Nevada King Gold Corp. (TSXV: NKG) (OTCQX: NKGFF) announced assay results from four reverse circulation holes and one core hole at its Atlanta Gold Mine Project today.

The holes are located 264 kilometers northeast of Las Vegas, Nevada in the Battle Mountain Trend. Drilled originally 200 meters north of the Atlanta pit on Section 22-16N, the drill cut across the high-grade feeder zone including structures comprising the Atlanta Mine Fault Zone (AMFZ).

“Meadow Bay made a significant high-grade discovery with its 2011 and 2012 drilling of the Northwest Target Zone. Advancing where they left off, Section 22-16N confirms connection of gold mineralization from the Meadow Bay intervals eastward to the AMFZ,” said Cal Herron, exploration manager for Nevada King.

Mineralization happens along sub-horizontal horizons dipping westward. True thickness in vertical holes is between 85 per cent and 95 per cent of reported drill intercept length.

The company drilled hole AT22WS-2 into the northwest target zone, approximately 32 meters eastward from the historical hole DHRI-11-NRC3. The target zone was originally identified by Meadow Bay Gold (CSE: MAY) in 2011 with hole DHRI-11-NRC3. Unfortunately, most of the following holes stepped out westward and southward from this discovery hole and failed to go deep enough.

Location map for holes along drill section 22-16N relative to the perimeter of the historical Atlanta Pit and footprint of the Gustavson 2020 NI 43-101 resource. Image via Nevada King.

Nevada King started drilling in the northwest target zone in late 2022 looking to define mineralization eastward for DHRI-11-NR3 moving toward the AMFZ and eventually into the main Gustavson 2020 resource envelope.

The holes released earlier along Section 22-16 confirm gold mineralization connects eastward into the AMFZ. They also present a 215 meter wide and 55-80 meter thick mineralized zone that remains open to the west and at depth. These zones present average intercept gold grades between 0.21 g/t to 3.9 g/t Au.

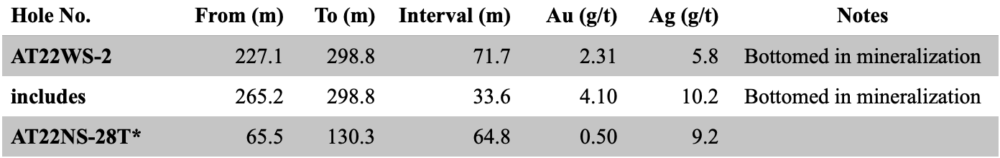

Further, several of the holes Nevada King released today have bottomed in mineralization. At present, step-out drilling is underway along this section line and on parallel fences along a north-south axis aimed at expanding the mineralized envelope laterally and to depth.

Read more: NevGold should be trading at a premium to peers: Analysis

Read more: 2023 will be a ‘very strong’ year for gold mining: NevGold

Nevada King drill holes bottom in mineralization

Mineralization occurs along sub-horizontal horizons generally dipping gently westward, and true mineralized thickness in vertical holes is between 85% and 95% of reported drill intercept length. Image via Nevada King.

The one characteristic that remains constant from hole to hole throughout the entire system is the consistent and contiguous nature of the mineralization in the drill intervals, according to Herron. The grade distribution did not fluctuate greatly between samples in the drill intervals. Even with the high-grade intervals, the gold values increase and decrease steadily and evenly.

“In my experience, this type of grade consistency is generally the hallmark of a strong and well-developed gold system. As it stands right now, we do not know how deep the gold mineralization extends at Atlanta nor do we know what the lateral boundaries of gold mineralization are,” Herron said.

Nevada King’s fence drilling across the southern tip of the Atlanta Mine Fault Zone demonstrates the importance of the AMFZ in terms of controlling thick mineralization zones within the volcanic section west of the fault, as well as higher-grade mineralization on both sides of the vault.

Follow-up drilling will be required to gain a better understanding of the structural geometry and distribution of higher-grade mineralization.

Drilling has been active on parallel sections and new results are anticipated shortly.

Shares of Nevada King Gold dripped $0.015 and are now trading at $0.35 on the Toronto Stock Exchange.

Fraser Institute ranks Nevada as third most attractive mining jurisdiction

Every year, the Fraser Institute’s rankings of the most attractive mining jurisdictions in the world consistently place the State of Nevada at or near the top. In 2021, Nevada dipped from the number one spot to third.

The state’s mining industry is built around its unique geology and long history of gold production. It has an abundance of both ultra-high-grade underground mines and large open pit ‘Carlin-type’ deposits. It also boasts a favourable climate, which makes it ideal for gold mining because of its year-round accessibility.

Read more: NevGold submits exploration and expansion plans for gold project in Nevada

Read more: NevGold Corp. gets exploration notice approval from Bureau of Land Management

NevGold Corp. (TSXV:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) is another company operating in Nevada. It recently submitted its exploration plan of operations (EPO) to the Bureau of Land Management

The EPO’s approval allows expansion drilling around mineralization into untested areas. It also possesses a project boundary of 16,488 acres and will allow up to 200 acres of surface disturbance.

NevGold shares rose a penny to $0.36 on the TSX Venture Exchange.

Nevgold is a sponsor of Mugglehead news coverage

Follow Joseph Morton on Twitter

joseph@mugglehead.com