McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is maintaining its production guidance for the year despite a drop of 13 per cent production forecast at its Gold Bar Mine in Eureka County, Nevada.

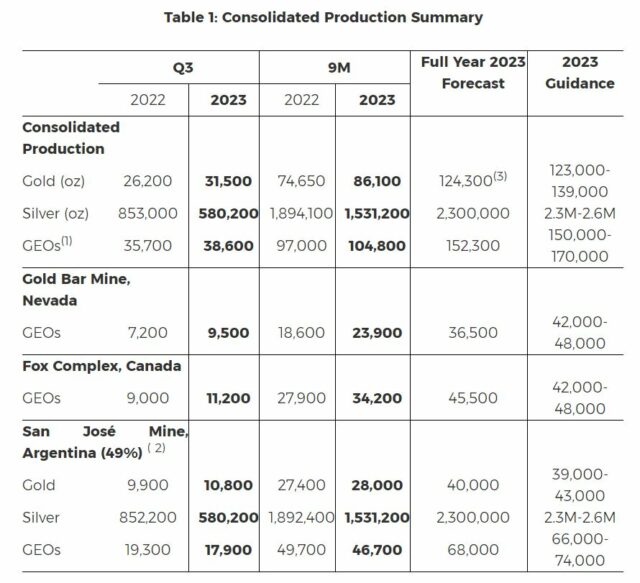

The Canadian miner announced its gold production for the third quarter of the year and reported 38,600 gold equivalent ounces (GEO) and 104,800 GEOs for the nine months ended Sept. 30. The forecast for the full year 2023 reflects actual productions to Sept. 30 and management’s current estimates for the Q4 2023, said the company in a statement this week.

The Gold Bar project is an open-pit heap leach operation in Eureka County, Central Nevada.

As of Sept. 30th, Gold Bar boasts an excellent safety record, having gone 1,313 days without a lost-time injury. In September, the rate of ore crushing and stacking on the heap leach pad reached 9,300 tonnes per day (tpd), representing a significant improvement compared to the preceding eight months, where the average was 6,150 tpd.

Year-to-date, the company has loaded ore onto the heap leach pad containing 41,600 ounces of gold, with an expected recovery rate averaging 68 per cent. This substantial gold inventory on the heap leach pad instills confidence in a reasonably robust Q4 and a promising start to 2024.

However, it’s important to note that the 2023 production forecast falls short of the guidance established in December 2022 by 13 per cent. This can be attributed to a combination of factors, including flooding, extreme weather conditions and a slower leach recovery rate for Gold Bar South ore.

The San José Mine is 49 per cent owned by McEwen Mining Inc. and 51 per cent owned and operated by Hochschild Mining plc. Production is shown on a 49 per cent basis. El Gallo Mine (on care and maintenance) is expected to recover 2,300 gold oz in 2023 from plant and pond cleanout. Table via McEwen Mining.

Read more: Calibre Mining intercepts high-grade gold below Jabali mine, identifies 3 new gold targets

Read more: Calibre Mining Q3 gold production numbers exceed analyst expectations: Canaccord Genuity

Timmins District’s Fox Complex performance exceeds expectations

In the Timmins District’s Fox Complex, Q3 performance exceeded expectations, with a strong possibility of slightly surpassing the mid-point of the guidance range. The complex celebrated a safety milestone, marking 738 days without a lost time injury as of Sept. 30. Mining operations at Froome remain on schedule and the Stock mill continues to enhance its average throughput.

Exploration drilling results, particularly in the ‘Ramp Portal Zone’ at the Stock Complex, have sparked excitement as they may signify an early mining horizon for the forthcoming Stock West project, as revealed in early October this year.

In San José, Argentina, which is under the operation of the company’s joint venture partner Hochschild Mining, Q3 production aligns with both quarterly expectations and the annual guidance. There was one injury reported in August 2023, but the worker has since made a full recovery and resumed regular duties.

Read more: Stellantis invests additional $160M in McEwen Copper’s Los Azules operation

Read more: McEwen Mining reports challenges in Q2 financial results but expects future improvements

McEwen Mining’s subsidiary McEwen Copper owns the large, advanced-stage Los Azules copper project in Argentina

Mid-October, McEwen Copper announced additional investments of ARS$42 billion by Stellantis (NYSE: STLA) (Euronext Milan: STLAM) (Euronext Paris: STLAP) and US$10 million by Nuton, which is Rio Tinto Ltd. (ASX: RIO) (LON: RIO)’s latest venture.

Since the creation of McEwen Copper, shareholders have invested $397 million to acquire shares even though the company has remained private.

The recent transactions occurred at $26 per share of McEwen Copper, giving it a market value of approximately $800 million. McEwen Mining retains 47.7 per cent ownership of McEwen Copper, with an implied market value of $380 million. This represents a value accretion for McEwen Mining shareholders of $98 million or $2 per share since March 2023.

McEwen Copper is now well-financed for the remainder of 2023 and 2024. The funds raised will be used to advance the feasibility study on the Los Azules project and for other corporate purposes. McEwen Mining also received proceeds of $6 million to augment its balance sheet.

“Currently, we have fourteen drill rigs on site at Los Azules, scaling up to 18 drill rigs for our drilling campaign targeting more than 45,000 meters. This program will generate all the remaining data required to complete the planned feasibility study by Q1 2025,” said the company.

Shareholders continue to show confidence in McEwen Copper’s potential, contributing to its growth. With these developments, McEwen Mining looks ahead to a promising future, focusing on the continued advancement of its projects and corporate initiatives.

📢 Production ⛏️ for Q3 2023 was 38,600 gold ⛏️🪙 equivalent ounces and 104,800 GEOs ⛏️🪙 for the nine months ended September 30th, 2023.https://t.co/MbkpY1f2Ft#mining #gold $MUX

— McEwen Mining (@McEwenMining) October 30, 2023