Riot Platforms, Inc. (NASDAQ: RIOT) picked up another 14 per cent stake in Bitfarms Ltd (NASDAQ: BITF) (TSX: BITF) in its ongoing bid to merge the two companies.

The company’s ongoing efforts to combine with Bitfarms has run into some unexpected resistance over the past month due to a peculiar clause in the acquisition agreement called a “poison pill.”

A poison pill is a defensive strategy used by a company to deter or prevent hostile takeovers.

It involves the issuance of new shares or securities to existing shareholders or rights holders, usually at a discount, if a hostile takeover bid reaches a certain threshold. This dilutes the value of the company’s stock making the takeover more expensive and less attractive to the acquirer.

Bitfarms may be using a form of poison pill strategy to make a potential takeover by Riot Platforms more difficult and costly.

Consequently, Riot Platforms intends to requisition a special meeting of Bitfarms’ shareholders to nominate independent directors to the board, citing concerns over corporate governance.

Riot also aims to influence Bitfarms’ strategic direction and governance standards.

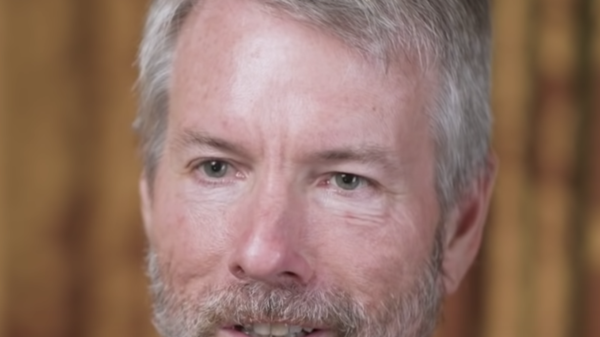

“We have attempted to privately engage with the Bitfarms Board and recently sent two letters urging constructive collaboration with us around the addition of at least two new directors who are fully independent of Bitfarms and Riot,” said Jason Les, CEO of Riot.

Instead of engaging with us privately and in good faith, Bitfarms has responded by implementing an off-market Poison Pill with a trigger well below the customary 20 per cent threshold.”

Read more: Genesis Global to repay $2B to defrauded crypto investors in New York

Read more: Cryptocurrency political action committee throws hat (and money) into the ring

Riot CEO criticizes Bitfarms board

Les criticized Bitfarms’ board for its entrenchment and disregard for shareholders’ perspectives, noting the recent ousting of co-founder Emiliano Grodzki. He urged the board to remove Chairman and interim CEO Nicolas Bonta, who has led the board since 2018. Les blames him for his company’s poor governance practices. Les pledged to keep pushing to address Bitfarms’ governance issues and ensure shareholders have a say in the company’s future.

It would establish the leading and largest Bitcoin miner globally, with about 1 gigawatt (GW) of current power capacity and 19.6 exahashes per second (EH/s) of self-mining capacity, projected to increase to up to 1.5 GW of power capacity and 52 EH/s of self-mining capacity by the end of the year.

Riot anticipates that this scale will significantly surpass that of any other publicly listed Bitcoin mining company globally.

The merger aligns well with Bitfarms’ vertically-integrated business model and is expected to generate substantial strategic and financial benefits for shareholders of both entities. Riot Platforms sees the proposed combination with Bitfarms Ltd. as highly advantageous for shareholders of both companies.

Additionally, the combined company would have 15 facilities spread across the United States, Canada, Paraguay, and Argentina, with a total power capacity of up to 2.2 GW when fully developed.

Riot has strong financials, including negligible negligible corporate debt and more than USD$700 million in cash on hand as of April 30, 2024—approximately 10 times greater than Bitfarms. It will be able to finance Bitfarms’ growth strategies.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com