A study published in the Journal of International Financial Markets, Institutions & Money analyzed data from 845 cryptocurrency exchanges to determine why nearly half of these exchanges have collapsed since 2014, and tried to determine how to predict these outcomes.

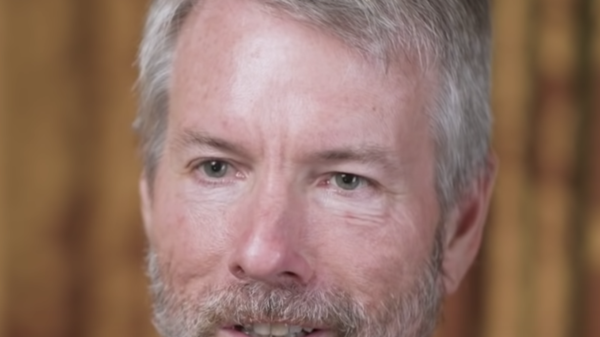

Announced on Friday, Assistant Professor Niranjan Sapkota from the University of Vaasa in Finland, identifies several indicators that lead to the collapse of exchanges. These include items like transparency, centralization, territorial access, fee structures, coin listings, referral schemes.

Centralized exchanges in well-regulated countries like the United States and Singapore often seem the safest, but a study reveals their surprising fragility. Stringent regulations, high compliance costs, and advanced infrastructures create vulnerabilities that fraudsters can exploit for illicit activities. In contrast, developing nations, where policymakers continue debating cryptocurrency adoption, face fewer such risks.

Sapkota notes that exchanges allowing U.S. customers to trade have a higher probability of default than those restricting U.S. clients. Overall, centralized exchanges, which control wallet custody like traditional banks manage accounts, face a greater default risk than decentralized exchanges (DEXs), where users retain self-custody and transact directly on the blockchain.

DEXs have a 31.2 per cent lower probability of failure than centralized platforms because their distributed structure reduces risks related to fraud, operational mismanagement, and liquidity crises. The study finds that high withdrawal fees often indicate financial instability, as defaulted exchanges charged withdrawal fees averaging 1.5 times higher than those that remained operational.

Read more: Hive Digital Technologies inks LOI to buy Paraguay Bitcoin mining facility from Bitfarms

Read more: President Trump and First Lady launch matching crypto

Exchanges with referral incentives less likely to fail

Exchanges that offer a wide variety of cryptocurrencies and maintain high user ratings have a greater chance of survival. A diverse cryptocurrency selection attracts a larger user base and generates steady revenue streams, while high user ratings typically indicate strong operational practices.

The study also stated that exchanges that offer referral incentives are less likely to fail.

“So, next time a friend shares a legitimate crypto exchange referral link, don’t dismiss it as mere bonus hunting,” said Sapkota.

This research fills a critical knowledge gap in cryptocurrency exchange risk, providing the insights needed to navigate the market with greater confidence and implement actionable solutions for more secure blockchain-based digital asset trading platforms.

“Policy makers can leverage these findings to design policies that protect users and strengthen market stability,” said Sapkota.

“Investors and traders can learn to spot critical red flags—such as poor ratings, excessive withdrawal fees, limited coin offerings, centralized exchanges, and U.S. client access—to avoid unreliable platforms and safeguard investments.”

The study demonstrates the effectiveness of traditional statistical methods, such as logit and probit models, in predicting cryptocurrency exchange bankruptcies with approximately 81 per cent accuracy.

The history of cryptocurrency and Bitcoin in particular is absolutely fraught with failed exchanges. Some fail for legitimate reasons, others fail because they’re staffed by people who are either incompetent or evil people, and some find themselves on the business end of a cryptocurrency unfriendly regulatory regime.

Read more: Bit Digital inks new deal to bring GPU firepower, and bumps $15M in revenue

Read more: Donald Trump pardons facilitator of dark web marketplace Silk Road

Crypto’s history is filled with failure

QuadrigaCX is probably the most well-known. It was a Vancouver-based exchange that collapsed in early 2019, leaving customers unable to access approximately CAD$190 million in crypto. Operating with minimal oversight, the exchange’s downfall exposed the dangers of unregulated markets.

Founder Gerald Cotten, who allegedly controlled all customer funds, reportedly died under mysterious circumstances in India, taking the exchange’s private keys with him. Investigations later revealed that Cotten had been running a Ponzi scheme, using customer deposits to fund his lavish lifestyle. QuadrigaCX remains one of the most infamous cautionary tales about the need for regulatory safeguards in the crypto industry.

FTX is what happens when managerial incompetence meets an unfriendly regulatory regime.

It was once a leading global exchange but it filed for bankruptcy in November 2022 due to financial mismanagement, regulatory scrutiny, and allegations of fraud. While its collapse primarily stemmed from misusing customer funds and risky trading strategies, the intense regulatory landscape also played a role.

FTX had to navigate complex global compliance requirements, which combined with its internal instability, made the situation worse. The high cost of compliance and regulatory uncertainty in major markets like the U.S. contributed to its failure.

Bittrex was a long-standing U.S.-based exchange before it shut down its American operations in April 2023, citing an “uncertain regulatory environment” as a key factor.

The SEC later charged Bittrex with operating as an unregistered securities exchange, adding further financial and legal strain. While Bittrex continued operating internationally for some time, its U.S. exit showed how excessive regulatory burdens can push exchanges out of well-established markets, reducing options for users and driving crypto activity to less transparent jurisdictions.

tom murdock

May 31, 2025 at 1:32 pm

That’s why automated trading bots appeal to me. They provide measurable results and eliminate the guesswork. When you’re talking about maximizing profit, it’s about optimizing your win/loss ratio and managing drawdowns. https://binancebot.io emphasizes metrics like Sharpe & Sortino Ratios, which are crucial for evaluating risk-adjusted returns, and offers insights into how their bots aim to limit maximum drawdown, a key risk management indicator, ensuring that your capital is protected while still pursuing gains.