With more in-person activities happening, cannabis is less popular than during lockdowns and market sales are returning to pre-pandemic levels, according to Headset.

The cannabis data firm released a report this week looking at fluctuations in America’s legal cannabis market, comparing pre-pandemic sales to sales during the last two years of the pandemic. It looked at sales growth in California, Colorado, Nevada, Oregon and Washington and used the data from point-of-sale systems that are linked to the company’s business intelligence software.

The firm found that growth through 2020 in all markets was mainly due to lockdowns and stimulus cheques, which created both increased demand and disposable income.

But as more in-person activities happen and less disposable income is available, people are less interested in buying weed, given they are unable to consume it indoors or at public events.

“While it does seem like sales trends in 2021 are slowing down, the data above shows that sales patterns are returning to pre-pandemic stability in legacy markets as more things return to normal in our day-to-day,” reads the report.

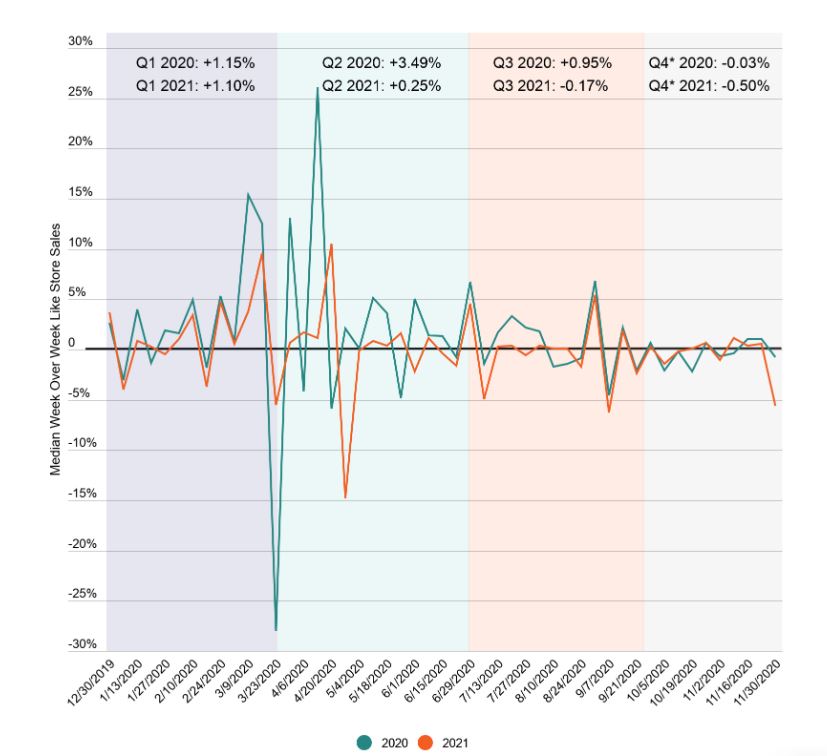

Last year, sales grew over 30 per cent annually. This year sales slowed during the summer and fall. Chart via Headset

Gains in 2020 were heavily influenced by increased sales consumers that were already in the cannabis market, rather than new customers being driven into the space, reads the report.

In the early pandemic, there were wild swings in sales related to shutdowns and panic buying. The firm says last year’s growth was unlikely to be sustained as it was due to abnormal circumstances imposed by the pandemic that led to more at-home activities.

Read more: Mature US state medical cannabis markets stabilize at 10–20% of total sales: Headset

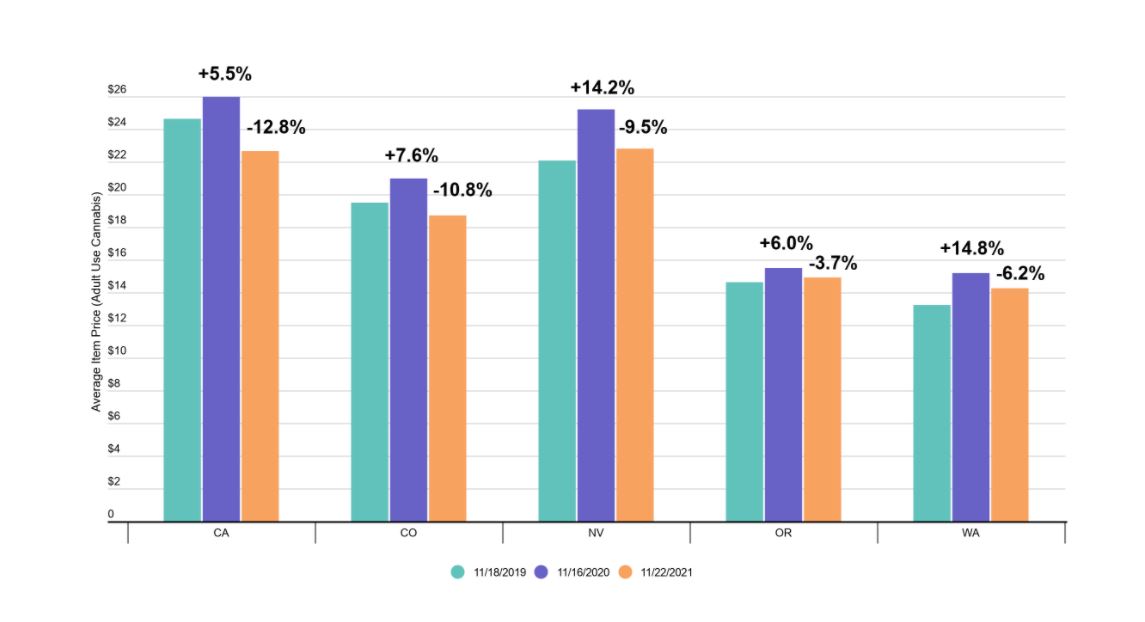

Graph via Headset

The firm also found that while prices rose through the start of the pandemic, they fell through 2021 because people were not buying as much weed.

In some markets, like Nevada, Oregon and Washington, the firm found that prices remained above pre-pandemic levels, but in Colorado and California prices are well below.

These differences are due to a competitive and saturated market, such as in California, where there’s a constant issuing of licences putting pressure on retailers, as well as medical-only licences shifting to a hybrid model that further increases competition.

“The Covid pandemic led to increased consumption levels in consumers in the cannabis enthusiast segment. This has stabilized to pre-pandemic levels and we expect sales to rebound into spring 2022.”

Read more: Cannabis flower likely to remain dominant consumer choice: Headset

Read more: Headset ups 2021 US pot market prediction to top $30B

Follow Natalia Buendia Calvillo on Twitter

natalia@mugglehead.com