This is the year the cannabis industry grew up.

That’s according to experts following the legal weed sector, which has seen a massive swing in investor sentiment over the past six months.

Up until the spring of 2019, initial cannabis players received frothy, speculative evaluations based on unrealistic growth expectations.

But without strategic or fiscal discipline, the early movers faced a punishing year-long collapse in stock prices. That meant companies had almost no access to capital as 2020 began.

Then Covid-19 hit.

The global health crisis accelerated the industry shakeout as companies faced liquidity crises amid a capital market deep-freeze.

While the pandemic hammered the economy and disrupted supply chains, it also led to governments deeming cannabis businesses an essential service. And across American and Canadian markets monthly sales hit record highs as people sheltered in place.

With cannabis proving to be a recession proof product, institutional investors have again been kicking tires in the space.

Since March 18, the Global Cannabis Stock Index has rallied 66 per cent as the industry rides a wave of pandemic-related success.

Almost mirroring Silicon Valley’s resurgence from the dot-com crash of 2000, experts say the cannabis sector is passing through a similar inflection point.

Not only is legalization spreading, big cannabis companies are trading in their original maverick leaders for seasoned professionals from established CPG, alcohol and pharma industries.

The corporate restructuring is helping recalibrate growth expectations and valuations in the space.

Market dominance is still up for grabs.

Cannabis data firm BDSA estimates the global cannabis market will reach US$47.2 billion by 2025, growing 22 per cent each year from today.

But BDSA managing director Tom Adams says it’s almost impossible to forecast which company will emerge as an Amazon of cannabis – just as nearly every investor didn’t know which internet companies would survive and thrive after the tech bubble burst.

For Adams, strong management is key for cannabis companies to push through the current capital crunch. Not only do businesses have to either be profitable, or have a very clear path to profitability, their leaders need to show sustainable growth metrics while battling red tape and a nimbler illicit market.

Read more: Cannabis market will triple by 2024, pot stocks will rebound: report

California cannabis companies weather Covid capital crunch

In California, the largest cannabis market in the world, illicit sales in 2019 were an estimated US$8.8 billion compared to legal sales of US$2.9 billion, according to BDSA.

And despite legal sales reaching a record US$334 million in July, operators in the Golden State continue to face challenges navigating a heavy tax and regulatory load.

Under California’s dual-licensing system, retailers have to get state and local government permits, and of 482 cities across the state, only 89 are allowing retailers to open.

Meanwhile, a state licensed grower can’t legally transport their crop to their own licensed extraction facility across the street without hiring a licensed distributor.

As legal cannabis sales surge in California amid the pandemic, operators still face extinction events. Photo via Cova Software

California’s burdensome regulations have created a fragile business environment and the coronavirus has only added to the hurdles.

Without access to banks, small cannabis companies have been in survival mode, cutting staff and trimming operations while weathering extinction events. According to California records, almost 40 manufacturers in the industry have been wiped out this year.

Retailer MedMen Enterprises Inc., one of the largest publicly-traded cannabis operators in California, has resorted to a financing deal with interest rates as high as 18 per cent. Shares of MedMen have slid 72 per cent year-to-date.

While legal sales are rising in California, experts say the coronavirus crisis is reshaping the industry with the shakeout expected to continue.

Despite headwinds, ‘the Amazon of cannabis’ goes public

So, how can a maturing legal industry adapt to the new normal? And what type of logistics system is needed to allow operators to get past onerous regulations and beat out the black market?

“It fundamentally comes down to a philosophical worldview,” says ManifestSeven CEO Sturges Karban. “You are either building an enterprise to service the industry as it exists today, or you are building one that will service the industry we know will exist tomorrow.”

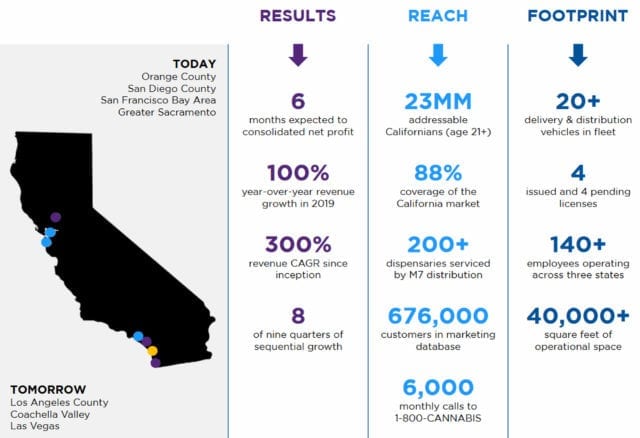

ManifestSeven Holdings Corporation (CSE: MSVN) is a first-of-its-kind cannabis logistics, delivery and retail company that has created a fully integrated omnichannel platform for both businesses and consumers through its distribution hubs across California.

Unlike legacy cannabis players, Karban and the M7 management team came into the space in 2014 boasting a combined 150 years of business and transactional experience.

M7’s seasoned executive team was able to navigate the 2020 market downturn and recently closed an aggregate US$10.2 million capital raise made up of three private placements.

“It’s a resounding affirmation of M7’s business model and corporate resilience in the face of economic headwinds, making us one of the few cannabis companies to raise capital in this environment successfully,” Karban says.

Further highlighting the company’s survivor story, Karban notes M7 is among the first post-Covid issuers in the cannabis space.

On Sept. 30, M7 began trading on the Canadian Securities Exchange under the ticker MSVN following a reverse-merger with listed Canadian firm P&P Ventures Inc.

For Karban and M7, getting to the finish line to go public is a significant affirmation of his company’s business model.

And the major milestone, along with the fresh injection of capital, helps the company expand its omnichannel strategy across the rest of California, and eventually into other North American markets.

Ultimately, M7 has weathered the Covid capital crunch to continue to pursue its ambitious plan of becoming the Amazon of cannabis.

Read more: How this company is becoming the ‘Amazon of Cannabis’

To execute its bold strategy, M7 says figuring out how to crack the code of California’s dysfunctional cannabis market has been key.

The Irvine-based company has built a way to service and support every vertical across the supply chain, merging distribution with a retail superhighway – always with a laser-focus on compliance.

The company’s expansive distribution network of four facilities and multiple licences has found a way to increase efficiency across California’s fragmented market.

“Through that network, we push what I believe is the industry’s only true full-service model,” Karban says.

Everything from logistics and transport to commodity brokerage, bulk wholesale, wholesale to retail and then a subset of licensed services that streamline into the distribution pathway.

“The money we raised gives us credibility to capture some of that business, because operators have already been burned by guys that just couldn’t follow through and they still have delinquent invoices everywhere,” he says. “So, it’s a huge opportunity to go in and scoop up all of that alienated or orphaned business.”

Through M7’s single access point — 1-800-CANNABIS — retail end-users can order a product from anywhere, and have that product order fulfilled from virtually anywhere in California.

To service consumers, the company has built a portfolio of retail operations across major metro markets in the state, starting as far north as the greater Sacramento area, through the San Francisco Bay, and all the way down the coast into Los Angeles, Orange, and San Diego counties. Under its Weden and MyJane banners, ManifestSeven owns and operates brick-and-mortar dispensaries, local on-demand delivery services, e-commerce and subscription offerings.

Zooming out, M7 is not just a logistics cannabis company that moves products up and down the state in trucks. Nor is it a simple e-commerce business that connects retailers with consumers with cannabis goods.

What separates M7 from any other distribution or retail company, is how its network checks off every regulatory and commercial box to optimize the process of moving cannabis from the cultivator through each step of the supply chain, and ultimately into the hands of the customer.

“The thinking was to first build a real foothold in California, validate that distribution and retail economic model there, and then build out a robust footprint with California as the anchor state in a regional, and then eventually national, play,” Karban says.

M7’s seasoned executives forge new path for legal weed

Before Karban launched his ambitious goal to create a cannabis superhighway, the company began as MJIC, Inc. in 2014, an investment business and venture capital firm.

Karban, a Harvard University alum and veteran investment banker, joined forces with other investment professionals and spent three years building domain expertise and rolodex of industry relationships. The MJIC team was focused on addressing the dearth of professionally-managed platforms and portfolios for investors interested in the California cannabis market.

As part of this strategy, MJIC acquired the “Marijuana Index,” which tracks U.S. and Canadian-traded weed stocks and has been used as the baseline for market participants ranging from retail investors to cannabis ETFs.

In 2016, the MJIC team decided to leverage its investor expertise and pivot into the space as operators. They had early sightlines on how California’s new regulatory framework posed fundamental systemic problems around the supply chain and started focusing on buying licenses to address this.

When Karban was appointed as CEO in 2017, the company realized it was wise to steer clear from the cultivation side of the industry, instead focusing on a downstream third-party model.

The company invested in licences and built its distribution hubs in Long Beach and Oakland.

“In looking at really where the need was, it was in B2B infrastructure from a license perspective, B2B services particularly distribution, packaging and manufacturing, and then ultimately a deficiency in the number of channels that were available on the retail end for consumers,” Karban said.

In 2018, MJIC zeroed in on modernizing the cannabis retail experience while addressing needs of consumer demographics, including seniors, women and millennials, that weren’t being met.

To meet these needs, the company acquired a foundational retail cannabis delivery business, MDelivers, and retail cannabis subscription business, MyJane.

The acquisition of MyJane offers consumers something unique in the cannabis space. The California-based wellness technology platform offered women a personalized cannabis experience by discreetly delivering products to their homes.

MyJane conducted a poll showing 79 per cent of women in Orange County were interested in using weed as a wellness option, but only 30 per cent felt comfortable visiting a local dispensary.

Fast forward to 2019, the company changed its name to ManifestSeven, M7 for short, and continued to advance its B2C strategy.

In August last year, the company acquired its flagship Weden dispensary in Santa Ana.

Located in the heart of Orange County, the dispensary has access to one of America’s highest median incomes and a robust adult-use community that attracts cannabis-friendly tourists.

Read more: ManifestSeven acquires Orange County dispensary

Disciplined tactical approach builds pot profits

Karban explains the Weden acquisition is a prototypical deal for M7 that demonstrates how it executes its fiscally responsible strategy.

Instead of paying cash up front, the firm amortized the approximate US$12 million purchase price for over a year-and-a-half.

Within the first six months of the purchase date, M7 organically increased sales by a significant margin. The company was then awarded a delivery licence as the pandemic first hit, after converting unused space in the building into a delivery depot. M7 now has a fleet of cars operating out of that location to deliver cannabis products across Orange County and into San Diego.

“Sometimes it can be an advantage to have a few investment banking veterans in the c-suite and on the board; we understand how to structure transactions efficiently, manage risk, and ultimately leverage under-exploited assets to accrete meaningful shareholder value,” Karban says.

“Focus, discipline, and the ability to extract every ounce of value from your asset portfolio is also how you prevail in a crisis like the one we just lived through with Covid, by the way,” he adds. “My partners on the executive team had all been here before and were already seasoned by episodes such as the dot-com collapse 20 years ago and the global crisis in 2008. Don’t get me wrong, Covid was hardly a breeze to manage, but most of us had been to this movie before, so we knew what to do when things became challenging to make sure we could deliver a happy ending on the other side.”

The company says it’s targeting additional dispensaries in major California markets that will all connect to and support its omnichannel strategy.

This disciplined tactical approach is different from larger retailers like MedMen, Karban continues, which was among many early players that had a capital-intensive land-grab mentality in the state.

“The land-grab sensibility is inherently flawed and will become increasingly anachronistic as the cannabis 2.0 landscape continues to take shape around us. It is also one of the primary factors explaining the persistent elusiveness of positive bottom lines across the industry,” he says.

Completing California buildout

In the near term, M7 plans to use its recently raised capital to focus on its distribution network that geographically covers about 90 per cent of the California market, including over 200 dispensaries.

The company will focus on organic investment — specifically in its bulk wholesale business.

Karban says over the past two years those segments offer some of the most reliably predictable returns: For every dollar of inventory finance, M7 can generally see a return of about 10–20 times in top-line revenue over the course of the following year.

“We want to be able to show the market that we know how to generate and grow revenue — not just buy it up — which is what a lot of people have done with the roll-up deals that defined the cannabis 1.0 era.”

In 2021, the company is looking to execute its broader M&A strategy in California by expanding its dispensary network and adding as many delivery locations as possible starting in the near term.

“I kind of look at those as cell phone towers in the late-90s. The more you have, the better your coverage, the better your customer retention,” Karban says.

That expansion drive will be the catalyst for the company’s growth and next capital raise.

M7’s highly integrative assimilation of assets unlocks a lot of differentiated value, higher efficiency and a shorter path to profitability on less revenue, Karban says.

“The reason that we’re now so close to consolidated net profitability, which we think is like a unicorn for anyone playing in distribution in California, is the integration of all of our assets – it’s a different approach that configures the company’s businesses to be internally synergistic with each other.”

M7 focuses on ground game since federal legalization is a ‘red herring’

While M7 intends to spend the next year focusing on the completion of its California buildout, it hasn’t ruled out being opportunistic in other states, particularly regionally, if something comes up in the distressed landscape.

The beauty of the 1-800-Cannabis is that it’s stateless and geocentrically agnostic, Karban notes.

“As we add states, 1-800-Cannabis is just as applicable to somebody in Massachusetts, as it is to a customer in California, as long as we have a physical operation to service it there — which is definitely the longer term plan,” he said.

And while federal legalization in the U.S. appears inevitable in the next several years, Karban wants to build M7’s cannabis superhighway across as many states as possible before the ban is lifted.

Why? Because those barriers keep Amazon, Constellation and big pharma out of the space, he says.

But for Karban, the federal issue is a red herring at the end of the day: firstly, since it would likely take years after legislation passes for regulations to come into effect, considering numerous federal agencies like the FDA would need to weigh in; secondly, because the industry ultimately operates at the local level.

“If you’re paying attention today, your ground game is at the local level. It’s not your state license even – it’s the city permits that get you your state license,” Karban says. “So, every city you’re operating in, you have to get their permission first.”

That’s a key reason why M7 chose to build out in California. Because it’s the most fragmented cannabis market of any legal state, it’s easier to duplicate the omnichannel model into other states as the company grows.

And when the U.S. goes federal, he argues, much of the infrastructure built by multi-state operators will become redundant.

“If you’re looking at a vertically integrated model, why do you need to grow in 10 different states? You would centralize operations. And frankly, it’s going to happen globally.”

M7 is a unique cannabis player in the space because it has the patience and audacity to target and build a generational wealth creation opportunity.

A year ago, Karban was asked who was going to buy out M7.

“Is it Canopy, is it Aurora?”

But Karban insists he isn’t going to sell to a Canadian public company.

If you look at the cannabis industry globally, and if your strategic time frame is right — if you’re not cashing out and walking away with $10 billion plus, then you’ve missed the opportunity, Karban says.

“The strategy here is to skate to the puck of the players — guys that have real balance sheets, and are going to need to be in the space in the next five years.”

“I am not building this company for Cresco. Think bigger. Give me five to seven years, and we are selling this company to Amazon.”

Disclosure: M7 is a Mugglehead advertiser, and a director of Mugglehead also own shares of M7

Top image via M7

jared@mugglehead.com

@JaredGnam