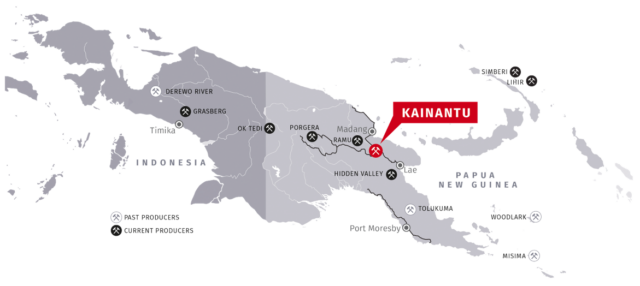

K92 Mining Inc. (TSX: KNT) (OTCQX: KNTNF) has received permission from the government of Papua New Guinea to continue its Kainantu Mine operations in the country for another 10 years.

On Tuesday, the Vancouver-based gold mining company announced news of the decade-long extension for its Mining Lease #150 and the company’s board of directors have now subsequently approved Stage 3 and 4 expansions at the site.

The Stage 3 Expansion will ideally enable the company to increase its annual throughput to 1.2 million tonnes per annum (mtpa) with the Stage 4 Expansion bringing that figure up to 1.7 mtpa. The previous Stage 2A Expansion only enabled K92 to have a throughput rate of 0.5 mtpa.

Photo via K92 Mining

Read more: Calibre Mining brings high grade gold drill results home from Nicaragua

Read more: i-80 Gold has success at Ruby Hill, continues 2022 drill program

“The extension of the Mining Lease by the Government of Papua New Guinea and the approval of the Stage 3 and 4 Expansions by the board of directors of K92 are major milestones for the Kainantu Gold Mine, Papua New Guinea, our communities, investors and many other stakeholders,” said John Lewins, CEO and Director of K92.

“When we acquired the Kainantu Gold Mine in 2015, it was under care and maintenance and had a designed throughput of 150,000 tpa – the Stage 4 Expansion targets throughput of 1.7 million tonnes per annum, a more than 11-fold increase,” added Lewins.

“The throughput increase, as outlined in the integrated development plan’s (IDP) Stage 4 preliminary economic assessment (PEA) Case, transforms Kainantu into a Tier 1 mine, with peak production of 500,192 oz AuEq in 2027, low life of mine average all-in sustaining costs of $687/oz (co-product) or $444/oz net of by-product credits and capital self-funded from mine cash flow.”

Lewins also added that the mine’s extension would help boost the country’s economy in terms of employment opportunities, exports, royalties and income tax. He says the company plans on expanding its community programs in Papua New Guinea as the mine expands, which will benefit local people in the area.

K92 is optimistic about its exploration programs at Kainantu and plans on increasing its number of drill rigs next year from the 11 currently in operation, focusing on resource expansion of the company’s porphyries and vein fields.

K92 declared commercial production at the Kainantu Mine at the beginning of 2018 and is in a strong financial position there. The company produces gold, silver and copper at the Papua New Guinea site.

Read more: Wesdome fulfills commercial production criteria at Quebec mining site

Read more: Orezone Gold announces commercial production at Burkina Faso mine

Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF) is another Vancouver-based, growing, mid-tier gold producer with a robust pipeline of development and exploration opportunities throughout the United States and Nicaragua.

Today, the company announced positive results from its step-out drilling along the Panteon North/VTEM geophysical corridor within the Limon Mine complex in Nicaragua.

Initial drilling results along the Panteon/VTEM Corridor consisted of:

- 11.61 g/t Au over 9.3 metres Estimated True Width (“ETW”) including 23.93 g/t Au over 1.7 metres ETW, and 15.34 g/t Au over 3.9 metres ETW in Hole LIM-22-4701;

- 6.73 g/t Au over 2.1 metres ETW in Hole LIM-22-4689;

- 3.67 g/t Au over 2.6 metres ETW including 11.10 g/t Au over 0.7 metres ETW in Hole LIM-22-4684.

By the end of this year, Calibre is expected to produce 220,000-235,000 ounces of gold with a total cash cost of between $1,075-$1,150 per ounce, and an all-in sustaining cost of $1,200 – $1,275 per ounce.

Note: All holes were drilled at angles of -45 to -90 degrees at azimuths designed to intersect targeted structures as nearly as possible to perpendicular when possible. Some drill holes and intercepts reported here did not cross mineralization perpendicularly, and do not represent exact ‘true widths’.

rowan@mugglehead.com