The bankrupt cryptocurrency lender Genesis Global has been ordered to repay USD$2 billion to hundreds of thousands of investors across the United States who were defrauded by the company.

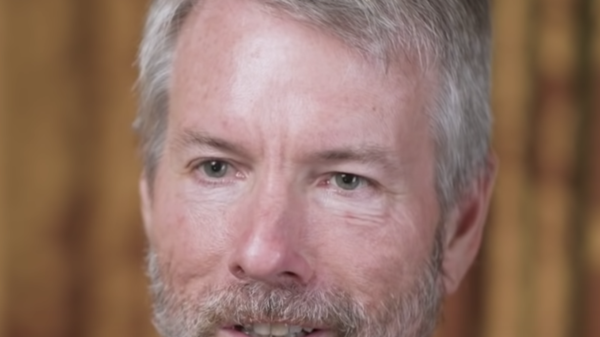

Letitia James, the attorney general of New York, is spearheading this initiative. Announced on Tuesday, the settlement arrived at the behest of allegations that Genesis had been involved in defrauding at least 29,000 New Yorkers, who had dropped over USD$1.1 billion using Genesis’ Gemini Earn Scheme.

The falling prices and collapse of FTX caused major problems in the industry, forcing Genesis to file for Chapter 11 bankruptcy protection early last year. A court approved Genesis’s Chapter 11 repayment plan, which included a settlement with the New York Attorney General’s office.

The court also dismissed a legal challenge from Digital Currency Group (DCG), Genesis’s parent company. This ruling allows Genesis to finally return customer assets that it has frozen on its platform since November 2022, following the collapse of other major crypto companies.

“This historic settlement is a major step towards ensuring the victims who invested in Genesis have a semblance of justice,” said James. “Once again, we see the real-world consequences and detrimental losses that can happen because of a lack of oversight and regulation within the cryptocurrency industry.”

Genesis did not address the allegations in the lawsuit (neither admitted nor denied them). However, the settlement prohibits them from operating in New York.

Read more: Cryptocurrency political action committee throws hat (and money) into the ring

Read more: Jack Dorsey reveals next generation Bitcoin mining chip

Genesis settlement establishes a Victims’ Fund

Digital Currency Group (DCG), initially included in the lawsuit but excluded from the settlement, had previously objected to the process. In February, they argued that Genesis’s proposed settlement unfairly favoured certain creditors and violated U.S. bankruptcy law.

Earlier this week, a court-approved plan from Genesis detailed the return of USD$3 billion in customer assets, representing approximately 77 per cent of what is owed.

The settlement also establishes a Victims’ Fund. This fund will receive up to $2 billion from Genesis’s remaining assets after the initial payouts to creditors. This money will compensate creditors for any remaining losses.

Attorney General James has been one of the key forces in the initiative to tame the wild west that is the cryptocurrency space.

Some of James’ biggest wins include the who’s who of the cryptocurrency world. These include acquiring USD$22 million from cryptocurrency exchange, KuCoin, for failing to register as a securities and commodities broker-dealer and falsely representing itself as a crypto exchange.

Additionally, in In May 2023, she secured USD$4.3 million from Coin Cafe for failing to register as a commodity broker-dealer and defrauding investors. In January 2023, Attorney General James, along with a multi-state coalition, recovered $24 million from the cryptocurrency platform Nexo for operating illegally.

She also sued the former CEO of Celsius for defrauding investors and concealing the company’s dire financial condition. In March 2022, Attorney General James issued a taxpayer notice to virtual currency investors and their tax advisors to accurately declare and pay taxes on their virtual investments.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com