Newmont Corporation (NYSE: NEM) (TSX: NGT) has reported its mineral reserve numbers for 2022 and saw a significant increase in gold ounces in comparison to the previous year.

On Thursday, the company announced that its gold mineral reserves increased by 3.3 million ounces, 4 per cent approximately, from 92.8 million in 2021 to 96.1 million in 2022.

Newmont’s South American operations contribute the largest share to its mineral reserves, accounting for 39 per cent of the total amount. North America follows closely behind representing 33 per cent, while Australia makes up 17 per cent and the remaining 11 per cent comes from Africa.

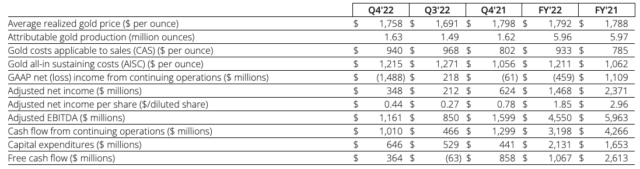

Newmont also announced today that it had achieved its 2022 guidance and released last year’s financial results.

Photo via Newmont Corporation

The company generated US$1.1 billion in free cash flow after reinvesting US$2.7 billion into the business to advance its ongoing projects and finished 2022 with US$6.7 billion in liquidity. Newmont reported substantial net losses of approximately US$1.5 billion in Q4 last year but had US$459 million in losses year-over-year.

Additionally, the company now possesses about 600 million ounces of silver reserves and 15 billion pounds of copper.

Today, we announced our fourth quarter and full-year 2022 results as well as our 2023 and longer-term outlook. Highlights from 2022 included producing 6.0M gold ounces and 1.3M gold equivalent ounces, generating $1.1B in free cash flow. Learn more: https://t.co/ak6LjGr9HC pic.twitter.com/yQTgCd1gke

— Newmont Corporation (@NewmontCorp) February 23, 2023

Read more: Calibre Mining strengthens management team with two new vice presidents

Read more: Calibre Mining increases mineral resources and reserves at its Nicaragua and Nevada operations

By the end of 2022, Newmont had 120 ounces of gold in its reserves for every 1,000 company shares and 75.3 million measured and indicated ounces.

“In 2022, Newmont replaced depletion and grew reserves by nearly four per cent as we continued to focus on extending mine life, developing districts and discovering new opportunities in the most favourable mining jurisdictions,” said Tom Palmer, CEO of Newmont.

“Our diverse, global portfolio of operations and projects delivers steady production for at least the next decade, leading the industry with approximately six million gold ounces per year.”

Newmont is the largest gold mining company in the world and its stock has been worth about $60 for the past five years on the Toronto Stock Exchange (TSX). Earlier this month, the Denver-based gold mining giant offered to purchase Newcrest Mining (TSX: NCM) for US$17 billion but was later rejected on the grounds that the amount wasn’t sufficient.

It is currently uncertain whether Newmont will make a more substantial offer to Newcrest.

Newmont’s stock price decreased by 0.43 per cent today to $59.72 on the TSX.

Read more: Calibre Mining gold discovery could breathe life into historic mining community

Read more: Calibre Mining budgets $29M for 2023 exploration in Nevada and Nicaragua

NGM celebrates the beginning of a solar facility’s construction near Dunphy, Nevada. Photo via Nevada Gold Mines

Newmont also owns 38.5 per cent of Nevada Gold Mines, a joint venture with the world’s second largest gold mining company Barrick Corporation (TSX: ABX) (NYSE: GOLD).

Nevada Gold Mines announced in December that it was constructing a 200 megawatt solar facility in Nevada to help forward its decarbonization mission and the company’s greenhouse gas reduction roadmap.

The joint venture aims to reduce its carbon footprint by 20 per cent before 2025 and the new solar facility will be instrumental in accomplishing that goal.

“The TS Solar Facility is a great example of how we can partner with local resources on a project that not only benefits the environment, but also provides sustainable long-term social and economic benefits,” said Peter Richardson, Executive Managing Director for Nevada Gold Mines in December.

rowan@mugglehead.com