Teck Resources Ltd. (TSE: TECK.B) (TSE: TECK.A) (NYSE: TECK) announced late Tuesday it will defer approving major growth projects until the Quebrada Blanca Phase 2 (QB2) copper mine in Chile achieves steady operations and target output.

The decision forms part of a comprehensive companywide operations review. Teck began the review in August to improve performance across its portfolio, and it expects to conclude the process by October. The company will publish updated guidance alongside its third-quarter results.

RBC Capital Markets analyst Sam Crittenden predicted a negative market reaction in a Wednesday note to clients. He maintained a USD$67 price target on Toronto-listed shares with an “Outperform” rating.

“We expect a negative reaction to Teck’s operations review and management changes,” Crittenden said. “While these changes could ultimately lead to better operational performance, they create uncertainty until the October guidance update.”

As part of the review, Teck appointed senior vice presidents of operations for Latin America and North America. Both executives will report directly to CEO Jonathan Price.

The company also engaged a “respected industry leader” with over three decades of experience, including work in Chile, to serve as senior adviser to the CEO and the QB team.

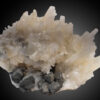

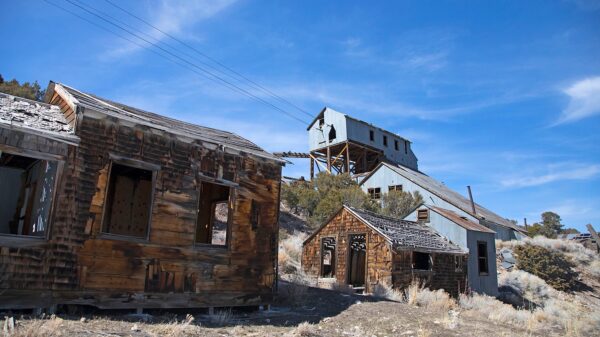

QB2 has proven critical to Teck’s strategic shift from coal to metals essential for the energy transition. Located high in the Andes, the mine began producing in 2023 and represents one of the largest new copper developments globally.

Teck owns a 60 per cent stake, Japan’s Sumitomo Corp. owns 30 per cent, and Chile’s government, via state-owned Codelco, owns 10 per cent. Additionally, the mine’s success is central to Teck’s future growth, yet it has struggled with delays and cost overruns.

Read more :Teck Resources expands copper project in Kamloops

Read more: First Quantum monetizes gold by-product in major streaming pact with Royal Gold

Supply disruptions and accidents have tightened the market

The project ran USD$4 billion over budget and several years behind schedule. In July, CEO Price cut 2025 production guidance for QB2 and the company overall. The annual production forecast for QB2 now sits at 210,000 to 230,000 tonnes, down from an earlier range of 230,000 to 270,000 tonnes. Analysts warn that tailings issues may linger into 2026 and that uncertainty remains around achieving a long-term production run rate of 300,000 tonnes.

Tailings storage has become QB2’s main challenge. The company must raise the tailings dam wall and improve water drainage to ensure safe, environmentally compliant storage. Significant work throughout 2025 has focused on accelerating water removal, but further progress is required to meet design targets. Additionally, the mine has faced ship-loader damage and pit instability, further complicating operations.

Despite setbacks, global copper prices have remained supportive. Supply disruptions at Ivanhoe Mines’ (TSE: IVN) (OTCMKTS: IVPAF) DRC mine and a fatal accident at Codelco’s largest mine in Chile have tightened the market. Copper hit a five-month high in London on Wednesday, partly reflecting these production challenges.

Teck is also exploring shared infrastructure between QB2 and the nearby Collahuasi mine. AngloGold Ashanti PLC‘s (NYSE: AU) (FRA: HT3) and Glencore plc (LON: GLEN) each hold a 44 per cent stake in Collahuasi. Leveraging existing infrastructure could help reduce costs and improve operational efficiency.

In the near term, Teck aims to “enable unconstrained production” at QB2. The company emphasizes tailings management as the highest priority, while also monitoring pit stability and operational equipment reliability. Furthermore, the operations review seeks to identify improvements across Teck’s portfolio, with the goal of enhancing performance companywide.

.

joseph@mugglehead.com