Metalla Royalty and Streaming (NYSE: MTA) (TSXV: MTA) inked a royalty purchase agreement with an arm’s length third party for a 2.5 per cent to 3.75 per cent gross value return royalty on gold and silver, with a 0.25 per cent to 3 per cent non smelter return (NSR) on copper and other non-previous minerals from the Lama project owned by Barrick Gold (NYSE: GOLD) (TSX: ABX).

The total cost will be USD$7.5 million in shares and cash. The Lama project is one of the largest gold deposits in the world and Barrick gold is presently considering it as a standalone operation.

“Our royalty will provide Metalla shareholders with outstanding exposure to one of the most significant geological gold bearing trends with a substantial amount of near-term growth, exploration upside, and first in class operator,” said Brett Heath, president and CEO of Metalla.

A royalty is a legally binding agreement made to an individual or company for the ongoing use of their assets. These includes copyrighted works, franchises and natural resources.

In the case of mineral royalties, these are paid by mineral extractors to property owners. The party extracts the minerals and pays the property owner an amount based on revenue or units.

Read more: Calibre Mining step-out drilling results show bonanza grade gold intercepts in Nicaragua

Read more: The Mugglehead technology roundup: merger and acquisition edition

Metalla looks for precious metals in Argentina

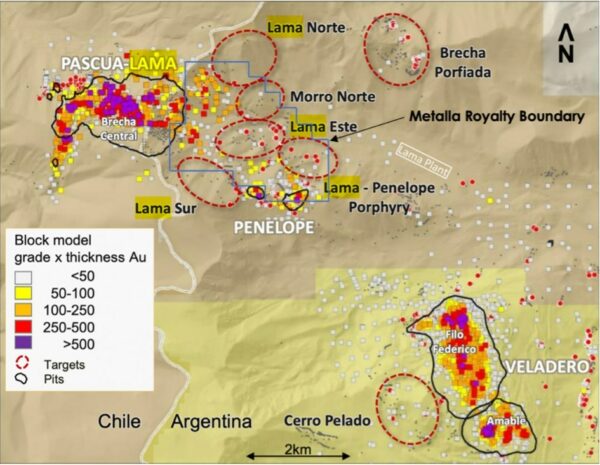

Lama regional map via Metalla Royalty and Streaming

Lama is the Argentine portion of the Pascua-Lama project between the borders of Chile and Argentina. The Chilean portion has been in a closure process, while the Argentina portion is presently being pondered as a potential standalone underground project at the Veladero-Lama complex operation. The Argentina portion shows contained metal of 3.13 Moz gold and 236.9 Moz silver

Previously, Barrick Gold spent USD$4 billion on infrastructure in the vicinity. The project intends to use the semi-completed process plant and tailings facilities. It also outlined a block cave underground Lama project with a processing capacity of 13,000-15,000 tonnes per day with the potential to expand to 30,000 tonnes per day in the future.

The company also committed up to USD$75 million at the Lama project and has 10-12 drill rigs operating. It also has continuous studies going to evaluate the capital required to finish the mill and plant facilities. The stretch goal for 2024 involves a development decision.

Recently drilling in the royalty area confirmed mineralization 300 meters east of the known resource in Lama East. It has significant intercepts, including 1.79 g/t AuEq over 96.2 meters. Meanwhile, at the Lama porphyry target, drilling confirmed the existence of gold-copper porphyry mineralization bearing a 2 kilometer by 1.5 kilometer footprint. The deposit is still open to the east, south and west, where no deep drilling has happened.

Metalla irons out royalty terms

The royalty includes an escalation feature. This is where the royalty rate jumps from 2.5 per cent to 3.75 per cent when the return exceeds 5 Moz of gold production. The copper royalty additionally gets a similar bump when the return rate goes from 0.25 per cent NSR to 3 per cent NSR based on net smelter returns.

Metalla agreed to pay $7.5 million via a $5 million equal split in cash and shares at US$5.3553 per share. The remaining cash will be paid when either it delivers 2 Moz of gold mineral reserve on the royalty area or 36 months after the transaction’s close.

Metalla also a pre-emptive right on the future sale of the remaining half of the royalty.

Metalla’s share price dipped $0.06 today to close at $7.18.

Follow Joseph Morton on Twitter

joseph@mugglehead.com