those words.”

.

joseph@mugglehead.com