Nevada King Gold Corp’s (TSX V:NKG) (OTCQX: NKGFF) recent assays reveal significant silver mineralization from the Atlanta Gold Mine Project in Nevada.

Released on Thursday, the high-grade silver intercept in AT22HG-18 occurred along the western side of the West Atlanta Fault on the eastern edge of this target. AT22HG-18 intercepted 1,084 g/t Ag over 10.7 meters within 33.5 meters of 2.35 g/t Au and 363.0 g/t Ag, and bottomed in mineralization at 291.2m depth where it was lost in a strongly fractured zone.

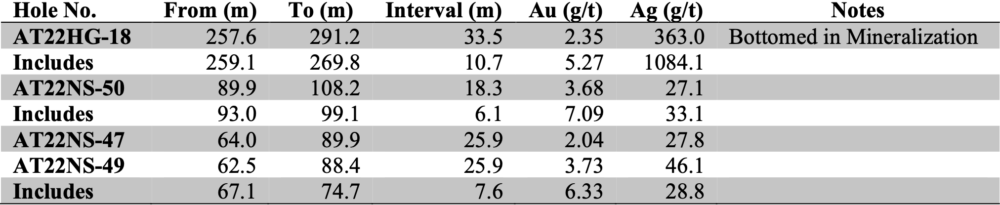

Mineralization occurs along sub-horizontal horizons generally dipping gently westward; true mineralized thickness in vertical holes is estimated to be between 85 per cent and 95 per cent of reported drill intercept length. Table from Nevada King.

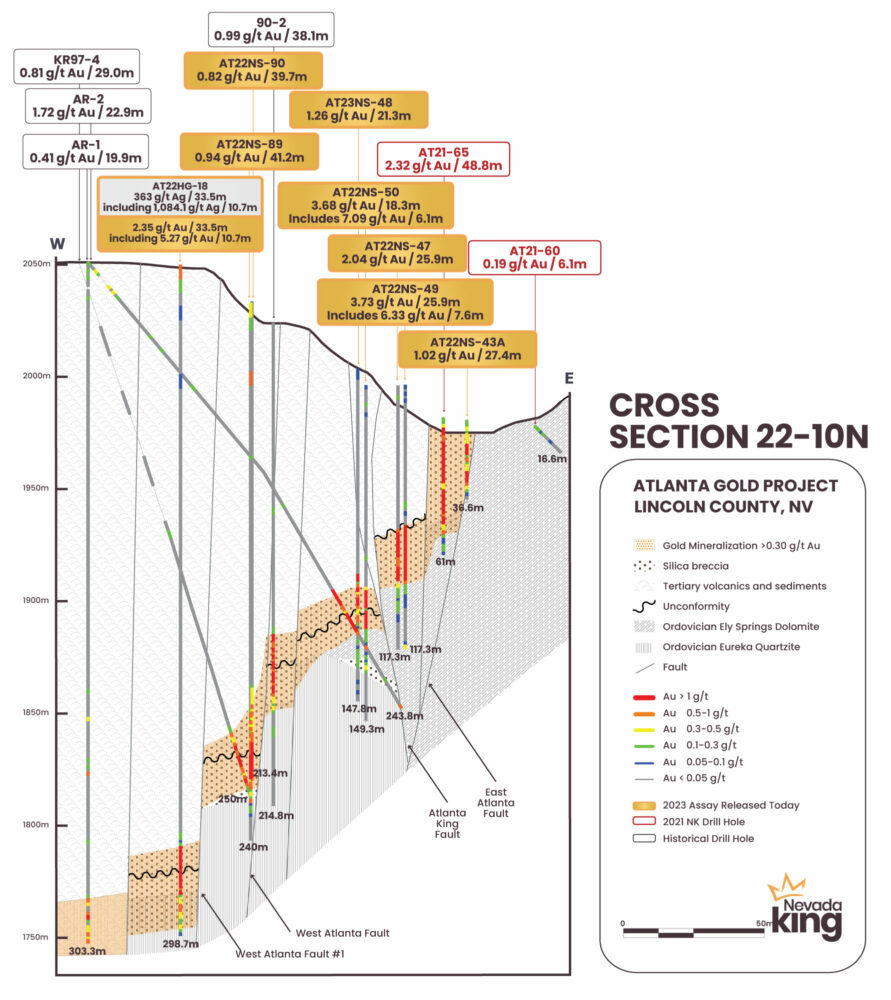

The vertical holes drilled on this section continue to advance northward, targeting the mineralization previously identified in Sections 22-5N through 22-9N.

The West Atlanta Graben Target, identified as a 150m-wide mineralized zone, hosts thick mineralization within the volcanic section above the contact with the basal Eureka Quartzite unit.

The drilling on Section 22-10N has focused on a 150 meter-wide high-grade feeder zone known as the Atlanta Mine Fault Zone (AMFZ). The AMFZ lies between the East Atlanta and West Atlanta Faults and is characterized by sub-parallel fault-bounded graben blocks containing high-grade gold mineralization.

Cross section 22-09N looking north across the southern portion of the Atlanta Mine Fault Zone. Higher grade mineralization is concentrated within narrow fault blocks formed between the East Atlanta and Nevada King Faults. Image via Nevada King.

Read more: NevGold’s oxide gold drill program in Nevada finds positive results

Read more: NevGold submits exploration and expansion plans for gold project in Nevada

Vertical holes returned higher gold grades than nearby historical holes

“There are no historical drill intercepts of this tenor anywhere near this part of the property. AT22HG-18 drilled into the eastern margin of the West Graben Target very close to the West Atlanta Fault, which may account for the high silver grade,” said Cal Herron, exploration manager of Nevada King.

“The only other hole drilled into the West Graben along this section line was Goldfield’s AR-1, but this hole just got into mineralized volcanics before it was lost and did not go deep enough to penetrate the higher-grade silica breccia horizon.”

Compared to nearby historical holes, the vertical holes drilled by the company returned higher gold grades. For instance, the angle hole AR-2 returned 22.9m at 1.72 g/t Au, while Nevada King’s AT23NS-50 returned 18.3m at 3.68 g/t Au. Further east, angle RC hole KR97-4 reported 29m grading 0.81 g/t Au, while AT22NS-89 returned 41.2m at 0.94 g/t Au and AT22NS-90 returned 39.7m at 0.82 g/t Au.

These results suggest that the company’s drilling program is successfully targeting high-grade mineralization within the Atlanta Mine Fault Zone.

Read more: 2023 will be a ‘very strong’ year for gold mining: NevGold

Read more: Gold is still the best hedge against inflation: NevGold CEO

Demand for silver jumped 18 per cent last year

According to the Silver Institute’s latest World Silver Survey, there was an 18 per cent increase in global demand for silver last year, reaching a record high of 1.24 billion ounces. This significant rise in demand created a massive supply deficit, leading the institute to predict more shortages in the future.

The survey found that in 2022, the silver market was undersupplied by 237.7 million ounces, which the Silver Institute believes may be the largest deficit on record. This follows a shortfall of 51.1 million ounces in 2021. These deficits wiped out cumulative surpluses from the previous decade. Furthermore, the institute predicts that there will be a further undersupply of 142.1 million ounces this year.

The Silver Institute’s survey highlights the growing demand for silver and the resulting supply shortages. The predicted undersupply for this year indicates that the trend is likely to continue. The institute’s findings are a cause for concern for those invested in silver and may indicate a need for increased production and supply in the future.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com