OceanaGold (TSX: OGC) announced results today from its 2022 resource conversion programs at Wharekirauponga in New Zealand, Haile in the United States and the resource growth program at Didipio in the Philippines.

The drilling to date has further defined only a portion of the East Graben Vein Zone, which is still open in multiple directions. The company has also been doing some follow-up drilling on two open parallel veins.

Furthermore, the exploration are Haile focused on conversion and expansion of the Palomino resource, with the aim being the enabling of resource growth and profitable mine life extension.

Accordingly, at Didipio, the company discovered two new mineralized structures outside the existing resource, which signals potential upside to its present mine plan and is one that the company intends to explore in 2023.

“Our 2022 drill programs delivered strong results, supporting our focus on creating value through near-mine resource conversion and growth. At Wharekirauponga, conversion drilling continues to define outstanding intercepts within the high-grade East Graben Vein Zone,” said Gerard Bond, president and CEO of OceanaGold.

Resource conversion and growth program highlights

Waihi, Wharekirauponga resource conversion drilling (estimated true width):

- 73.4 g/t Au and 133.0 g/t Ag over 12.9 m from 448.7 m, East Graben (“EG”) Vein, (WKP109)

- 52.8 g/t Au and 136.2 g/t Ag over 11.8 m from 445.7 m, EG Vein Zone, (WKP115)

- 44.4 g/t Au and 97.8 g/t Ag over 9.8 m from 488.8 m, EG Vein, (WKP107A)

- 17.7 g/t Au and 38.4 g/t Ag over 10.5 m from 405.3 m, EG Hanging Wall Splay, (WKP112)

- 25.9 g/t Au and 42.9 g/t Ag over 5.2 m from 354 m, EG Hanging Wall Splay (WKP116)

Haile, Palomino resource conversion and expansion drilling (downhole length):

- 6.83 g/t Au over 100.6 m from 410.2 m (DDH1121)

- 5.43 g/t Au over 73.2 m from 395.1 m (DDH1142)

- 4.46 g/t Au over 83.1 m from 349.2 m (DDH1119)

- 4.60 g/t Au over 61.7 m from 421.5 m (DDH1125)

Didipio underground resource growth drilling (downhole length):

- 1.90 g/t AuEq (0.87 g/t Au and 0.74% Cu) over 54.3 m from 4.7 m (RDUG449)

- 2.83 g/t AuEq (1.27 g/t Au and 1.12% Cu) over 40.4 m from 3.6 m (RDUG450)

- 3.74 g/t AuEq (1.91 g/t Au and 1.32% Cu) over 30.0 m from 4.0 m (RDUG453)

Read more: Metalla Royalty inks royalty deal with Barrick Gold for Argentina mining

Read more: Calibre Mining high-grade gold drill positive results to continue at Panteon North, say analysts

Gold and silver system found north of Waihi gold mine

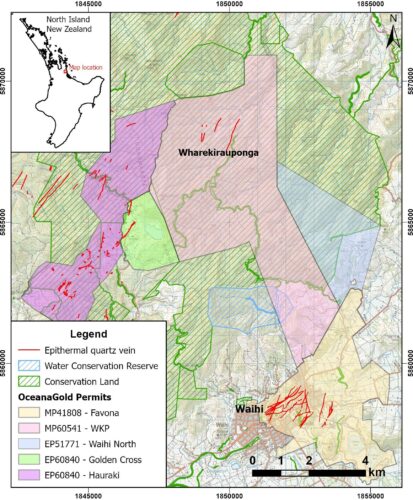

Location Map showing Waihi Gold Mine and Wharekirauponga Deposit. Image via OceanaGold.

The Wharekirauponga low sulphidation epithermal gold and silver vein system can be found 10 kilometres north of OceanaGold’s Waihi gold mine. Accordingly, the system hosts an existing indicated resource of 1.6 million tonnes at 13.5 g/t Au, and 26.6 grams g/t Ag for 0.64 million ounces of gold and 1.26 million ounces of silver in the East Graben Vein.

Additionally, the inferred resources add up to 2.3 million tonnes at grade of 9.4 g/t Au and 21.8 g/t Ag for 0.70 million ounces of gold and 1.62 million ounces of silver. Additionally, this includes the 80 per cent of the inferred resource contained within the East Graben and two footwall veins.

Also, the company drilled 5,829 meters into the Wharekirauponga since its March 2022 mineral resource estimate. The aim here was resource conversion from the EG Vein Zone in addition to 679 meters in support of geohydrological and geotechnical studies. Consequently, the results meet expectations and the company hopes they will be enough to increase confidence in the geological and grade continuity of the deposit.

Long Section on the EG Vein Geology and Gram x Meter Drill Intercepts. Image via: OceanaGold

The best overall intersections from the EG Vein include:

- 73.4 g/t Au and 133.0 g/t Ag over 12.9 m from 448.7 m, EG Vein, (WKP109)

- 52.8 g/t Au and 136.2 g/t Ag over 11.8 m from 445.7 m, EG Vein Zone, (WKP115)

- 44.4 g/t Au and 97.8 g/t Ag over 9.8 m from 488.8 m, EG Vein, (WKP107A)

- 17.7 g/t Au and 38.4 g/t Ag over 10.5 m from 405.3 m, EG Hanging Wall Splay, (WKP112)

- 25.9 g/t Au and 42.9 g/t Ag over 5.2 m from 354 m, EG Hanging Wall Splay (WKP116)

Exploration pipeline at Haile is in various stages of development

The company defined a pipeline of underground gold hosted in sediment, and exploration opportunities including Horseshoe, Horseshoe Extension and Palomino. These all bear structural settings across a strike length of 800 meters. These exploration targets are now in various stages of development from reserves and current underground development at Horseshoe, indicated and inferred resources at Palomino, and resource definition at Horseshoe Extension.

Long Section for the Palomino underground showing geology and drill holes completed to date (pre-2022 and 2022 with drill hole identification. Image via OceanaGold.

Altogether, the Palomino resource has an indicated resource of 2.3 million tonnes grading 2.79 g/t Au for 0.20 million ounces of gold and an inferred resource of 3.6 million tonnes at a grade of 2.3 g/t Au for 0.26 million ounces of gold, based on the 2021 program consisting of 7,046 meters in 16 holes.

The company dug a further 9,977 meters in 20 holes in 2022, focusing on converting the remaining inferred resource to indicated. It did this to support an internal economic analysis and updated resource estimate, which will be released March 31, 2023.

Selected intersects:

- 6.83 g/t Au over 100.6 m from 410.2 m (DDH1121)

- 5.43 g/t Au over 73.2 m from 395.1 m (DDH1142)

- 4.46 g/t Au over 83.1 m from 349.2 m (DDH1119)

- 4.60 g/t Au over 61.7 m from 421.5 m (DDH1125)

The mineralization at Palomino resembles the Horseshoe deposit with wide zones of gold mineralisation hosted by pyritic and silicified siltstone and intrusive rocks at the meta-volcanic and meta-sedimentary contact.

Calibre Mining brings high grade intercepts

Calibre Mining (TSX: CXB) (OTCQX: CXBMF) is another company with high grade intercepts, but this time from its mining operations in Panteon North operations within the Limon Mine Complex in Nicaragua.

Highlights from the company’s most recent drill results in the Limon Mine Complex include:

- 17.80 g/t Au over 7.9m (LIM-22-4694)

- 13.14 g/t Au over 8.4 m (LIM-22-4659)

- 12.30 g/t Au over 4.4 m (LIM-22-4672)

- 15.18 g/t Au over 2.9 m (LIM-22-4671)

- 12.85 g/t Au over 10.6 m including 22.47 g/t Au over 4.9 m (LIM-22-4691)

Follow Joseph Morton on Twitter

joseph@mugglehead.com