Toronto-based Sol Strategies (CNSX: HODL) took a substantial step towards helping expand institutional adoption of the Solana blockchain.

The company announced on Tuesday that it was chosen as the staking provider for 3iQ Corp’s Solana Staking ETF.

Sol Strategies, formerly Cypherpunk Holdings, invests in staking rewards, Solana-based projects, and blockchain infrastructure. In comparison, 3iQ is a global digital asset investment manager with USD$1 billion in assets.

3iQ submitted prospectuses late January to list the 3iQ Solana Staking ETF and the 3iQ XRP ETF on the TSX. If approved, these ETFs will be the first to offer exposure to Solana and XRP.

“Sol Strategies’ institutional-grade infrastructure and proven track record in this ecosystem made them the clear choice,” Pascal St-Jean, CEO and president at 3iQ.

This move responds to growing interest in financial products that give investors exposure to tokens beyond Bitcoin and Ethereum. Furthermore, President Donald Trump’s broad embrace of the crypto industry and pledge to reform the regulatory landscape largely drive this trend.

The U.S. Securities and Exchange Commission started soliciting public comments on a proposal to list and trade the Grayscale Solana Trust, converting it into an exchange-traded product. Meanwhile, Bloomberg analysts estimate that spot Solana ETFs have a 70 per cent chance of approval this year.

Read more: Gold backed stablecoins along for the ride as gold soars to all new highs

Read more: Why do cryptocurrency exchanges fail?

Asset’s ecosystem services multiple sectors

Solana is a high-performance blockchain platform that provides fast, secure, and scalable decentralized applications (dApps) and crypto-currencies. It operates using a consensus mechanism called Proof of History (PoH). It timestamps transactions to increase throughput and reduce latency. This approach allows Solana to process thousands of transactions per second (TPS).

Additionally, Solana’s low transaction fees and high scalability attracts developers and businesses to build decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and various other dApps.

The asset’s ecosystem also includes a variety of projects across sectors such as gaming, finance, and NFTs.

Further, Sol Strategies and its subsidiaries held 189,968 SOL, acquired at an average price of USD$179 per unit.

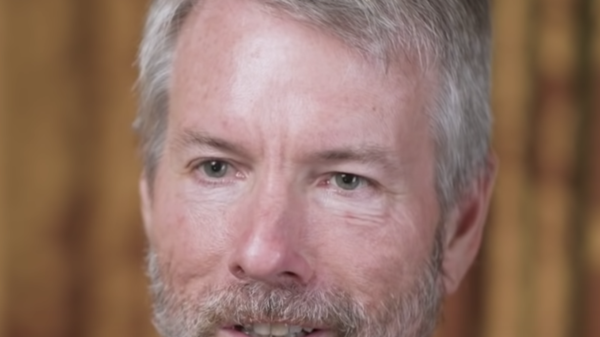

“Being selected as 3iQ’s staking partner validates our infrastructure and demonstrates the growing demand for regulated staking solutions,” said Sol Strategies CEO Leah Wald.

“This partnership represents a pivotal moment for institutional Solana staking, allowing traditional investors to access staking rewards through a regulated investment vehicle.”

The company’s stock surged over 2,000 per cent last year and now trades over-the-counter in the U.S., with plans to list on the Nasdaq.