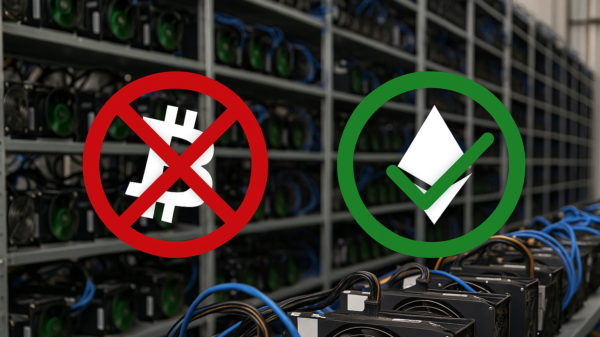

Originally, Ethereum used the same consensus mechanism as Bitcoin. It’s called Proof of Work and it involves entire data centres of servers working on ridiculously hard math problems and gobbling up lots of computing power with the winner taking home the block reward, or a number of cryptocurrency. Bitcoin’s network uses up enough energy to power the entire country of Argentina, while Ethereum in a distant second place, only used up 112 terawatt-hours, or more power than Pakistan uses in a year.

The mechanism also poses considerable scaling issues, which for Ethereum meant network congestion, which drove up fees and slowed down processing rates. This pushed smaller developers out as the network became too expensive for smaller transactions and not worth it in terms of scaling for larger ones.

Staking (or Proof-of-Stake) changes that.

It requires ‘validators’ to put in coins or tokens they own to be chosen to approve transactions and earn a reward. The probability of getting the reward increases with the amount staked, but all staked ether will earn interest, which makes staking relative to buying shares or bonds without the overhead.

Here are three companies set to benefit from the merge.

Hive Blockchain came prepared for the Ethereum merge

Hive Blockchain Technologies (TSXV:HIVE) has been mining coins with its GPUs for literal months in an attempt to get out in front of the merge, and has implemented beta testing prior to the merge. The idea here is the company with the most ethereum pre-mined and ready for staking will enjoy extremely high performance when staking goes live.

The beta testing consisted of a strategy to optimize the hash rate economics of Hive’s 6.5 terahash mining capacity before Ethereum’s transitioned to proof of stake across various other GPU minable coins.

Prior to the merge, the company employed the idea that the competitive landscape for GPU miners where the most efficient equipment in terms of energy usage per coin generated would win. Towards this end, the company’s data centre and crypto mining facility in Boden, Sweden, was one of the world’s largest sites devoted entirely to mining Ethereum, with power fixed at U.S. pennies per kilowatt hour.

The total energy capacity is approximately 21.5 megawatts or 16 per cent of the company’s total portfolio of 130 megawatts of green energy (from both hydro and geothermal sources) data centre capacity. Now specifically, of these 21.5 megawatts, approximately 14.8 are from legacy GPU cards (usually AMD Radeon RX580 cards), which have been online since 2018. If converted to ASIC mining using newer generation ASICS, the company would be able to pull in between 400 to 440 extra petahashes per second in Bitcoin mining in these 14.8 megawatts of capacity.

“The company’s production of ETH from GPU mining (including selective optimizations of GPU hash rate) has yielded a total ETH production of 3,010 ETH. In August, we produced an average of 16.7 bitcoin equivalent per day, comprised of approximately 9.4 BTC per day, and our ethereum production of approximately 97 ethereum per day. We are pleased to note that as of today, we are producing over nine BTC, even with last week’s bitcoin difficulty increase of almost 10 per cent,” said Frank Holmes, executive chairman of Hive.

That’s the tradeoff. The wattage being saved for no longer needing to actively mine Ethereum will be transitioned over to Bitcoin mining. The cards no longer being used to mine Ethereum can be repurposed for cloud computing and AI applications and rendering of engineering applications, as well as scientific modelling of fluid dynamics.

Hive already has a test pilot project for cloud computing at a Tier 3 data centre, where it will be using a portion of its A40 GPU cards for cloud computing.

3iQ Digital Asset Management and ethereum 2.0 dissenters

Not everyone is on board with the merge. There are some individuals and companies that prefer the old way of doing things. They think the new merge will somehow make ethereum more centralized and therefore vulnerable to attack, while others don’t want to lose their proof-of-work cash cow.

One company, 3iQ Digital Asset Management is taking proactive measures on behalf of investors in case there’s at least one hard fork of the Ethereum protocol, which may end up producing new tokens.

Founded in 2012, 3iQ is a digital asset investment fund manager with over CAD$700 million assets under management. It was also the first to offer a public bitcoin investment fund, called The Bitcoin Fund (TSX:QBTC) and a public ether investment fund, The Ether Fund (TSX:QETH.UN), and most recently it launched the 3iQ CoinShares Bitcoin ETF (TSX:BTCQ) and the 3iQ CoinShares Ethereum ETF (TSX:ETHQ).

Now it’s waiting to see what else is going to come of this ethereum upgrading. Ethereum’s proof-of-work Mainnet merge with the Beacon Chain proof-of-stake system could go two ways. The first would be finding a new PoW blockchain in support of existing mining hardware, and the second would be to reject the upgrade entirely and continue to mine Ethereum under the previous consensus mechanism, thereby creating an entirely new blockchain.

If miners opted for the entirely new blockchain, a hard fork (or chain split) would happen that would produce a post-Merge Ethereum PoS blockchain and new versions of Ethereum would keep working on a PoW consensus mechanism. The result would be two different blockchain networks with tow different native tokens—Ethereum and some other Ethereum-based proof of work token.

Naturally 3iQ has no intention to stop trading QETH and ETHQ and other products involved in ETH exposure, but it does have plans in place to get involved in any potential new assets.

“3iQ will always put our investors and shareholders’ best interests first. Our best-in-class team will continue to evaluate all aspects of the Merge and potential hard forking of Ethereum blockchain. We will regularly update investors and continue to examine all possible avenues to maximize unit holder accretion while maintaining our Funds’ investment objectives,” said Fred Pye, chairman and CEO of 3iQ.

Coinbase is already offering staking

Coinbase (NASDAQ:COIN) is one of the biggest cryptocurrency trading companies in the world, and its set to benefit considerably from the Ethereum merge. This is because the company has a much larger market share of ether assets (15 per cent) than the 7 per cent share it has of the otherall crypto ecosystem, putting itself in a much better staking position going forward.

The company also expanded its staking offerings with ETH at the beginning of August, giving potential clients the option of going with a reputable company with strong security for their staking requirements. After all, the Ethereum blockchain rewards stakers that keep their coins involved in the process, and punish those that don’t, like those who prefer to have downtime. That’s what Coinbase offers—a safe place to stake where someone can get results while minizing risk.

The company anticipates its incremental annual staking revenue from the merge will be USD$650 million assuming an Ethereum price remains stable at $2K with a 5 per cent ETH staking yield.

Read more: The Mugglehead technology roundup: crypto in the snow edition.

Read more: Hive Blockchain numbers aren’t chilly during the crypto winter

Read More: The Mugglehead technology roundup: surviving the crypto-winter edition