Gold mergers and acquisitions involve companies coming together or buying assets in the gold mining industry. These deals can range from small projects to big companies joining forces.

They happen for different reasons, like increasing general efficiencies and as part of a cost reduction strategy. Typically, gold prices, political stability in mining areas and the company’s internal strategies can all affect these decisions.

Due diligence is key as in most market moves. The right business combination can strengthen a company or collapse it; help to save money or squander it away; and give investors exposure to different projects in different places, or waste their time and money. The gold market and the people that govern it, along with world events and economic factors, guide these decisions and shape the industry.

Most of 2023 was reasonably quiet for gold in terms of acquisition activity with the likely culprit being gold’s sky-high price. Then in the last few months of the year, the gold market saw a few respectable sized shake-ups.

Here are five of the year’s most noteworthy acquisitions in the gold space arranged by market valuation.

Wide angle lens shot of Newmont’s Red Chris property, acquired with Newcrest. Image via Newmont.

1. Newmont Corporation and Newcrest Mining

Market Cap: Approximately $60 billion

After months of negotiations, Newmont Corporation (TSX: NGT) (NYSE: NEM) closed a merger with Australian gold mining giant and former spinout Newcrest Mining in October.

Prior to the merger, Newmont was the largest gold mining company in the world after an earlier merger with Goldcorp. It had challengers, though. Barrick Gold (TSX: ABX) (NYSE: GOLD) vied to return to the top spot. It even made an USD$18 billion bid for a hostile takeover in 2019, which Newmont stymied. Now after this merger there’s no competition.

For context, Newcrest Mining was already in the top ten mining companies in the world before the merger went through. Now it’s added its wealth to Newmont’s.

The company’s plans include combining high-quality operations, projects, and reserves concentrated in low-risk jurisdictions. This combination includes 10 Tier 1 operations supporting decades of safe, profitable, and responsible gold and copper production.

Newmont’s aim post-merger is to generate pre-tax synergies of USD$500 million within the first two years. The company also intends to realize at least $2 billion in cash improvements through portfolio optimization in the first two years after closing. The company has paid over USD$5 billion in dividends since closing the Goldcorp transaction in 2019, and plans to continue to do that.

The team at Newmont will feature a deep bench of experienced leaders, subject matter experts, and existing regional teams in Australia and Canada with extensive mining industry experience.

Read more: Calibre Mining remains an excellent operator with ample exploration targets: Cormark Securities

Read more: Calibre Mining reports record breaking sales and increased net income in Q2

2. Pan American Silver Corp and Agnico Eagle Mines share Yamana Gold assets

Market cap(s):

CAD$7.3 billion for Pan American.

CAD $34 billion for Agnico Eagle Mines

Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) and Agnico Eagle Mines Limited (TSX: AEM) (NYSE: AEM) closed the acquisition of Yamana Gold Inc in late March.

Yamana Gold split off its Canadian assets to Agnico Eagle Mines while Pan American Silver took all of the company’s mines and properties in Latin America.

Agnico picked up the Canadian Malartic, but also ownership of the Wasamac project in the Abitibi region of Quebec. It also acquired other exploration properties throughout Ontario and Manitoba.

In the past 18 months, the company has acquired 100 percent ownership of the Canadian Malartic mine. It also collected 100 percent ownership of the Wasamac project situated in the Abitibi region of Quebec, and various exploration properties in Ontario and Manitoba.

The company anticipates its gold production in the Abitibi gold belt to be in the range of 1.9 million to 2.1 million ounces per year through 2025. Beyond that, the company also enjoys the unique capability to monetize future mill capacity at the Canadian Marlartic mine.

While nowhere near Agnico’s valuation, Pan American pulled away from the acquisition with a respectable new set of assets.

Pan American Silver’s portfolio now includes the Jacobina mining complex in Brazil, the El Peñón and Minera Florida mines in Chile, and the Cerro Moro mine in Argentina. The company has added the MARA development project in Argentina. This expansion adds some diversity to Pan American’s Latin American exposure by introducing two new jurisdictions, Brazil and Chile.

It is expected to bring a meaningful increase in silver and gold production and improve operating margins. The company anticipates the revenue increase to be in the range of USD$40 million to USD$60 million per year.

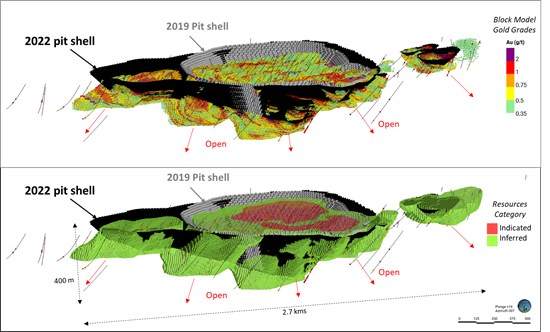

Inclined view of the Nelligan 2022 resource pit shell showing estimated blocks above 0.35 g/t. Image via IAMGOLD.

3. IAMGOLD Corporation and VanStar Resources

Market cap: $1.4 billion

In late November, the IAMGOLD Corporation (NYSE: IAG) (TSX: IMG) and Vanstar Mining Resources acquisition centered around the Nelligan deposit in Chibougamau, Quebec. Vanstar owned and operated it and IAMGOLD wanted it, and quickest and easiest way to get it, was to pick up Vanstar.

The updated mineral resource estimate for Nelligan had the indicated category at 1.97 million ounces of gold, with 75.2 million tonnes averaging 0.85 grams per tonne. The inferred category there were 3.24 million ounces of gold, with 114.1 million tonnes averaging 0.88 g/t of gold.

Previously, IAMGOLD had owned a 75 per cent stake and an earn in option in the Nelligan operation.

“This transaction consolidates our interests in the highly prospective Nelligan deposit while building our exploration portfolio within Northern Quebec,” said Renaud Adams, president and chief executive officer of Iamgold.

“Our exploration efforts at Nelligan to date, in partnership with Vanstar, have shown the potential for further resource expansion, which we will continue to advance.”

IAMGOLD and Vanstar also recently released the results of their combined summer drilling campaign.

According to Vanstar CEO J.C. St-Amour, the outcomes of the summer drilling initiative continue to underscore the Nelligan deposit’s potential for expansion.

Valentine Property banner from Marathon Gold.

4. Calibre Mining Corp. and Marathon Gold

Market cap: $579 million

In November, Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF) and Marathon Gold Corp. (TSX: MOZ) closed a business combination to create a mid-tier gold producer projected to achieve high margin and high growth status. Its estimated average annual production ranges around 500,000 ounces from 2025 to 2026.

According to the agreement, the ownership of the combined company skews in Calibre’s favour by 66 per cent, with the remainder taken up by Marathon. Marathon does, however, get to nominate one board member to Calibre’s board.

Calibre purchased 66.6 million Marathon shares at a price of CAD$0.60 per share, resulting in proceeds of CAD$40 million. This acquisition provides Calibre with a 14.2 percent equity stake in Marathon.

Before the merger, Calibre had strong production numbers in both of its Nicaragua and Nevada based operations, pulling in record setting year-to-date gold sales of 208,020 ounces for $410.1 million total revenue, at an average price of $1,932 per ounce. This amounted to 208,011 total ounces pulled from the ground with the extra nine coming from previous years.

The acquisition of Marathon Gold will change all of that.

The Valentine Gold mine in Newfoundland is anticipated to become the largest in Atlantic Canada. It consists of 20 kilometers of mineralized deposits. It also means the addition of an average annual production of 195,000 ounces at all in sustaining costs of USD$1,007 per ounce in the first 12 years of production starting in 2025.

Additionally, this acquisition represents a substantial combined mineral endowment. It includes over 4.0 million ounces of mineral reserves, 8.6 million ounces of measured and indicated mineral resources, and 4.0 million ounces of inferred mineral resources.

Read more: Calibre Mining reports record year-to-date earnings in Q3 financials

5. Nighthawk Gold Corp. and Moneta Gold Inc.

Market cap: $47 million

In late November, Nighthawk Gold Corp. (TSX: NHK) (OTCQX: MIMZF) and Moneta Gold Inc. agreed to an at-market merger

The company raised approximately CAD$12.5 million by selling 36 million subscription receipts to underwriters on a “bought deal” basis. The money will be used by the new company to fund its exploration and development efforts at the Tower Gold Project in Ontario and Colomac Gold Project in the Northwest Territories.

The merger aims to create a stronger Canadian gold developer, combining two large-scale Canadian gold projects with robust project economics. The new company boasts 7.8M gold ounces indicated and 10M gold ounces inferred in mineral resources.

The Tower Gold Project’s preliminary economic assessment (PEA) outlines economics of a CAD$1.1-billion after-tax net present value (NPV) at a 5-per cent discount rate and a 32-per cent after-tax internal rate of return (IRR), based on a USD$1,600 per ounce gold price.

It anticipates an average potential production profile of 261,000 ounces per year over the first 11 operating years. Similarly, the Colomac Gold Project’s PEA outlines economics of a $1.2-billion NPV (at a 5-per cent discount) and a 35-per cent IRR, based on the same gold price assumption, with an average potential production profile of 290,000 ounces per year over its 11.2-year life of mine.

The merger brings potential advantages such as the ability to unlock general and administrative and operational efficiencies with seasonal workflow sequencing and staggered and phased project development. The management team plans to leverage cross-project experiences for collaborative studies advancement, permitting, and project derisking.

.

Calibre Mining is a sponsor of Mugglehead news coverage

.